filmov

tv

What's The Right Way To Invest 15% Of Your Income?

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

How To Eat Sushi The Right Way

The Right Way to Use Your Fork and Knife

8-8-2024 Lions Gate Portal | 888 Portal | BE CAREFULL !!

The right way to play Monopoly

What's the right way to wrap Tefillin? who's right and who's wrong?

What Is the RIGHT Way to Hold a Handgun? (How To Grip And Shoot Your Handgun)

How To Do A Burpee | The Right Way | Well+Good

The Right Way to Use a Meat Thermometer

The US Economy is CRASHING (Right NOW) : How YOU Can SURVIVE the CARNAGE #layoffs #market #housing

The only right way to pick latte

How to clean a TV screen the right way | Avoid damage to your 4K flat screen!

The science is in: Exercise isn’t the best way to lose weight

How To Set Goals The RIGHT Way 📍 - Elon Musk

The Right Way to Consume Fruits | Dr. Hansaji Yogendra

Learn to Drive, Determine the Right-of-Way, & Give Way to Road Users

UK riots: 400 arrested amid far-right violence and clashes with police

Stop Cutting Watermelon Wrong! 🔪🍉 Here's the Right Way. #shorts

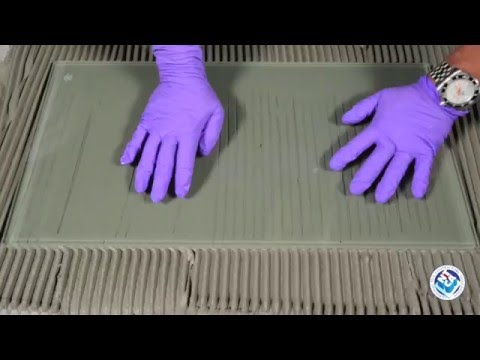

Trowel and Error - How to Set Tile the Right Way

Is it a good way to have fun together?

How To Do A Kettlebell Swing | The Right Way | Well+Good

How To Squat For Your Anatomy (FIND THE RIGHT STANCE)

The Right Way to Clean Your Glasses

The Best Way To Sharpen & Clean Knives (And The Worst) | Epicurious 101

How To Buy Tires, the RIGHT WAY

Комментарии

0:06:36

0:06:36

0:03:18

0:03:18

0:11:28

0:11:28

0:06:37

0:06:37

0:00:40

0:00:40

0:10:08

0:10:08

0:03:24

0:03:24

0:01:19

0:01:19

0:00:57

0:00:57

0:00:18

0:00:18

0:04:21

0:04:21

0:04:57

0:04:57

0:00:35

0:00:35

0:06:10

0:06:10

0:25:17

0:25:17

0:42:28

0:42:28

0:00:50

0:00:50

0:06:36

0:06:36

0:00:15

0:00:15

0:02:33

0:02:33

0:06:53

0:06:53

0:01:10

0:01:10

0:13:27

0:13:27

0:12:45

0:12:45