filmov

tv

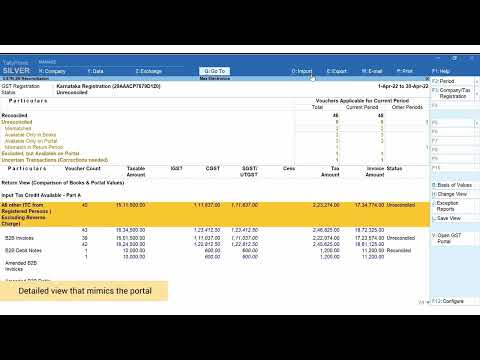

GSTR 2b reconciliation in tally prime 3.0 | Reconcile Accounts book with GST Portal

Показать описание

In this video, you will learn about gstr 2b reconciliation in tally prime. Reconcile your accounts books with gst portal. GST reconciliation includes GSTR 2B, GSTR 2A, and GSTR 1.

GSTR 2A and GSTR 2B Reconciliation | TallyPrime Walkthrough

How to Reconcile GSTR-2B Transactions in TallyPrime | TallyHelp

GSTR 2b reconciliation in tally prime 3.0 | Reconcile Accounts book with GST Portal

How to Update or Copy Doc No. and Date from the GST Portal to Books to Reconcile GSTR-2A or GSTR-2B

Easy GSTR- 2A & 2B Reconciliation with TallyPrime 3.0

Reconciliation of GSTR2B in tally prime | How to reconcile Gstr-2b in Tally Prime

GSTR2b Reconciliation in Tally ERP or Tally Prime Learn Tamil

How to Update or Copy Doc No. and Date from the GST Portal to Books to Reconcile GSTR-2A or GSTR-2B

Tally TDL : Show HSN Code & GST % in Columnar Register in Tally Prime Software.

GSTR2B reconciliation in tally prime 3.0 | how to reconcile gstr 2b in tally prime

GSTR-2B Reconciliation In TallyPrime

How to Export GSTR-2 in Old Format from the GSTR-2B or GSTR-2A Reconciliation Report in TallyPrime

how to reconciliation gstr 2b in tally prime 4.0 | gstr 2a reconciliation in tally prime 4.0

How to reconciliation Gstr2B in excel | Gstr 2b reconciliation kaise kare | Gst Reconciliation

GSTR 2A & 2B Reconciliation using TallyPrime. #shorts

Automatic GSTR2B Reconciliation Annually or Monthly From Tally Prime

GSTR-2A/2B With PURCHASE RECONCILIATION in Excel

GSTR 2B Reconciliation in Tally Prime

GSTR 2B Reconciliation in Tally Prime 5.0 | Auto-Reconcile GSTR 2B without Import any JSON file

GSTR-2B reconciliation in tally prime 3.0 #shorts

One-Click GST Reconciliation | Explainer | TallyPrime 5.0

GST reconciliation with Excel Pivot Tables 🔄 | Pivot Tables in Excel for GST Reconciliation

GSTR-2B reconciliation in tally prime release 3.0 #shorts

gstr 2b reconciliation in tally prime 4.1| 2b reconciliation in tally prime | 2b in Tally 2024-25 |

Комментарии

0:01:30

0:01:30

0:21:39

0:21:39

0:09:22

0:09:22

0:04:53

0:04:53

0:05:53

0:05:53

0:06:40

0:06:40

0:16:30

0:16:30

0:04:50

0:04:50

0:03:24

0:03:24

0:22:03

0:22:03

0:04:32

0:04:32

0:03:15

0:03:15

0:15:28

0:15:28

0:12:39

0:12:39

0:00:49

0:00:49

0:16:40

0:16:40

0:06:41

0:06:41

0:06:26

0:06:26

0:06:02

0:06:02

0:01:00

0:01:00

0:02:32

0:02:32

0:12:35

0:12:35

0:00:58

0:00:58

0:10:05

0:10:05