filmov

tv

Time Value of Money- Macroeconomics

Показать описание

Should you take $100 today or $200 in two years? Mr. Clifford expalins how to calculate the future value and the present value of money.

Time Value of Money- Macroeconomics

Time value of money | Interest and debt | Finance & Capital Markets | Khan Academy

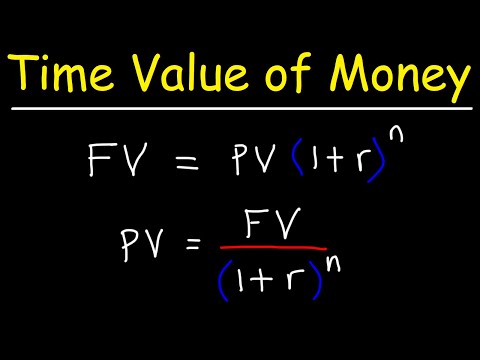

Time Value of Money - Present Value vs Future Value

Understanding the Time Value of Money | Macroeconomics

Time value of money explained

Time Value of Money Finance - TVM Formulas & Calculations - Annuities, Present Value, Future Val...

The Time Value of Money (Explained)

AP Macroeconomics: Time Value of Money

Inflation Meaning, Features & its Types | Currency & Banking | CUET PG M.Com 2025 | M.Com En...

The Time Value of Money | Personal Finance Series

TVM, Time Value of Money full chapter, Compounding, Discounting method, Business finance, Capital

Time Value of Money - Explained (Step by Step Beginner's Guide)

Time Value of Money | By Wall Street Survivor

What is Time Value of Money - Explained with Formula and Examples.

Time Value of Money: Basic Concept【Dr. Deric】

017 - Engineering Economy Time Value of Money

Time value of money. Simplified

Basic Bond Algebra Time Value of Money

Time Value of Money Values over the Timeline

Time value of money finance. Theory and formula

Time Value of Money

What is Time Value of Money - Time Value of Money Formula

Time value of Money | Fundamentals of Financial Mathematics Part 1| Financial Economics

Casharka 1aad Time Value of Money Chapter 5 Finance

Комментарии

0:02:50

0:02:50

0:08:17

0:08:17

0:05:14

0:05:14

0:08:48

0:08:48

0:04:57

0:04:57

0:21:53

0:21:53

0:11:31

0:11:31

0:04:02

0:04:02

0:21:59

0:21:59

0:04:27

0:04:27

0:18:34

0:18:34

0:13:11

0:13:11

0:01:51

0:01:51

0:05:15

0:05:15

0:06:37

0:06:37

0:33:29

0:33:29

0:21:21

0:21:21

0:04:31

0:04:31

0:03:05

0:03:05

0:08:21

0:08:21

0:30:53

0:30:53

0:09:35

0:09:35

0:14:25

0:14:25

0:22:37

0:22:37