filmov

tv

BEFORE Trading Options Learn The GREEKS | (Delta, Gamma, Theta, Vega, Rho)

Показать описание

🔥 Access Live Exclusive Masterclass events to learn options and the market:

👉🏻💥 CONNECT WITH ME:

Advanced Plays

In this series, we'll explore advanced options strategies – straddles and strangles, short condors and long/short butterflies. Whether you're looking to generate consistent income, profit in a rangebound market, or take advantage of significant price movements, these strategies can help you achieve your objectives. We'll cover the best practices for each strategy, including identifying optimal environments and constructing them for maximum effectiveness. If you're an advanced options trader looking to take your trading to the next level, don't miss this opportunity to learn about these powerful strategies.

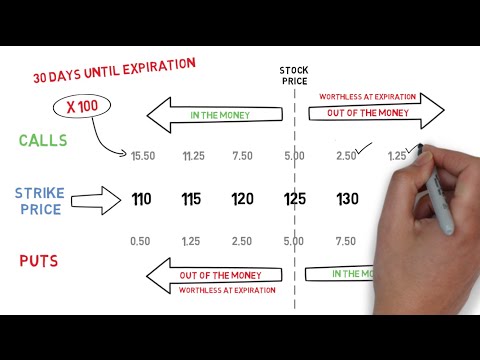

Session 1: Advanced Plays Pre-Req: The Option Greeks

Join us for an engaging educational session where we delve into the world of option Greeks: Delta, Theta, Gamma, and Vega. 🏛 Understanding these key 🔑 variables is essential for evaluating the risks and rewards of various options strategies. We will use these for the advanced options sessions.

In this session, you will learn:

✅ How Delta, Theta, Gamma, and Vega influence the behavior of options and their values.

✅ The significance of each Greek in determining the potential profitability and risk exposure of options strategies.

✅ Practical insights on leveraging the Greeks to make more informed decisions when selecting strikes, expirations, and adapting to changing market conditions.

Gain a comprehensive understanding of how the Greeks impact your options trades and discover the foundational elements necessary for selecting strikes, expirations, and optimal trading environments. 📖

**Become an OptionsPlay member to get unlimited access to all our educational recordings and easy-to-follow slides!

_______________________

Disclaimer: OptionsPlay LLC is not registered as a securities broker-dealer or advisor either with the U.S. Securities and Exchange Commission or with any state securities regulatory authority. OptionsPlay does not recommend the purchase of any stock, ETF, or advise on the suitability of any trade. The information and data contained in OptionsPlay was obtained from sources believed to be reliable, but accuracy is not guaranteed. Neither the information nor any opinion expressed, constitutes a recommendation to purchase or sell a security or to provide investment advice.

#optionstrading #technicalanalysis #technicalindicators

Комментарии

0:18:21

0:18:21

0:23:15

0:23:15

0:12:08

0:12:08

0:42:36

0:42:36

0:22:23

0:22:23

2:53:42

2:53:42

0:08:14

0:08:14

0:07:31

0:07:31

0:07:17

0:07:17

1:13:32

1:13:32

0:13:17

0:13:17

0:27:07

0:27:07

0:13:24

0:13:24

0:10:44

0:10:44

0:20:19

0:20:19

0:10:55

0:10:55

0:09:00

0:09:00

0:16:18

0:16:18

0:10:31

0:10:31

0:08:01

0:08:01

0:00:23

0:00:23

0:05:16

0:05:16

0:23:16

0:23:16

0:16:14

0:16:14