filmov

tv

Capital Asset Pricing Model

Показать описание

Professor Dr. Markus Rudolf, Allianz Endowed Chair of Finance, WHU, explains the Capital Asset Pricing Model (CAPM)

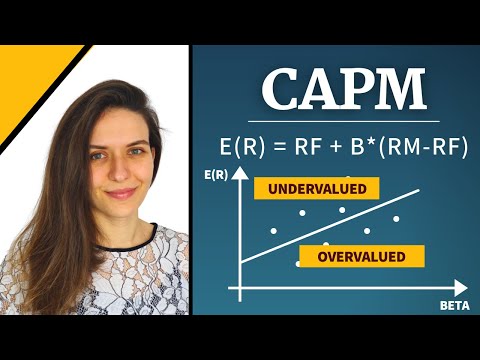

CAPM - What is the Capital Asset Pricing Model

Capital Asset Pricing Model

CAPM Explained - What is the Capital Asset Pricing Model? (AMZN Example)

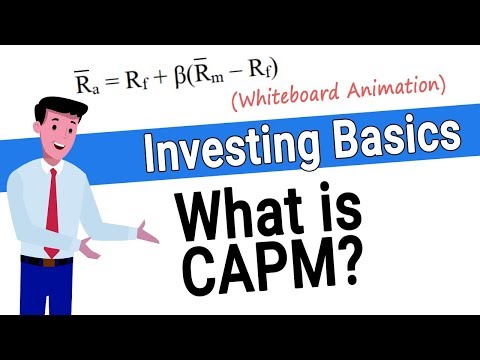

🔴 3 Minutes! CAPM Finance and the Capital Asset Pricing Model Explained (Quick Overview)

Explaining the Capital Asset Pricing Model (CAPM) & Security Market Line (SML)

Capital Asset Pricing Model (CAPM)

What is Capital Asset Pricing Mode (CAPM) | with Calculation Examples

Capital Asset Pricing Model (CAPM) - Financial Markets by Yale University #16

Arbitrage Pricing Theory vs Capital Asset Pricing Model

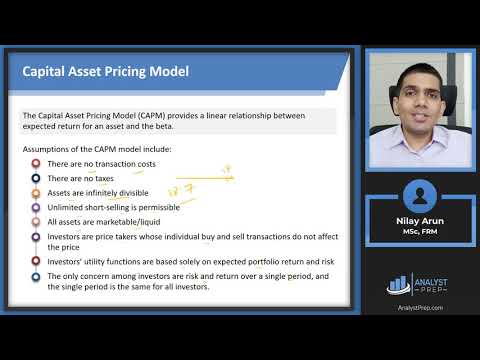

The Standard Capital Asset Pricing Model (FRM Part 1 – Book 1 – Chapter 10)

Capital Asset Pricing Model

Solving Some Simple Problems Using The Capital Asset Pricing Model (CAPM)

CAPITAL ASSET PRICING MODEL(CAPM) INTRO - VIDEO 1

Capital asset pricing model (part a) - ACCA Financial Management (FM)

Introduction to the Capital Asset Pricing Model (CAPM)

Capital Asset Pricing Model | CAPM |ACCA | CMA | CPA | CIMA | CA | CIA | CA | Commerce Specialist |

How to Use the Capital Asset Pricing Model (CAPM) to Invest Wisely

Beta and CAPM (Calculations for CFA® and FRM® Exams)

CAPM | Was ist das Capital Asset Pricing Model? | einfach erklärt

CAPM - Derivation of the Capital Asset Pricing Model

CAPITAL ASSETS PRICING MODEL(CAPM) QUESTION - LESSON 2

CAPM Explained

Capital Asset Pricing Model

Capital Asset Pricing Model

Комментарии

0:05:20

0:05:20

0:04:23

0:04:23

0:05:38

0:05:38

0:02:47

0:02:47

0:08:01

0:08:01

0:06:43

0:06:43

0:10:23

0:10:23

0:10:34

0:10:34

0:05:51

0:05:51

0:25:55

0:25:55

0:03:02

0:03:02

0:10:39

0:10:39

0:33:08

0:33:08

0:19:28

0:19:28

0:16:37

0:16:37

0:16:02

0:16:02

0:09:36

0:09:36

0:21:08

0:21:08

0:04:45

0:04:45

0:10:05

0:10:05

0:37:05

0:37:05

0:09:52

0:09:52

0:32:40

0:32:40

0:34:20

0:34:20