filmov

tv

Bond Valuation: Interest Rate Risk, Price Risk and Reinvestment Risk

Показать описание

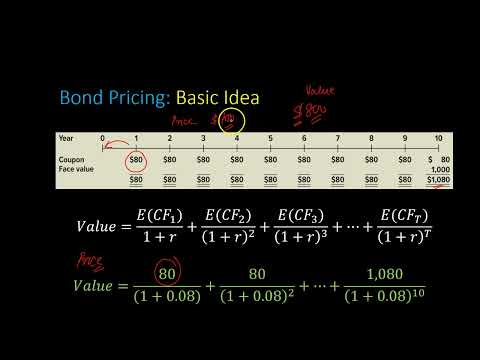

In this video, I explain the concepts of interest rate risk, price risk and reinvestment risk as they relate to bond investments. Students will understand how price risk and reinvestment risk of a bond depend on its time to maturity and its coupon payments. This will also help them understand more advance bond valuation concepts like Duration. Finally, students will also learn why it generally makes sense for investors to match their investment horizon with the time to maturity (or Duration) of bonds.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance (13th Edition) by Ross, Westerfield, Jaffe and Jordan.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance (13th Edition) by Ross, Westerfield, Jaffe and Jordan.

Bond Valuation: Interest Rate Risk, Price Risk and Reinvestment Risk

What happens to my bond when interest rates rise? | Financial Fundamentals

Macro Minute -- Bond Prices and Interest Rates

Bond Valuation - A Quick Review

Relationship between bond prices and interest rates | Finance & Capital Markets | Khan Academy

Chapter 7 : Interest Rates and Bond Valuation

Bond Valuation and Risk

GB703: Chapter 7, Interest Rates and Bond Valuation

Why T-Bill Rates Are Plummeting: What You Must Know! | 🦖 #TheInvestingIguana EP555

Interest Rate Risk

Session 2: Understanding Risk - The Risk in Bonds

Video 12.1 - Bond Risks part 1: Interest Rate Risk

Bonds and Bond Valuation

Bond Prices Vs Bond Yield | Inverse Relationship

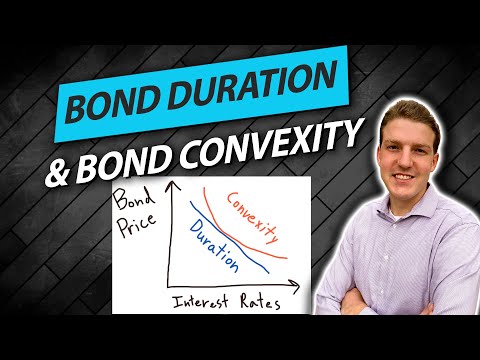

Bond Duration and Bond Convexity Explained

Session 7: Valuing Bonds

Investing Basics: Bonds

Bond Prices And How They Are Related To Yield to Maturity (YTM)

How to Calculate the Current Price of a Bond

Calculate Bond Convexity and Duration in Excel | Interest Rate Risk

Session 07: Objective 1 - Bonds and Bond Valuation (2016)

Chapter 6 Rates and Bonds

Session 07: Objective 1 - Interest Rates and Bond Valuation (2023)

Measuring Interest Rate Risk

Комментарии

0:13:16

0:13:16

0:03:07

0:03:07

0:02:48

0:02:48

0:11:08

0:11:08

0:13:16

0:13:16

1:08:37

1:08:37

0:16:42

0:16:42

1:47:18

1:47:18

0:15:42

0:15:42

0:02:44

0:02:44

0:16:05

0:16:05

0:09:50

0:09:50

0:39:52

0:39:52

0:04:45

0:04:45

0:09:18

0:09:18

0:15:37

0:15:37

0:04:47

0:04:47

0:15:37

0:15:37

0:02:20

0:02:20

0:11:03

0:11:03

0:16:24

0:16:24

1:04:56

1:04:56

0:16:28

0:16:28

0:20:39

0:20:39