filmov

tv

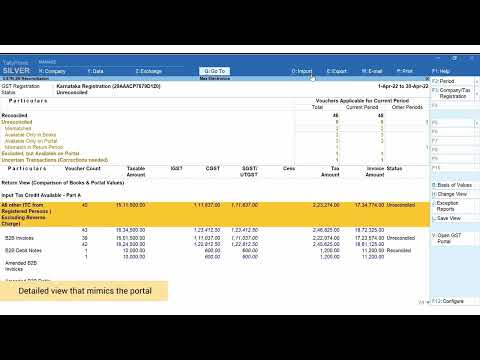

How to Export GSTR-2 in Old Format from the GSTR-2B or GSTR-2A Reconciliation Report in TallyPrime

Показать описание

Applicable to Release 5.0 and later.

This video demonstrates the process of exporting GSTR-2 as per the old format from the GSTR-2B or GSTR-2A Reconciliation report in TallyPrime.

GSTR-2 is a monthly return containing details of all the purchases, including reverse charge purchase.

This return is used for the reconciliation of transactions between a buyer and a seller.

Watch the video to know how you can export GSTR-2 as an Excel file in the required old format.

Have a question?

Refer to:

Write/Chat/Call us:

Connect with us on:

This video demonstrates the process of exporting GSTR-2 as per the old format from the GSTR-2B or GSTR-2A Reconciliation report in TallyPrime.

GSTR-2 is a monthly return containing details of all the purchases, including reverse charge purchase.

This return is used for the reconciliation of transactions between a buyer and a seller.

Watch the video to know how you can export GSTR-2 as an Excel file in the required old format.

Have a question?

Refer to:

Write/Chat/Call us:

Connect with us on:

How to Export GSTR-2 in Old Format from the GSTR-2B or GSTR-2A Reconciliation Report in TallyPrime

How to Export GSTR-2 in Old Format from the GSTR-2B or GSTR-2A Reconciliation Report in TallyPrime

How to export gstr-1 and how to show gstr 2 in miracle accounting software.

How to Export GSTR 2 in Old Format from GSTR 2B/2A Reconciliation in TallyPrime? |4qs| Tally

How to Export GSTR 2 Report Tally Prime into Excel, Json formats in Telugu

Export invoice-wise GSTR-2 Report in Excel | Tally

How to export gstr 2 from tally prime?

How to Export GSTR 2 Report MARG ERP into Excel format in Telugu |#GSTReturns

How to Export GSTR 2 From Tally Prime in Excel | How to Export GSTR 2 from Tally in Excel Hindi me.

GSTR 2A and GSTR 2B Reconciliation | TallyPrime Walkthrough

How to Export GSTR 2 In Excel,Csv,Json [13 Miracle Accounting Software] - Accounting Tips

How to Export Purchase Register from Tally Prime 3.0 for GSTR-2B Reconciliation at MyGSTcafe

How to record Import of service of GSTR-2 in TallyPrime

How to Download GSTR-2A in 1 Minute With Computax II Easy & Error Free II

How to record Import of Goods of GSTR-2 in TallyPrime

GSTR-2 EXPLAINED STEP BY STEP IN DETAILS||LIVE DEMO||ENGLISH

How to enable GSTR 2 in Tally Prime 3 0

GSTR2 REPORT IN MARG SOFTWARE

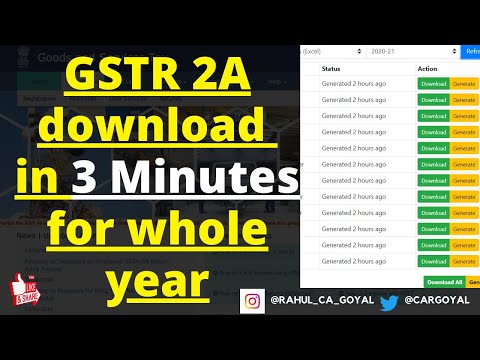

How to download GSTR 2A for whole year | GSTR 2A download | GST return download for a year |

GSTR-2 in Tally ERP 9 | GST Return Filing in tally | Filing GSTR-2 Tally | Future Vision |(Class-23)

How to record B2BUR Invoices of GSTR -2 in TallyPrime

GoFrugal RPOS7 GSTR2 : Step 5 - Exporting GSTR2 and uploading .JSON into GST portal.

How to Clean GSTR 2A (Remove Double Amount Row & Remove Blank Row) in Excel

How to Record Nilrated, Exempted, Non-gst goods of GSTR-2 in TallyPrime

Комментарии

0:03:15

0:03:15

0:03:31

0:03:31

0:03:17

0:03:17

0:03:24

0:03:24

0:05:38

0:05:38

0:00:56

0:00:56

0:01:40

0:01:40

0:05:23

0:05:23

0:02:42

0:02:42

0:01:30

0:01:30

0:02:59

0:02:59

0:05:52

0:05:52

0:01:24

0:01:24

0:02:47

0:02:47

0:01:40

0:01:40

0:14:26

0:14:26

0:00:59

0:00:59

0:03:24

0:03:24

0:07:35

0:07:35

0:04:15

0:04:15

0:03:04

0:03:04

0:05:45

0:05:45

0:06:14

0:06:14

0:02:02

0:02:02