filmov

tv

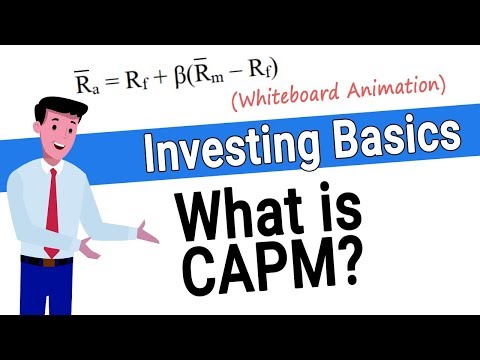

CAPM (Capital Asset Pricing Model EXPLAINED)

Показать описание

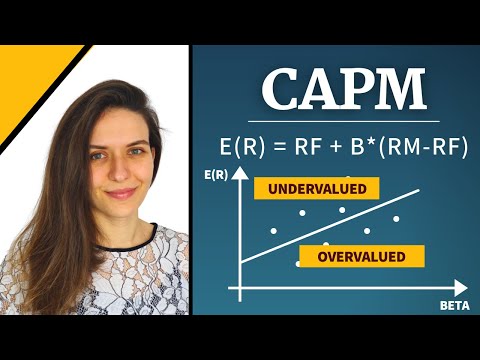

So what exactly is CAPM? Or in other words, what is the Capital Asset Pricing Model?

In this video, you will learn about the basics of CAPM. For example, its equation, how it works, and a clear example of CAPM in action. This way, you can learn to use CAPM for yourself too. Next, we will move on the more specific parts of CAPM too. For instance, the beta coefficient and the efficient frontier. Both of these are important concepts in the CAPM and are widely-used terms in the financial world. Lastly, we will talking about the problems with CAPM. Does it actually work in the real work?

Quick Summary: CAPM, or the Capital Asset Pricing Model identifies the relationship between systematic risk and the assured return of assets like stocks. In other words, it basically shows you how much risk you have to take to get a certain amount of return. CAPM is a great tool to price risk securities and find the expected returns of an asset based on the risk and cost of capital.

Want to watch the "Most Popular" video that all investors watch?

Contents of the Video

00:00 - Intro

00:12 - What does CAPM stand for?

00:26 - What is the CAPM?

01:15 - How does CAPM work?

02:47 - Example of the CAPM

03:23 - Problems with the CAPM

04:14 - CAPM and the Efficient Frontier

05:04 - Key Takeaways

05:42 - Outro

Hashtags

#CAPM

#CapitalAssetPricingModel

#WhatisCAPM

#WhatistheCapitalAssetPricingModel

#CAPMModel

#CAPMEquation

#BetaCoefficient

#TheEfficientFrontier

#MostEfficientPortfolio

#WhataretheproblemswithCAPM

#TheBetaCoefficientofStocks

#IsCAPMRealistic

#DiscountedCashFlow

#Investing

#TechicalAnalysis

Credits/Sources:

In this video, you will learn about the basics of CAPM. For example, its equation, how it works, and a clear example of CAPM in action. This way, you can learn to use CAPM for yourself too. Next, we will move on the more specific parts of CAPM too. For instance, the beta coefficient and the efficient frontier. Both of these are important concepts in the CAPM and are widely-used terms in the financial world. Lastly, we will talking about the problems with CAPM. Does it actually work in the real work?

Quick Summary: CAPM, or the Capital Asset Pricing Model identifies the relationship between systematic risk and the assured return of assets like stocks. In other words, it basically shows you how much risk you have to take to get a certain amount of return. CAPM is a great tool to price risk securities and find the expected returns of an asset based on the risk and cost of capital.

Want to watch the "Most Popular" video that all investors watch?

Contents of the Video

00:00 - Intro

00:12 - What does CAPM stand for?

00:26 - What is the CAPM?

01:15 - How does CAPM work?

02:47 - Example of the CAPM

03:23 - Problems with the CAPM

04:14 - CAPM and the Efficient Frontier

05:04 - Key Takeaways

05:42 - Outro

Hashtags

#CAPM

#CapitalAssetPricingModel

#WhatisCAPM

#WhatistheCapitalAssetPricingModel

#CAPMModel

#CAPMEquation

#BetaCoefficient

#TheEfficientFrontier

#MostEfficientPortfolio

#WhataretheproblemswithCAPM

#TheBetaCoefficientofStocks

#IsCAPMRealistic

#DiscountedCashFlow

#Investing

#TechicalAnalysis

Credits/Sources:

Комментарии

0:05:20

0:05:20

0:02:47

0:02:47

0:08:01

0:08:01

0:10:34

0:10:34

0:04:23

0:04:23

0:04:45

0:04:45

0:12:19

0:12:19

0:05:51

0:05:51

0:07:00

0:07:00

0:06:43

0:06:43

0:03:02

0:03:02

0:08:17

0:08:17

0:25:55

0:25:55

0:08:07

0:08:07

0:05:38

0:05:38

0:18:36

0:18:36

0:32:40

0:32:40

0:08:01

0:08:01

0:16:02

0:16:02

0:10:23

0:10:23

0:19:28

0:19:28

0:04:39

0:04:39

0:03:31

0:03:31

0:33:08

0:33:08