filmov

tv

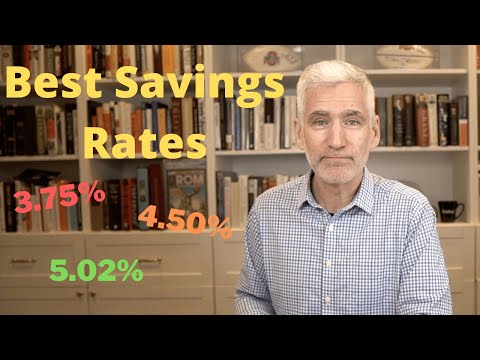

My 5 BEST Savings Accounts | RECESSION PROOF

Показать описание

My 5 best savings accounts in a recession:

My PO Box:

Andrei Jikh

4132 S. Rainbow Blvd # 270

Las Vegas, NV 89103

SOURCES:

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

My PO Box:

Andrei Jikh

4132 S. Rainbow Blvd # 270

Las Vegas, NV 89103

SOURCES:

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

My 5 BEST Savings Accounts | RECESSION PROOF

The Top 5 Savings Accounts of 2024 (High Yield Savings)

Top 5 BEST Savings Accounts of 2024 (SUPER HIGH YIELD)

5 Best High Yield Savings Accounts: High Interest No Fee’s

The 5 BEST High Yield Savings Accounts of 2024 - July 2024 UPDATE

5 BEST Savings Account 2023 - Q4

7 BEST High Yield Savings Accounts of 2024

Best High Yield Savings Accounts for Everyone in 2024 - My Recommendations!

The 5 Best High Yield Savings Accounts (High Interest No Fees!)

6 High Yield Savings Accounts to Build Wealth in 2024

I FOUND THE 5 BEST BANK ACCOUNTS OF 2023

The 5 Best Savings Account To Hold Your Money

BEST High Yield Savings Accounts of Q1(Jan - March) 2024

Top 5 Savings Accounts in Australia 2024

The BEST High Yield Savings Accounts Of 2024 (GET THESE!)

These are the Best HIGH YIELD Savings Accounts of 2024 (Over 5% APY!)

Top 5 Savings Accounts [2023]

Best Savings Account Rates (2023) | High Yield Savings Accounts Over 5%

The 6 BEST Bank Accounts of 2023 (High Yield)

5 BEST High Yield Savings Accounts That Helped Me Save $100,000

Best Savings Accounts 2024: July Update

The HIGHEST Interest Rate Savings Account

Buy a Home FASTER - The 5 Best Savings Accounts For Your Down Payment

The 5 Best Bank Accounts 2023 | High-Yield Savings Accounts and Certificate of Deposits

Комментарии

0:14:15

0:14:15

0:12:57

0:12:57

0:11:33

0:11:33

0:21:33

0:21:33

0:08:41

0:08:41

0:10:34

0:10:34

0:13:23

0:13:23

0:10:17

0:10:17

0:25:52

0:25:52

0:11:22

0:11:22

0:09:39

0:09:39

0:10:55

0:10:55

0:11:28

0:11:28

0:13:20

0:13:20

0:15:40

0:15:40

0:04:43

0:04:43

0:10:44

0:10:44

0:10:54

0:10:54

0:15:53

0:15:53

0:11:10

0:11:10

0:12:09

0:12:09

0:10:55

0:10:55

0:07:58

0:07:58

0:12:15

0:12:15