filmov

tv

How to handle expiry day spikes ? | Best strategy to trade 0 DTE

Показать описание

To book at one to one with our team,

Please fill out this form, and the team will get in touch with you.

Follow me on Instagram & Twitter -

Important Disclaimer : My videos, presentations, and writing are for educational purposes only and should not be construed as investment & Trading advice.

Please fill out this form, and the team will get in touch with you.

Follow me on Instagram & Twitter -

Important Disclaimer : My videos, presentations, and writing are for educational purposes only and should not be construed as investment & Trading advice.

How to handle expiry day spikes ? | Best strategy to trade 0 DTE

Expiry Special Strategy with 90%+ Accuracy | Safest Option Trading to Earn Money in Share Market

Choosing The Correct Options Expiration Date | Real Trade Example

EXPIRY Day Option Trading : LIVE DEMO MASTERCLASS | Options Trading for Beginners Strategy

Food expiration dates don’t mean what you think - Carolyn Beans

Expiry Strategy | Trading in Stock Market | Earn Regular Money on Every Expiry with Options

Option Buying Trading : Expiry Day Strategies, Psychology & Pro Tips

How to Make Money Using Expiry Day Strategy | Live Trade with 55k Profits

🔴 LIVE: Nifty & Bank Nifty Expiry Special Trading/@atradingmonk-q3o

Identifying Zero to Hero Trades on Expiry Days

Robinhood Options Expiration Explained: Avoiding Costly Mistakes

GOLDEN RULES OF OPTIONS HEDGING |Expiry Option Selling

Short Straddle Adjustment for Expiry Day Trading | 80% No Loss Options Strategy

Expiry Day Option Trading Mastery: Simple Strategies For Expiry Trading!

What Happen If do not exit on expiry day / Options not exit on expiry day / STT charges

Option Trading 3 Biggest Mistakes | Share Market Intraday for Beginners

Expiry date control system?? How to find another 7 days what are the items going to Expire??

Gamma Blast Strategy | Expiry Jackpot Strategy | Zero - Hero Trade

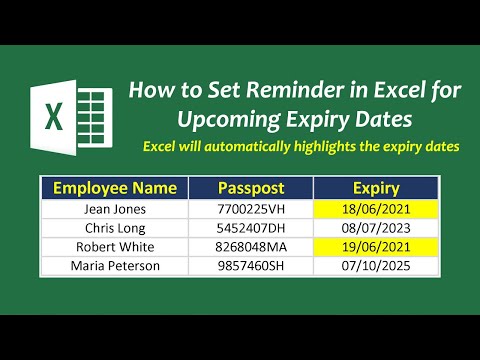

Automatic Expiry Dates Highlights in Excel | Set Reminder for Expiry Dates in Excel

Expiry Day Option Selling Strategy | Limited Risk with High POP | Nifty & Bank Nifty | Arun Bau

Expiry Day Strategy | Earn Monthly Income | 1:2 Risk Reward | Theta Gainers

How to Manage Expiry Date in Odoo 17 Inventory | Odoo 17 Inventory Tutorials

Expiry Date Printing Machine |New design mini hand held portable inkjet printer| Printer Price

The best way for ' Strangle ' Adjustment for Intraday | Expiry Day Trading | Short Strang...

Комментарии

1:08:49

1:08:49

0:20:59

0:20:59

0:10:33

0:10:33

0:16:54

0:16:54

0:05:06

0:05:06

0:18:40

0:18:40

0:16:39

0:16:39

0:25:43

0:25:43

0:47:28

0:47:28

0:28:16

0:28:16

0:15:54

0:15:54

0:11:01

0:11:01

0:20:10

0:20:10

0:18:47

0:18:47

0:04:21

0:04:21

0:09:21

0:09:21

0:02:24

0:02:24

0:09:01

0:09:01

0:01:41

0:01:41

0:18:29

0:18:29

0:29:27

0:29:27

0:09:57

0:09:57

0:00:17

0:00:17

0:16:03

0:16:03