filmov

tv

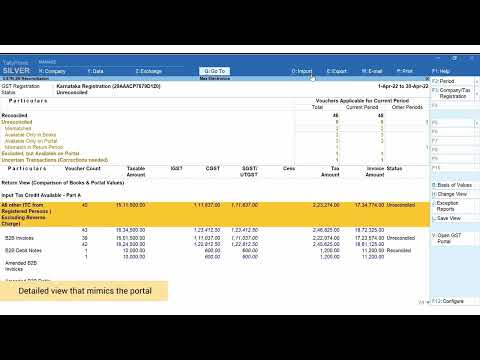

gstr 2b reconciliation in tally prime 4.1| 2b reconciliation in tally prime | 2b in Tally 2024-25 |

Показать описание

GST Notification Related link :-

income tax related any work :- Any refund & Notice Related Contact :-Link-

#unitedarabemirates

gst reconciliation in tally prime 4.1

how to compare gstr 2b with tally

gstr 2b reconciliation in tally prime 4.1

hpw to do gstr 2b reconciliation in tally prime,

how to import gstr 2b in tally prime,

gst reconciliation in excel

2b reconciliation in tally prime |

how to reconciliation 2b in tally prime 4.1 |

how to reconcile gstr 2a in tally prime |

how to import gstr 2b in tally prime|

gstr 2b reconciliation in tally prime 4.0 |

GST Notification Link :-

Taxation Notification link:-

Income tax return filing 2023-24,

itr filing 2023-24,

how to file income tax return,

how to fill income tax return form online,

how to download 26as from income tax site,

e filing income tax return for ay 2023-24,

how to file income tax return for salaried person,

how to download income tax return acknowledgement,

how to fill form 16 income tax return online,

how to file itr 2023-24 for salary person,

how to create sales ledger in tally prime 4.0,

how to change place of supply in tally prime,

tally prime 4.0 full details,

tally prime 4.0 gst entry,

tally prime 4.0 voucher entry,

how to create sales return ledger in tally prime,

tally prime sales invoice number setting,

delivery challan in tally prime,

mismatch in gst registration details between the party and the transaction,

how to make delivery challan in tally prime,

gst rate details overridden in transaction,

tally prime gst return file,

how to create delivery challan in tally prime,

hsn/sac is invalid or not specified in tally prime,

gst return filing tally prime,

tally se gst return kaise fill kare,

tally prime 4.0,

gst registration details of the party are invalid or not specified,

mismatch between place of supply of the party and nature of supply,

how to import bank statement in prime,

tally prime se gst return kaise fill kare,

tally prime me delivery challan kaise banaye,

how to file gst return in tally prime,

hsn details are overridden in transaction,

mismatch in the nature of transaction and place of supply in tally,

hsn/sac details are overridden in transaction,

how to create json file for gstr1 in tally prime,

tally prime delivery challan,

taxability type is invalid or not specified in tally prime,

gst return in tally prime,

gstr 1 return filing tally prime,

hsn is invalid or not specified in tally prime,

tally gst return file,

gst registration details of the party are invalid or not specified in tally prime 3.0,

tax ledger is not specified in tally prime 3.0,

import bank statement in tally prime,

mismatch in nature of transaction and place of supply party's country in tally,

tally me delivery challan kaise banaye,

how to export json file in tally prime 3.0 gstr 1,

excel to tally import without software,

gst filing in tally prime,

how to download json file from tally prime,

mismatch due to tax amount modified in voucher tally prime,

tally 4.0,

tally prime gstr-1 json file error,

how to import bank statement in tally prime,

delivery challan kaise banaye,

how to export gstr 1 json file from tally prime,

how to make challan in tally prime,

tally me challan kaise banaye,

tally me gst return file kaise kare,

tally prime 4.0 excel import,

tally prime json file,

import purchase entry in tally prime,

uncertain transaction in tally prime,

conflicting nature of transaction in tally prime,

how to generate json file for gstr1 in tally prime 3.0,

income tax related any work :- Any refund & Notice Related Contact :-Link-

#unitedarabemirates

gst reconciliation in tally prime 4.1

how to compare gstr 2b with tally

gstr 2b reconciliation in tally prime 4.1

hpw to do gstr 2b reconciliation in tally prime,

how to import gstr 2b in tally prime,

gst reconciliation in excel

2b reconciliation in tally prime |

how to reconciliation 2b in tally prime 4.1 |

how to reconcile gstr 2a in tally prime |

how to import gstr 2b in tally prime|

gstr 2b reconciliation in tally prime 4.0 |

GST Notification Link :-

Taxation Notification link:-

Income tax return filing 2023-24,

itr filing 2023-24,

how to file income tax return,

how to fill income tax return form online,

how to download 26as from income tax site,

e filing income tax return for ay 2023-24,

how to file income tax return for salaried person,

how to download income tax return acknowledgement,

how to fill form 16 income tax return online,

how to file itr 2023-24 for salary person,

how to create sales ledger in tally prime 4.0,

how to change place of supply in tally prime,

tally prime 4.0 full details,

tally prime 4.0 gst entry,

tally prime 4.0 voucher entry,

how to create sales return ledger in tally prime,

tally prime sales invoice number setting,

delivery challan in tally prime,

mismatch in gst registration details between the party and the transaction,

how to make delivery challan in tally prime,

gst rate details overridden in transaction,

tally prime gst return file,

how to create delivery challan in tally prime,

hsn/sac is invalid or not specified in tally prime,

gst return filing tally prime,

tally se gst return kaise fill kare,

tally prime 4.0,

gst registration details of the party are invalid or not specified,

mismatch between place of supply of the party and nature of supply,

how to import bank statement in prime,

tally prime se gst return kaise fill kare,

tally prime me delivery challan kaise banaye,

how to file gst return in tally prime,

hsn details are overridden in transaction,

mismatch in the nature of transaction and place of supply in tally,

hsn/sac details are overridden in transaction,

how to create json file for gstr1 in tally prime,

tally prime delivery challan,

taxability type is invalid or not specified in tally prime,

gst return in tally prime,

gstr 1 return filing tally prime,

hsn is invalid or not specified in tally prime,

tally gst return file,

gst registration details of the party are invalid or not specified in tally prime 3.0,

tax ledger is not specified in tally prime 3.0,

import bank statement in tally prime,

mismatch in nature of transaction and place of supply party's country in tally,

tally me delivery challan kaise banaye,

how to export json file in tally prime 3.0 gstr 1,

excel to tally import without software,

gst filing in tally prime,

how to download json file from tally prime,

mismatch due to tax amount modified in voucher tally prime,

tally 4.0,

tally prime gstr-1 json file error,

how to import bank statement in tally prime,

delivery challan kaise banaye,

how to export gstr 1 json file from tally prime,

how to make challan in tally prime,

tally me challan kaise banaye,

tally me gst return file kaise kare,

tally prime 4.0 excel import,

tally prime json file,

import purchase entry in tally prime,

uncertain transaction in tally prime,

conflicting nature of transaction in tally prime,

how to generate json file for gstr1 in tally prime 3.0,

Комментарии

0:01:30

0:01:30

0:21:39

0:21:39

0:09:22

0:09:22

0:04:53

0:04:53

0:05:53

0:05:53

0:06:40

0:06:40

0:16:30

0:16:30

0:04:50

0:04:50

0:03:24

0:03:24

0:22:03

0:22:03

0:04:32

0:04:32

0:03:15

0:03:15

0:15:28

0:15:28

0:00:49

0:00:49

0:12:39

0:12:39

0:16:40

0:16:40

0:06:41

0:06:41

0:06:26

0:06:26

0:01:00

0:01:00

0:06:02

0:06:02

0:02:32

0:02:32

0:00:58

0:00:58

0:06:59

0:06:59

0:12:35

0:12:35