filmov

tv

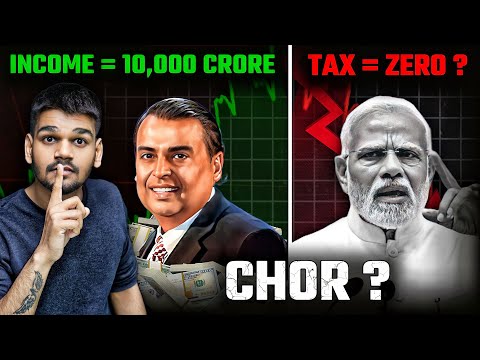

HOW THE RICH NEVER PAY TAXES ? : Business Case Study | Aditya Saini

Показать описание

Pay your Credit Card Bill only on the MobiKwik app.

MobiKwik offers 1%* cashback on every full credit card bill payment.

How can Credit Card Bill Payment via MobiKwik helps to save extra?

☑️ Lightning fast settlement to avoid late payment fee/penalty

☑️ Spend Analytics (Monitor & optimize your expenses)

☑️ 1%* Cashback

☑️ Regular bill reminders (Never miss the due date)

-------------------------------------------------

Are you tired of seeing the ultra-rich get away with not paying their fair share of taxes? In this eye-opening video, we reveal the shocking tactics used by the wealthy to avoid paying taxes and how it impact the rest of society. Our expert guests provide insightful commentary and analysis on this controversial issue. Don't miss out on this must-see video that exposes the truth about how the rich avoid paying taxes. Watch now and join the conversation.

In this eye-opening video, we dive deep into the strategies used by the wealthy to legally avoid paying their fair share of taxes. You'll learn about the loopholes and tactics employed by the ultra-rich to keep their money out of the government's hands, and how this affects the rest of us. Whether you're a concerned citizen or a budding entrepreneur, the insights shared in this video will be invaluable in understanding the complex world of tax evasion. So don't miss out on this must-watch content – hit play now and get ready to be enlightened.

In this video, we dive into the world of tax evasion and how the rich are able to avoid paying their fair share. We'll explore the legal loopholes, offshore accounts, and other strategies used by the wealthy to minimise their tax burden. You'll learn about the history of tax avoidance, the impact it has on society, and what you can do to help level the playing field. This is a must-watch video if you're interested in the intersection of wealth, power, and politics.

Topics covered in this video:

The difference between tax avoidance and tax evasion

The most common tax avoidance strategies used by the rich

The History of tax evasion and its Impact on society

The Role of offshore accounts and tax havens

The political and ethical implications of tax avoidance

What you can do to advocate for tax reform and greater equality

Watch this video now to learn how the rich avoid taxes and what we can do about it. Don't forget to subscribe to our channel for more insightful content on finance, economics, and politics.

-------------------------------------------------

MORE POWERFULL VIDEOS:

-------------------------------------------------

MY SOCIAL MEDIA HANDLES:

-------------------------------------------------

-------------------------------------------------

THANK YOU SO MUCH

#adityasaini #adityasainicasestudy #businesscasestudy #taxes #makemoneyonline #makemoneyonline #casestudyinhindi #taxevasion #casestudyinhindi

MobiKwik offers 1%* cashback on every full credit card bill payment.

How can Credit Card Bill Payment via MobiKwik helps to save extra?

☑️ Lightning fast settlement to avoid late payment fee/penalty

☑️ Spend Analytics (Monitor & optimize your expenses)

☑️ 1%* Cashback

☑️ Regular bill reminders (Never miss the due date)

-------------------------------------------------

Are you tired of seeing the ultra-rich get away with not paying their fair share of taxes? In this eye-opening video, we reveal the shocking tactics used by the wealthy to avoid paying taxes and how it impact the rest of society. Our expert guests provide insightful commentary and analysis on this controversial issue. Don't miss out on this must-see video that exposes the truth about how the rich avoid paying taxes. Watch now and join the conversation.

In this eye-opening video, we dive deep into the strategies used by the wealthy to legally avoid paying their fair share of taxes. You'll learn about the loopholes and tactics employed by the ultra-rich to keep their money out of the government's hands, and how this affects the rest of us. Whether you're a concerned citizen or a budding entrepreneur, the insights shared in this video will be invaluable in understanding the complex world of tax evasion. So don't miss out on this must-watch content – hit play now and get ready to be enlightened.

In this video, we dive into the world of tax evasion and how the rich are able to avoid paying their fair share. We'll explore the legal loopholes, offshore accounts, and other strategies used by the wealthy to minimise their tax burden. You'll learn about the history of tax avoidance, the impact it has on society, and what you can do to help level the playing field. This is a must-watch video if you're interested in the intersection of wealth, power, and politics.

Topics covered in this video:

The difference between tax avoidance and tax evasion

The most common tax avoidance strategies used by the rich

The History of tax evasion and its Impact on society

The Role of offshore accounts and tax havens

The political and ethical implications of tax avoidance

What you can do to advocate for tax reform and greater equality

Watch this video now to learn how the rich avoid taxes and what we can do about it. Don't forget to subscribe to our channel for more insightful content on finance, economics, and politics.

-------------------------------------------------

MORE POWERFULL VIDEOS:

-------------------------------------------------

MY SOCIAL MEDIA HANDLES:

-------------------------------------------------

-------------------------------------------------

THANK YOU SO MUCH

#adityasaini #adityasainicasestudy #businesscasestudy #taxes #makemoneyonline #makemoneyonline #casestudyinhindi #taxevasion #casestudyinhindi

Комментарии

0:06:07

0:06:07

0:18:23

0:18:23

0:13:23

0:13:23

0:10:15

0:10:15

0:00:35

0:00:35

0:10:29

0:10:29

0:11:08

0:11:08

0:01:00

0:01:00

0:10:42

0:10:42

0:18:07

0:18:07

0:20:19

0:20:19

0:01:00

0:01:00

0:10:01

0:10:01

0:10:34

0:10:34

0:09:12

0:09:12

0:19:36

0:19:36

0:00:47

0:00:47

0:00:57

0:00:57

0:09:44

0:09:44

0:10:29

0:10:29

0:11:02

0:11:02

0:18:42

0:18:42

0:00:16

0:00:16

0:00:19

0:00:19