filmov

tv

Portfolio variance for a two-asset portfolio (for the @CFA Level 1 exam)

Показать описание

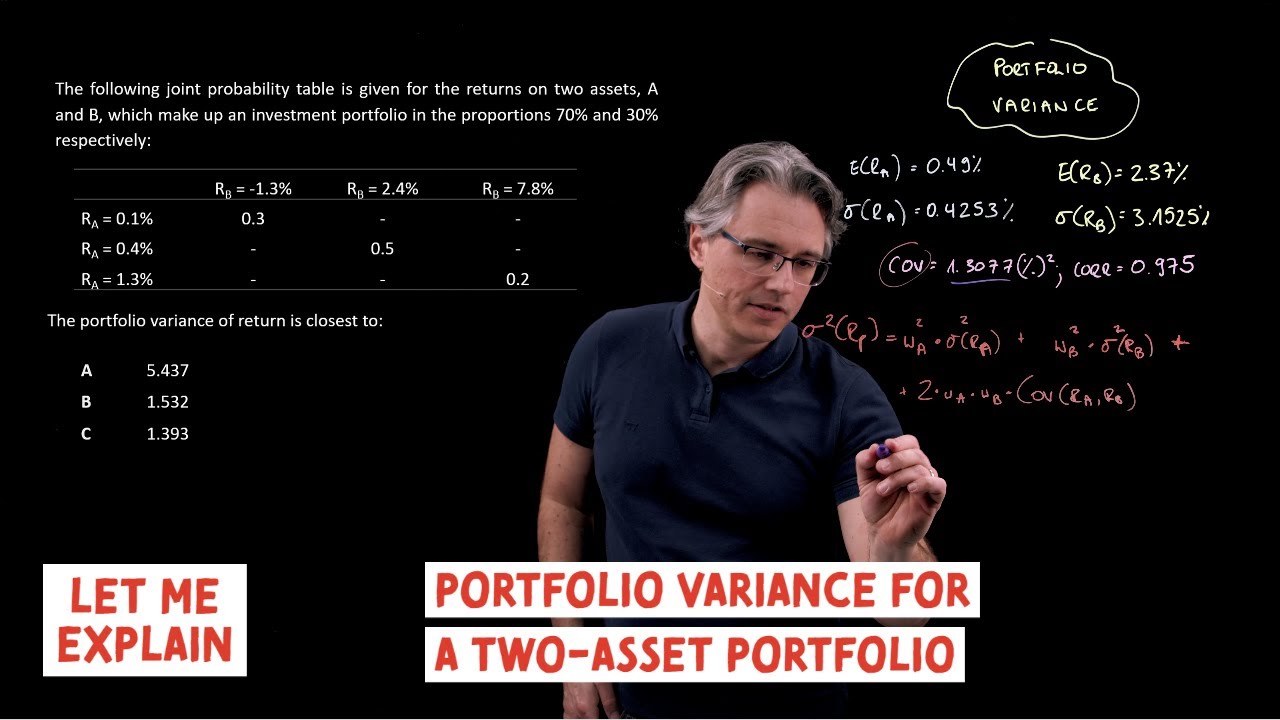

Portfolio variance for a two-asset portfolio (for the @CFA Level 1 exam) explores the application of the variance formula in the context of a portfolio composed of 2 assets.

Diversification with Two Assets

Portfolio variance for a two-asset portfolio (for the @CFA Level 1 exam)

Calculating Expected Portfolio Returns and Portfolio Variances

Portfolio Theory: Calculating a Minimum Variance Two Asset Portfolio - Part 1

Calculating Risk and Return of a Two Asset Portfolio

How to Easily Calculate Portfolio Variance for Multiple Securities in Excel

Two security portfolio variance and risk with covariance and variance values

Texas BA II Plus | STO and RCL functions for 2-asset Portfolio Variance and Standard Deviation

Markowitz Model and Modern Portfolio Theory - Explained

Calculating Two Asset Porfolio Standard Deviation 2 0

Calculating Two Asset Porfolio Standard Deviation

CFA® Level I Portfolio Management - Minimum Variance Portfolios and Efficient Frontier

Variance of a Single Asset

7. Two Asset Portfolio: Calculating Covariance and Weights of Securities

Portfolio Theory: Calculating a Minimum Variance Two Asset Portfolio - Part 2

Portfolio of Two Risky Assets

Portfolio Return and Variance (Calculations for CFA® and FRM® Exams)

Portfolio Theory: Calculating a Minimum Variance Two Asset Portfolio - Part 3

Calculate Risk And Return Of A Two-Asset Portfolio In Excel (Expected Return And Standard Deviation)

Lecture 52 Example 1 of Portfolio Variance

14. Portfolio Theory

Minimum Variance Portfolio with Many Stocks

Portfolio Variance Part 2

Lecture 53: Example 2 of Portfolio Variance

Комментарии

0:14:20

0:14:20

0:04:07

0:04:07

0:12:55

0:12:55

0:05:31

0:05:31

0:03:29

0:03:29

0:07:18

0:07:18

0:06:25

0:06:25

0:03:55

0:03:55

0:09:12

0:09:12

0:11:22

0:11:22

0:11:22

0:11:22

0:07:51

0:07:51

0:03:29

0:03:29

0:18:12

0:18:12

0:06:23

0:06:23

0:14:17

0:14:17

0:21:19

0:21:19

0:06:09

0:06:09

0:04:33

0:04:33

0:12:17

0:12:17

1:24:55

1:24:55

0:07:04

0:07:04

0:14:32

0:14:32

0:04:13

0:04:13