filmov

tv

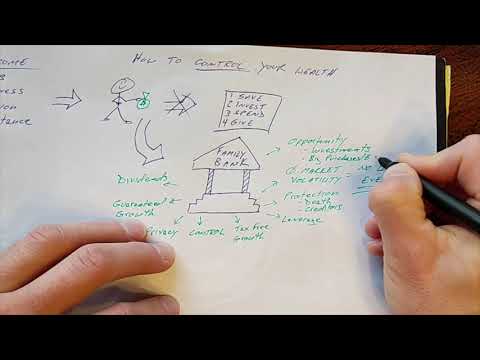

Be Your Own Bank Explained: Secret Method (How I Turn My Expenses into Tax-Free Income)

Показать описание

Watch Be Your Own Bank Explained Secret Method and learn How I Turn My Expenses into Tax-Free Income where I, Brandon Anthony Clark, share my unique financial strategy that has changed the game to my approach to personal finance. If you've ever wondered how to make your money work smarter for you, this video is a must-watch!

What You'll Learn:

-Personal insights and tips on managing finances to maximize and protect wealth for you and your family.

-How I transformed my regular expenses into a source of tax-free income.

-The fundamentals of the 'Be Your Own Bank' strategy.

-Step-by-step process to implement this method using Indexed Universal Life Insurance (IUL).

Why This Method?

In a world where financial security is paramount, understanding how to safeguard and grow your wealth is crucial. This method isn't just about saving money; it's about turning what you spend into an income stream. It's time to rethink your approach to personal finance.

Key Takeaways:

-Understanding the power of Indexed Universal Life Insurance.

-Learning the concept of 'Be Your Own Bank'.

-Strategies to protect and grow your wealth.

-Real-life examples and my personal experience with this method.

Stay Connected:

For more insightful financial strategies and tips, make sure to subscribe to my channel and hit the bell icon for notifications. Your journey to financial mastery starts here!

Explore More:

Interested in diving deeper into smart financial strategies? Check out these other videos that cover various aspects of wealth management and personal finance:

Max Out Your IUL in 3 Years

Why I Invested in an IUL Policy Through My Business

The Ultimate Max-Funded IUL Masterclass for Future Millionaires

IUL Fees Exposed: See the Hidden Fees Agents Don't Want You to Know

Let's Connect:

Your Feedback Matters:

Did you find this video helpful? Do you have any questions or topics you'd like me to cover in future videos? Let me know in the comments below!

Take the Next Step:

Ready to dive deeper? Click the link below to start creating your custom-designed FLIP plan with step-by-step guidance for every element of your policy.

Contact Me Directly:

For personalized advice and to begin your path to financial freedom, reach out to me.

Disclaimer:

This video is for informational purposes only and does not constitute financial, legal, or other professional advice. Please consult with a professional financial advisor before implementing any strategies discussed.

00:00 Introduction and Overview

01:23 Personal Background and Journey

02:19 Understanding Life Insurance Policies

08:53 Key Benefits of Indexed Universal Life Insurance

10:17 Personal Story and Importance of Life Insurance

12:22 How to Turn Everyday Expenses into Tax Free Income

12:33 Understanding Cashflow and the Flip System

13:02 The Importance of Cash Flow

15:34 Understanding Your Insurance Policy as an Asset

18:09 Demonstration of the Flip System with Personal Policy

22:14 Conclusion and Next Steps

What You'll Learn:

-Personal insights and tips on managing finances to maximize and protect wealth for you and your family.

-How I transformed my regular expenses into a source of tax-free income.

-The fundamentals of the 'Be Your Own Bank' strategy.

-Step-by-step process to implement this method using Indexed Universal Life Insurance (IUL).

Why This Method?

In a world where financial security is paramount, understanding how to safeguard and grow your wealth is crucial. This method isn't just about saving money; it's about turning what you spend into an income stream. It's time to rethink your approach to personal finance.

Key Takeaways:

-Understanding the power of Indexed Universal Life Insurance.

-Learning the concept of 'Be Your Own Bank'.

-Strategies to protect and grow your wealth.

-Real-life examples and my personal experience with this method.

Stay Connected:

For more insightful financial strategies and tips, make sure to subscribe to my channel and hit the bell icon for notifications. Your journey to financial mastery starts here!

Explore More:

Interested in diving deeper into smart financial strategies? Check out these other videos that cover various aspects of wealth management and personal finance:

Max Out Your IUL in 3 Years

Why I Invested in an IUL Policy Through My Business

The Ultimate Max-Funded IUL Masterclass for Future Millionaires

IUL Fees Exposed: See the Hidden Fees Agents Don't Want You to Know

Let's Connect:

Your Feedback Matters:

Did you find this video helpful? Do you have any questions or topics you'd like me to cover in future videos? Let me know in the comments below!

Take the Next Step:

Ready to dive deeper? Click the link below to start creating your custom-designed FLIP plan with step-by-step guidance for every element of your policy.

Contact Me Directly:

For personalized advice and to begin your path to financial freedom, reach out to me.

Disclaimer:

This video is for informational purposes only and does not constitute financial, legal, or other professional advice. Please consult with a professional financial advisor before implementing any strategies discussed.

00:00 Introduction and Overview

01:23 Personal Background and Journey

02:19 Understanding Life Insurance Policies

08:53 Key Benefits of Indexed Universal Life Insurance

10:17 Personal Story and Importance of Life Insurance

12:22 How to Turn Everyday Expenses into Tax Free Income

12:33 Understanding Cashflow and the Flip System

13:02 The Importance of Cash Flow

15:34 Understanding Your Insurance Policy as an Asset

18:09 Demonstration of the Flip System with Personal Policy

22:14 Conclusion and Next Steps

Комментарии

0:25:16

0:25:16

0:05:37

0:05:37

0:11:01

0:11:01

0:04:27

0:04:27

0:15:25

0:15:25

0:10:54

0:10:54

0:16:45

0:16:45

0:00:49

0:00:49

0:07:26

0:07:26

0:03:27

0:03:27

0:08:06

0:08:06

0:17:37

0:17:37

0:13:59

0:13:59

0:43:01

0:43:01

0:00:49

0:00:49

0:12:13

0:12:13

0:09:17

0:09:17

0:00:34

0:00:34

0:00:42

0:00:42

0:23:21

0:23:21

0:11:05

0:11:05

1:02:06

1:02:06

0:16:43

0:16:43

0:00:29

0:00:29