filmov

tv

Present value, future value, and compounding made easy

Показать описание

Background

A dollar received now is more valuable than a dollar received a year from now. If you have that dollar today, you can invest it and increase its value. Let's explain a bit further:

The time of value of money is the difference in value between having a dollar in hand today and receiving a dollar sometime in the future.

Why is present and future value important?

Since money has a time value, we must take this time value into consideration when making business decisions. Present and future value calculations are powerful methods available in making financial decisions.

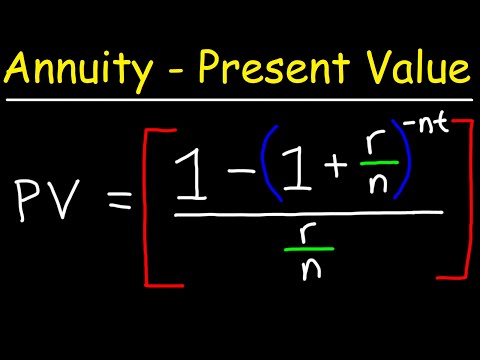

Once you understand and master the calculations, you can apply these equations for restating cash flows to make them equivalent in business decisions. The calculations are building blocks for many decisions facing individuals and managers alike. In addition, these calculations allow one to calculate returns on investments, capital budgeting, and return on annuities, just to name a few.

Key terms:

Future value (fv) and present value (pv) are two concepts in clarifying the value of money.

Future value is explained as an amount of money invested at present and will mature at the end of a given time when compounded at a given interest rate.

Present value is money that must be invested now to accrue to a certain amount of money in the future when compounded. In simpler terms, present value is the value today of an amount of money in the future. Why is this important? For these situations, businesses need to find a method of weighing cash flows that are received at various periods of times (annual, years, quarters, ect).

How do we go about finding the present and future value of cash flow?

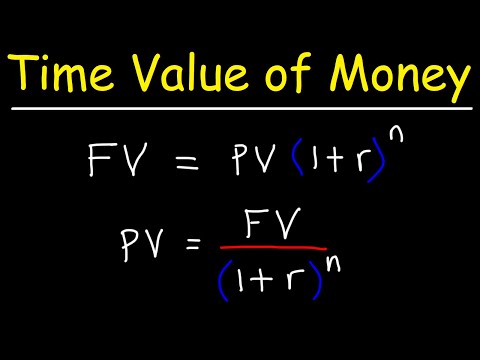

There are two fundamental equations that are commonly used; this video will demonstrate them throughout the presentation.

Objectives:

Following my discussion, you will be able to:

• Have the knowledge of present value (pv) and future value (fv)

• Be able to calculate the pv and fv with compounding

• Have an understanding of compound interest

Discussion:

The video discusses the value of a dollar in hand today and applying calculations to determine what that dollar will be worth in the future. In addition, the video demonstrates the concept of wanting to have a specified amount of money in the future and the amount of money needed today in order to earn that specified amount.

See the formulas used in video:

Fv=pv (1+i) n

Pv= (1/1+i) n

FvPvn

Pv=the beginning amount

i= the interest rate/year

n=number of years

Fv=value at the end of n years.

Important points:

When computing compounding interest for greater than one year, remember that the interest in the next year is being paid on interest. The interest on the original dollar amount is referred to as "simple interest." Lastly, Net present value can be defined as the difference between the PV of cash inflows and the present value of cash outflows. Net present value is used in capital budgets to assess the probability of a project. The net present value is a standard affirming that a project should be established.

Example:

If a bank pays 5% interest on a $100 deposit today, in one year, this $100 will be worth $105. This is expressed by the following equation: F1= p (1+r). F1 is the balance at the end of the period, p represents the amount of invested, and r represents the rate of interest.

For example, the future of $1,000 compounded at 10%, would be $1,100 after one year and $ 1,331 after three years of investing. For example, if the interest rate is 10%, then the present value of $500 earned or spent in one year from now is $500 divided by 1.10, equates to $455. This example demonstrates the overall notion that the present value of a future amount is less than the actual future amount.

Summary

Present and future values are important methods for any financial decision. An investment can be viewed in two methods. We discussed present and future values in this video. The process of finding the present value of future cash flows is referred as discounting. Discounting future value to present value is a common technique, especially when weighing in on capital budget decisions. Have the knowledge of the calculations will allow individuals to calculate almost any investment decision

A dollar received now is more valuable than a dollar received a year from now. If you have that dollar today, you can invest it and increase its value. Let's explain a bit further:

The time of value of money is the difference in value between having a dollar in hand today and receiving a dollar sometime in the future.

Why is present and future value important?

Since money has a time value, we must take this time value into consideration when making business decisions. Present and future value calculations are powerful methods available in making financial decisions.

Once you understand and master the calculations, you can apply these equations for restating cash flows to make them equivalent in business decisions. The calculations are building blocks for many decisions facing individuals and managers alike. In addition, these calculations allow one to calculate returns on investments, capital budgeting, and return on annuities, just to name a few.

Key terms:

Future value (fv) and present value (pv) are two concepts in clarifying the value of money.

Future value is explained as an amount of money invested at present and will mature at the end of a given time when compounded at a given interest rate.

Present value is money that must be invested now to accrue to a certain amount of money in the future when compounded. In simpler terms, present value is the value today of an amount of money in the future. Why is this important? For these situations, businesses need to find a method of weighing cash flows that are received at various periods of times (annual, years, quarters, ect).

How do we go about finding the present and future value of cash flow?

There are two fundamental equations that are commonly used; this video will demonstrate them throughout the presentation.

Objectives:

Following my discussion, you will be able to:

• Have the knowledge of present value (pv) and future value (fv)

• Be able to calculate the pv and fv with compounding

• Have an understanding of compound interest

Discussion:

The video discusses the value of a dollar in hand today and applying calculations to determine what that dollar will be worth in the future. In addition, the video demonstrates the concept of wanting to have a specified amount of money in the future and the amount of money needed today in order to earn that specified amount.

See the formulas used in video:

Fv=pv (1+i) n

Pv= (1/1+i) n

FvPvn

Pv=the beginning amount

i= the interest rate/year

n=number of years

Fv=value at the end of n years.

Important points:

When computing compounding interest for greater than one year, remember that the interest in the next year is being paid on interest. The interest on the original dollar amount is referred to as "simple interest." Lastly, Net present value can be defined as the difference between the PV of cash inflows and the present value of cash outflows. Net present value is used in capital budgets to assess the probability of a project. The net present value is a standard affirming that a project should be established.

Example:

If a bank pays 5% interest on a $100 deposit today, in one year, this $100 will be worth $105. This is expressed by the following equation: F1= p (1+r). F1 is the balance at the end of the period, p represents the amount of invested, and r represents the rate of interest.

For example, the future of $1,000 compounded at 10%, would be $1,100 after one year and $ 1,331 after three years of investing. For example, if the interest rate is 10%, then the present value of $500 earned or spent in one year from now is $500 divided by 1.10, equates to $455. This example demonstrates the overall notion that the present value of a future amount is less than the actual future amount.

Summary

Present and future values are important methods for any financial decision. An investment can be viewed in two methods. We discussed present and future values in this video. The process of finding the present value of future cash flows is referred as discounting. Discounting future value to present value is a common technique, especially when weighing in on capital budget decisions. Have the knowledge of the calculations will allow individuals to calculate almost any investment decision

Комментарии

0:05:14

0:05:14

0:04:57

0:04:57

0:02:50

0:02:50

0:05:26

0:05:26

0:21:53

0:21:53

0:05:02

0:05:02

0:01:29

0:01:29

0:14:43

0:14:43

0:44:09

0:44:09

0:07:33

0:07:33

0:07:50

0:07:50

0:04:59

0:04:59

0:32:07

0:32:07

0:16:15

0:16:15

0:15:54

0:15:54

0:30:52

0:30:52

0:08:17

0:08:17

0:15:10

0:15:10

0:10:03

0:10:03

0:03:58

0:03:58

0:03:27

0:03:27

0:04:25

0:04:25

0:00:57

0:00:57

0:11:24

0:11:24