filmov

tv

Why it’s hard for Americans to retire

Показать описание

There’s a reason so many of us don’t have enough retirement savings.

This video is presented by Metro by T-Mobile. Metro has no editorial influence on our videos, but their support makes videos like this possible.

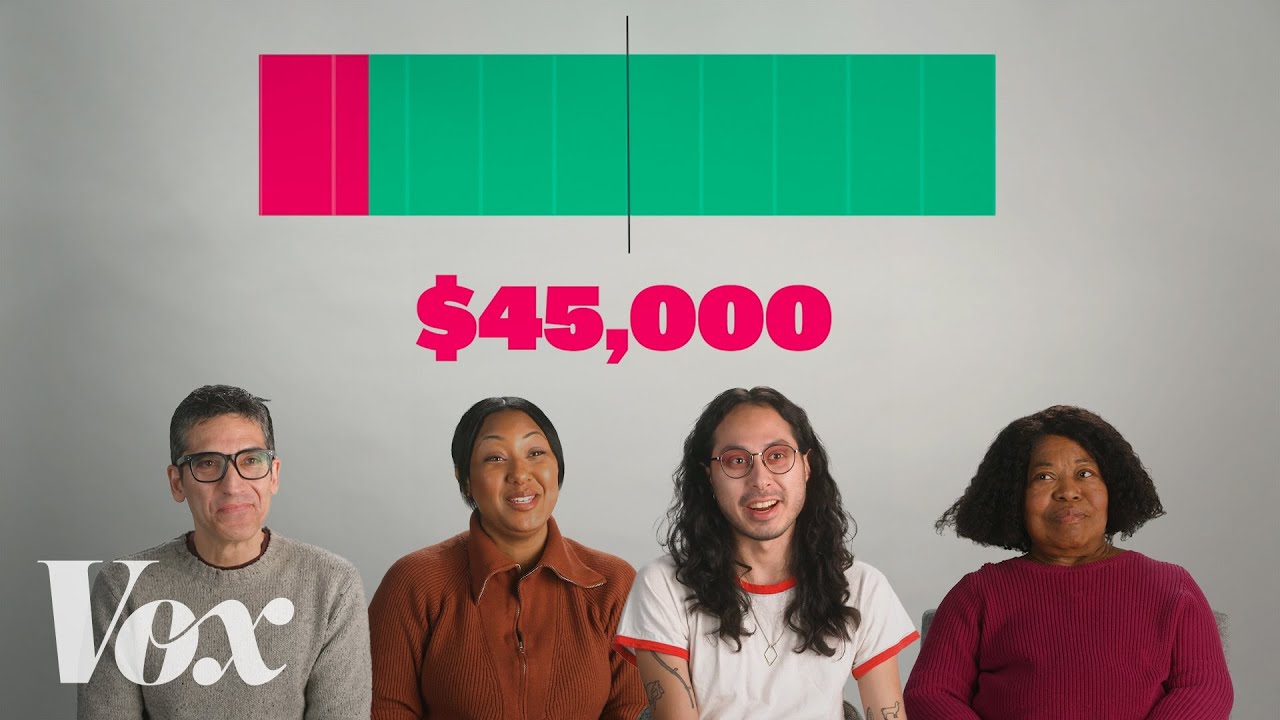

Vox sat down with people in our New York City studio to talk to them about the state of their retirement savings.

By the standards of most financial experts, Americans are woefully behind on saving for retirement. The reason why is rooted in changes in policy to our retirement system with today's result being a flawed design in how people set aside money so they can one day stop working.

In this video, we interviewed four people about their level of retirement preparedness and two experts about the state of retirement readiness more broadly in the US. One culprit lies in changes to the country’s pension system, which sets the US apart from countries like Australia and the UK; these places have systems which help more people save more money for retirement.

Sources and further reading:

Vanguard’s “How America Saves” report was recommended by one of our experts, John Scott, and provided some of the data in the video:

John Scott’s work at the Pew Charitable Trusts includes how lack of retirement readiness impacts state and federal budgets:

Teresa Ghilarducci has written extensively about retirement, including her book Work, Retire, Repeat:

Sen. Bernie Sanders has released a report about how the state of US retirement impacts low-income seniors:

We used the TransAmerica Retirement survey for some of our data:

This video is presented by Metro by T-Mobile. Metro has no editorial influence on our videos, but their support makes videos like this possible.

Vox sat down with people in our New York City studio to talk to them about the state of their retirement savings.

By the standards of most financial experts, Americans are woefully behind on saving for retirement. The reason why is rooted in changes in policy to our retirement system with today's result being a flawed design in how people set aside money so they can one day stop working.

In this video, we interviewed four people about their level of retirement preparedness and two experts about the state of retirement readiness more broadly in the US. One culprit lies in changes to the country’s pension system, which sets the US apart from countries like Australia and the UK; these places have systems which help more people save more money for retirement.

Sources and further reading:

Vanguard’s “How America Saves” report was recommended by one of our experts, John Scott, and provided some of the data in the video:

John Scott’s work at the Pew Charitable Trusts includes how lack of retirement readiness impacts state and federal budgets:

Teresa Ghilarducci has written extensively about retirement, including her book Work, Retire, Repeat:

Sen. Bernie Sanders has released a report about how the state of US retirement impacts low-income seniors:

We used the TransAmerica Retirement survey for some of our data:

Комментарии