filmov

tv

CFA/FRM: How to Calculate Covariance Using Texas Instrument BA II Plus | FinTree

Показать описание

CFA | FRM | CFP | Financial Modeling

Live Classes | Videos Available Globally

Follow us on:

We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with!

This Video lecture was recorded by our Lead Trainer for CFA, Mr. Utkarsh Jain, during one of his live Session in Pune (India).

To know more about CFA/FRM training at FinTree, visit:

CFA/FRM: How to Calculate Covariance Using Texas Instrument BA II Plus | FinTree

Covariance and Correlation (Calculations for CFA® and FRM® Exams)

Covariance and correlation from a joint probability function (for the @CFA Level 1 returns)

Value at Risk Explained in 5 Minutes

Covariance, using the BA II PLUS Calculator

Portfolio Return and Variance (Calculations for CFA® and FRM® Exams)

Level 1 Chartered Financial Analyst (CFA ®): Correlation, covariance and probability topics

Calculating Portfolio Variance using Variance Covariance Matrix in Excel + Risk Contribution

Standard Deviation| Variance| Covariance| Correlation| Beta| Standard Deviation of the Portfolio

How to Calculate Beta using Covariance and Variance

FRM -Covariance and Correlation

Portfolio variance for a two-asset portfolio (for the @CFA Level 1 exam)

CFA® Level II Quant - Autoregressive (AR) Models: Mean reversion, Covariance Stationarity

Parametric Method: Value at Risk (VaR) In Excel

Texas BA II Plus | STO and RCL functions for 2-asset Portfolio Variance and Standard Deviation

CFA/FRM Calculator Basics Part 4

CFA Level 3 | CME: Multi-Factor Models to Estimate Variances and Covariances of Asset Returns

CFa Level I. Reading 39-2. Module 39 2 Covariance and Correlation

How to calculate Covariance on BA II plus calculator

Covariance vs Correlation with simple data | Covariance vs Correlation Coefficient

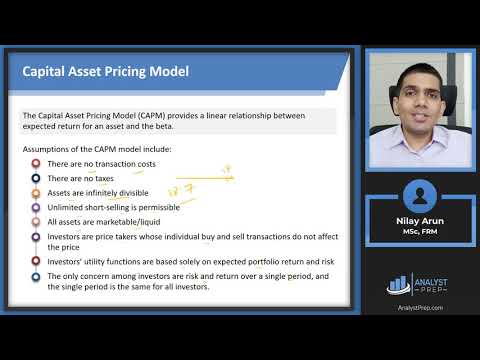

Beta and CAPM (Calculations for CFA® and FRM® Exams)

Covariance and Correlation Part 2 revised

Solving Statistical Problems with Texas Instruments BA II Calculator (CFA, MBA, FRM)

CFA/FRM : Applying Knowledge in Practice - Some ideas for beginners in Financial World!

Комментарии

0:10:36

0:10:36

0:20:01

0:20:01

0:13:07

0:13:07

0:05:09

0:05:09

0:02:23

0:02:23

0:21:19

0:21:19

0:48:15

0:48:15

0:14:24

0:14:24

0:25:45

0:25:45

0:07:16

0:07:16

0:17:00

0:17:00

0:04:07

0:04:07

0:08:31

0:08:31

0:07:23

0:07:23

0:03:55

0:03:55

0:09:38

0:09:38

0:22:55

0:22:55

0:11:42

0:11:42

0:07:56

0:07:56

0:12:06

0:12:06

0:21:08

0:21:08

0:13:34

0:13:34

0:12:33

0:12:33

0:09:49

0:09:49