filmov

tv

How to CALCULATE YOUR return on investment? Property investment ROI EXPLAINED

Показать описание

When it comes to the numbers side of property it’s super important that you manage to get your head round them! But they are complicated! Today I am going to try my best to breakdown how you can calculate your return on investment! Return on investment is one of the main things to consider when entering the property investment world, and in having a positive return of investment will set you up for a strong journey through out your property investment trip! Did this video on calculating return of investment help? Have you managed to work out your return on investment? Have you been putting off working out your return on investment? Let me know in the comments below!

------------------------------------------------------------------------------------------------

Before you go make sure you've subscribed to not miss out on the latest property investment videos!

------------------------------------------------------------------------------------------------

Before you go make sure you've subscribed to not miss out on the latest property investment videos!

The Return On Investment (ROI) in One Minute: Definition, Explanation, Examples, Formula/Calculation

How to Calculate Total Return on Stock

How to calculate stock returns

How To Calculate Your Rate of Return

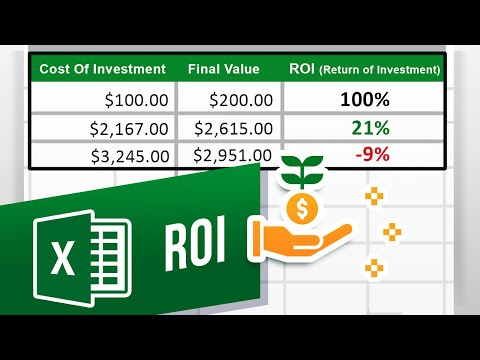

How to Calculate ROI (Return on Investment)

How To Calculate Stock Returns

Math in Daily Life : How to Calculate Rate of Return

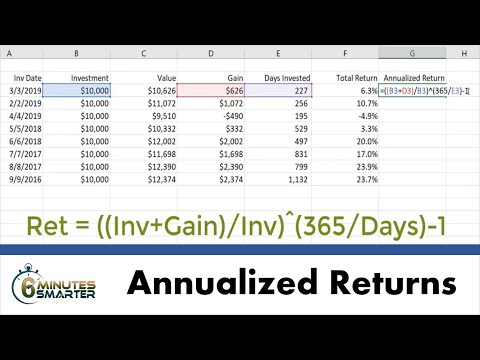

Calculate Annualized Returns for Investments in Excel

How to Calculate Your CRS Score Correctly & Get Canadian PR in 2025!

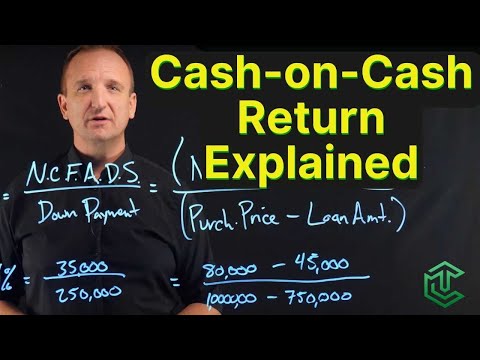

How To Calculate Cash-On-Cash Return

HOW TO CALCULATE DIVIDENDS: 5 EASY STEPS

How to Calculate Your Investment Returns | Kirtan Shah CFP

Know-how to calculate your stock returns | INDmoney #shorts

How to Calculate Return on Stock in Excel

How to Calculate your Portfolio's Expected Return! (Step by Step)

How To Calculate ROI

Excel 2016 - How to Calculate your Return / Percentage of Gains or Losses of an Investment

Easy way to estimate your tax return, Manually calculate your refund

Crowdlending P2P Excel spreadsheet. How to calculate your return. (Download link in description)

How To Calculate Return On Investments (ROI)? #shorts

How To Calculate The Return on Investment (ROI) of Real Estate & Stocks

XIRR vs CAGR: Better way to calculate Return on Mutual Funds?

401k Returns: Understand Your Rate of Return (Compare, Calculate, & More)

How to calculate YIELD vs How to calculate ROI in PROPERTY | Jamie York

Комментарии

0:01:20

0:01:20

0:02:52

0:02:52

0:06:41

0:06:41

0:05:17

0:05:17

0:01:53

0:01:53

0:08:52

0:08:52

0:02:04

0:02:04

0:05:15

0:05:15

0:19:48

0:19:48

0:01:44

0:01:44

0:02:23

0:02:23

0:01:13

0:01:13

0:00:59

0:00:59

0:02:48

0:02:48

0:03:58

0:03:58

0:13:45

0:13:45

0:01:32

0:01:32

0:10:23

0:10:23

0:05:01

0:05:01

0:00:39

0:00:39

0:15:07

0:15:07

0:00:58

0:00:58

0:19:40

0:19:40

0:10:21

0:10:21