filmov

tv

Capital asset pricing model (part a) - ACCA Financial Management (FM)

Показать описание

Capital asset pricing model (part a) - ACCA Financial Management (FM)

Free lectures for the ACCA Financial Management (FM) Exam

Please go to opentuition to post questions to ACCA Tutor, we do not provide support on youtube.

Free lectures for the ACCA Financial Management (FM) Exam

Please go to opentuition to post questions to ACCA Tutor, we do not provide support on youtube.

CAPM - What is the Capital Asset Pricing Model

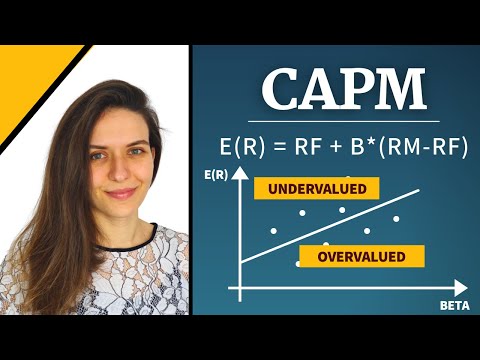

CAPM Explained - What is the Capital Asset Pricing Model? (AMZN Example)

Capital Asset Pricing Model

The capital asset pricing model (part 1) - ACCA (AFM) lectures

Capital asset pricing model (part a) - ACCA Financial Management (FM)

Capital asset pricing model (part b) - ACCA Financial Management (FM)

CAPM | Was ist das Capital Asset Pricing Model? | einfach erklärt

The Standard Capital Asset Pricing Model (FRM Part 1 – Book 1 – Chapter 10)

October 8, 2024 Budget Committee

Explaining the Capital Asset Pricing Model (CAPM) & Security Market Line (SML)

ACCA F9 Capital asset pricing model (part a)

ACCA F9 Capital asset pricing model (part b)

🔴 3 Minutes! CAPM Finance and the Capital Asset Pricing Model Explained (Quick Overview)

Capital Asset Pricing Model (CAPM)

CAPITAL ASSET PRICING MODEL(CAPM) INTRO - VIDEO 1

What is Capital Asset Pricing Mode (CAPM) | with Calculation Examples

Advanced CAPM Part 1: Capital Asset Pricing Model

The capital asset pricing model (part 2) - ACCA (AFM) lectures

CIMA F3 Capital Asset Pricing Model (CAPM) - part 1

CAPITAL ASSETS PRICING MODEL(CAPM) QUESTION - LESSON 2

Capital Asset Pricing Model (CAPM) - Financial Markets by Yale University #16

Capital Asset Pricing Model

CAPM Model Part 4 - Required Return - What is Capital Asset Pricing Model

Solving Some Simple Problems Using The Capital Asset Pricing Model (CAPM)

Комментарии

0:05:20

0:05:20

0:05:38

0:05:38

0:04:23

0:04:23

0:29:31

0:29:31

0:19:28

0:19:28

0:21:25

0:21:25

0:04:45

0:04:45

0:25:55

0:25:55

2:29:24

2:29:24

0:08:01

0:08:01

0:19:30

0:19:30

0:21:27

0:21:27

0:02:47

0:02:47

0:06:43

0:06:43

0:33:08

0:33:08

0:10:23

0:10:23

0:09:59

0:09:59

0:27:58

0:27:58

0:14:37

0:14:37

0:37:05

0:37:05

0:10:34

0:10:34

0:03:02

0:03:02

0:09:03

0:09:03

0:10:39

0:10:39