filmov

tv

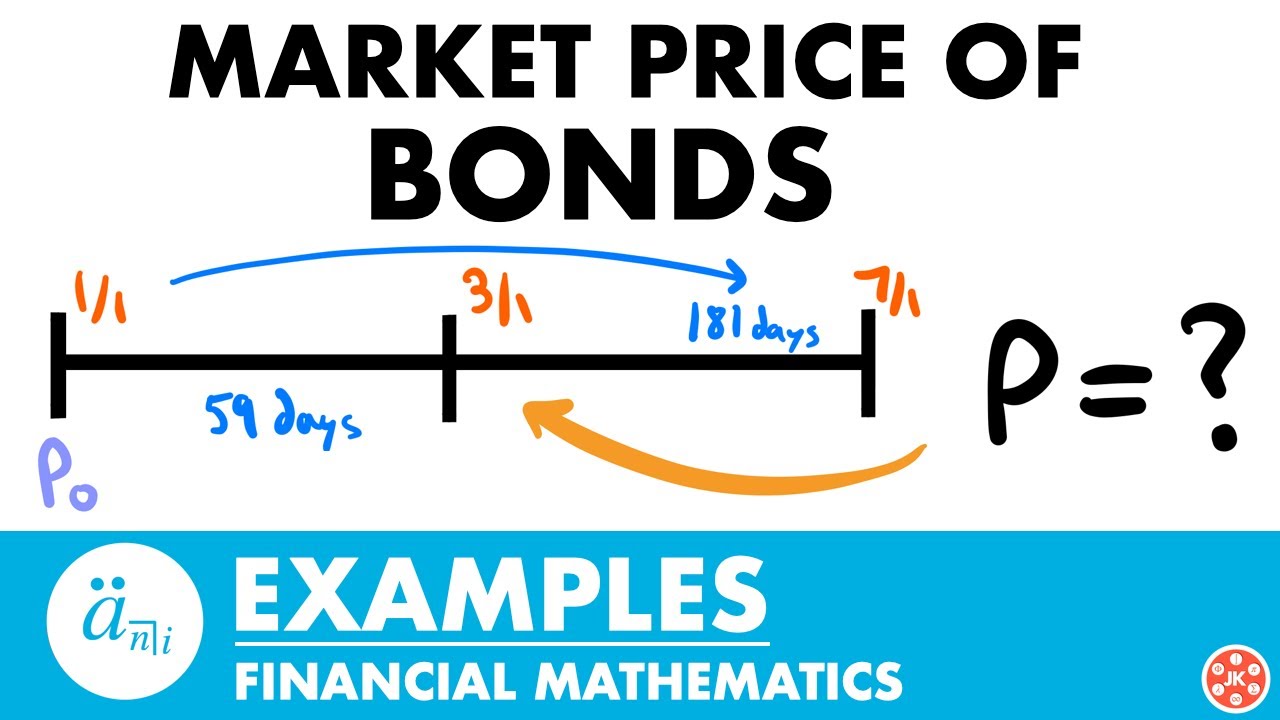

Market Price of Bonds Examples | Exam FM | Financial Mathematics - JK Math

Показать описание

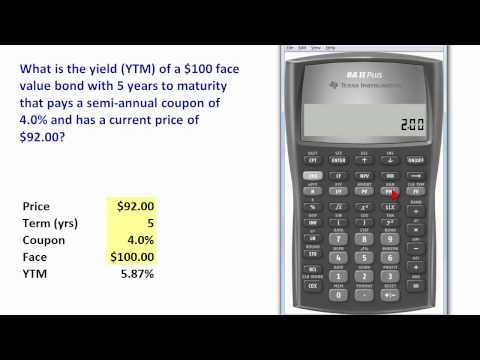

Example Problems For How to Calculate the Market Price of a Bond (Financial Mathematics)

In this video we look at practice problems of calculating the price of a bond when it is valued in between coupon dates, also known as the market price of a bond. We look at two different examples of finding the market price of a bond, using the formula we learned in our corresponding lesson video.

This course is designed to help students understand the concepts of mathematics of investment and credit, as well as provide a starting point in preparation for the Actuarial Exam FM (Financial Mathematics).

Financial Mathematics requires a proficient understanding of Calculus concepts such as derivative and integration techniques. This implies that a solid understanding in various algebra skills, including manipulating equations, basic factoring methods, solving logarithmic equations, and more, are also required to fully comprehend and learn the concepts of the Financial Mathematics course.

Video Chapters:

0:00 Example 1 - Basic Market Price Problem

10:38 Example 2 - Harder Market Price Problem

19:28 Outro

⚡️Math Products I Recommend⚡️

⚡️Textbooks I Use⚡️

⚡️My Recording Equipment⚡️

(Commissions earned on qualifying purchases)

Find me on social media:

Instagram: @jk_mathematics

Found this video to be helpful? Consider giving this video a like and subscribing to the channel!

Thanks for watching! Any questions? Feedback? Leave a comment!

-Josh from JK Math

#math #finance #examfm

Disclaimer: Please note that some of the links associated with the videos on my channel may generate affiliate commissions on my behalf. As an amazon associate, I earn from qualifying purchases that you may make through such affiliate links.

In this video we look at practice problems of calculating the price of a bond when it is valued in between coupon dates, also known as the market price of a bond. We look at two different examples of finding the market price of a bond, using the formula we learned in our corresponding lesson video.

This course is designed to help students understand the concepts of mathematics of investment and credit, as well as provide a starting point in preparation for the Actuarial Exam FM (Financial Mathematics).

Financial Mathematics requires a proficient understanding of Calculus concepts such as derivative and integration techniques. This implies that a solid understanding in various algebra skills, including manipulating equations, basic factoring methods, solving logarithmic equations, and more, are also required to fully comprehend and learn the concepts of the Financial Mathematics course.

Video Chapters:

0:00 Example 1 - Basic Market Price Problem

10:38 Example 2 - Harder Market Price Problem

19:28 Outro

⚡️Math Products I Recommend⚡️

⚡️Textbooks I Use⚡️

⚡️My Recording Equipment⚡️

(Commissions earned on qualifying purchases)

Find me on social media:

Instagram: @jk_mathematics

Found this video to be helpful? Consider giving this video a like and subscribing to the channel!

Thanks for watching! Any questions? Feedback? Leave a comment!

-Josh from JK Math

#math #finance #examfm

Disclaimer: Please note that some of the links associated with the videos on my channel may generate affiliate commissions on my behalf. As an amazon associate, I earn from qualifying purchases that you may make through such affiliate links.

Комментарии

0:02:20

0:02:20

0:18:24

0:18:24

0:19:48

0:19:48

0:04:47

0:04:47

0:03:07

0:03:07

0:03:47

0:03:47

0:01:26

0:01:26

0:13:16

0:13:16

1:21:46

1:21:46

0:06:44

0:06:44

0:08:42

0:08:42

0:10:49

0:10:49

0:09:34

0:09:34

0:07:58

0:07:58

0:12:26

0:12:26

0:04:42

0:04:42

0:07:24

0:07:24

0:06:38

0:06:38

0:02:17

0:02:17

0:11:13

0:11:13

0:36:20

0:36:20

0:09:22

0:09:22

0:45:01

0:45:01

0:13:51

0:13:51