filmov

tv

What's the Difference? Utility Tokens vs Security Tokens - EXPLAINED!

Показать описание

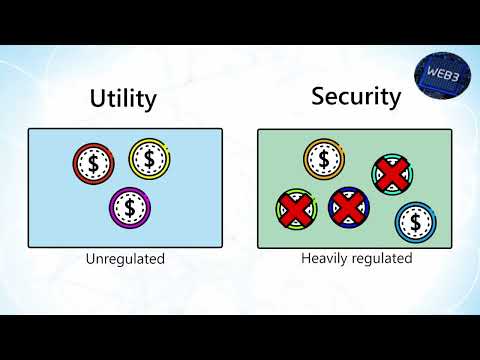

Cryptocurrencies have become a popular way to invest and make transactions, but not all cryptocurrencies are created equal. There are two main types of cryptocurrencies: security tokens and utility tokens. In this video, we'll take a closer look at security tokens and their features.

Utility tokens have become a popular way for companies to raise funds and incentivize users. These tokens are designed to be used within a particular platform or ecosystem and do not provide ownership rights. However, they do provide access to a specific service or feature.

While utility tokens offer flexibility and ease of use, it is important to note that they are not subject to the same regulatory requirements as security tokens. This means that there is a risk of fraudulent or misleading utility token offerings, as we’ve seen with several cryptocurrencies in 2022. So investors should exercise caution and do their due diligence before investing.

Security tokens are investments that provide their holders with ownership rights in a company or claims to a debt instrument, part of a real estate project, or even a painting. The sky is the limit. When you invest in a security token, you are essentially buying a piece of the asset that issued it. This means that as the asset grows in value, the value of the security token may increase.

My favorite part of security tokens is that if the underlying asset produces revenue, the security token can automatically distribute a proportioned share to the token holders. Similar to a dividend or interest payment.

I’ve even seen security tokens that unlock access to special events or meetings simply by being a token holder. In fact, the sky is the limit.

Security tokens are similar to traditional investments, such as stocks or bonds. They are regulated by securities laws, and issuers must comply with specific legal requirements. This includes registering with regulatory bodies and providing ongoing reporting to investors. The aim of these regulations is to protect investors and ensure that they receive accurate and transparent information about the investment opportunity.

In contrast, to utility tokens, security tokens provide ownership rights and potential return on investment, so they come with greater regulatory scrutiny and compliance requirements. Some people like that protection, but most crypto diehards do not.

Whether you're considering investing in a security token or using a utility token to access a specific service, it's important to understand the risks and potential benefits associated with each. By doing your due diligence and staying informed, you can make informed decisions and minimize your risk.

Remember, if you enjoyed this explanation to subscribe and click the bell to receive all of our videos. We promise to keep it interesting.

Utility tokens have become a popular way for companies to raise funds and incentivize users. These tokens are designed to be used within a particular platform or ecosystem and do not provide ownership rights. However, they do provide access to a specific service or feature.

While utility tokens offer flexibility and ease of use, it is important to note that they are not subject to the same regulatory requirements as security tokens. This means that there is a risk of fraudulent or misleading utility token offerings, as we’ve seen with several cryptocurrencies in 2022. So investors should exercise caution and do their due diligence before investing.

Security tokens are investments that provide their holders with ownership rights in a company or claims to a debt instrument, part of a real estate project, or even a painting. The sky is the limit. When you invest in a security token, you are essentially buying a piece of the asset that issued it. This means that as the asset grows in value, the value of the security token may increase.

My favorite part of security tokens is that if the underlying asset produces revenue, the security token can automatically distribute a proportioned share to the token holders. Similar to a dividend or interest payment.

I’ve even seen security tokens that unlock access to special events or meetings simply by being a token holder. In fact, the sky is the limit.

Security tokens are similar to traditional investments, such as stocks or bonds. They are regulated by securities laws, and issuers must comply with specific legal requirements. This includes registering with regulatory bodies and providing ongoing reporting to investors. The aim of these regulations is to protect investors and ensure that they receive accurate and transparent information about the investment opportunity.

In contrast, to utility tokens, security tokens provide ownership rights and potential return on investment, so they come with greater regulatory scrutiny and compliance requirements. Some people like that protection, but most crypto diehards do not.

Whether you're considering investing in a security token or using a utility token to access a specific service, it's important to understand the risks and potential benefits associated with each. By doing your due diligence and staying informed, you can make informed decisions and minimize your risk.

Remember, if you enjoyed this explanation to subscribe and click the bell to receive all of our videos. We promise to keep it interesting.

Комментарии

0:05:36

0:05:36

0:03:02

0:03:02

0:04:26

0:04:26

0:07:04

0:07:04

0:06:58

0:06:58

0:00:55

0:00:55

0:02:01

0:02:01

0:07:54

0:07:54

0:01:57

0:01:57

0:05:41

0:05:41

0:08:45

0:08:45

0:07:18

0:07:18

0:04:15

0:04:15

0:01:24

0:01:24

0:08:30

0:08:30

0:09:38

0:09:38

0:01:27

0:01:27

0:21:59

0:21:59

0:07:16

0:07:16

0:04:25

0:04:25

0:02:46

0:02:46

0:03:08

0:03:08

0:01:30

0:01:30

0:15:36

0:15:36