filmov

tv

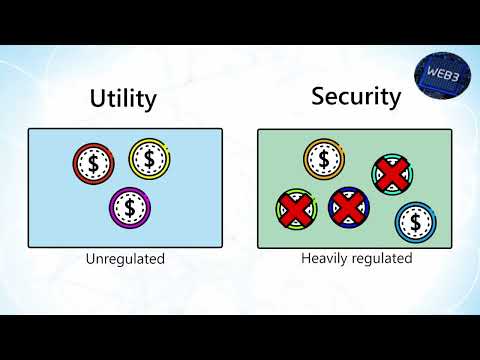

Utility Tokens vs Security Tokens | Learn the Difference | Explained For Beginners

Показать описание

Utility tokens and security tokens represent distinct categories in the cryptocurrency space. Utility tokens provide access to a specific product or service within a blockchain ecosystem, emphasizing functionality. On the other hand, security tokens derive their value from external, tradable assets and often involve regulatory compliance. Distinguishing between these token types is crucial for beginners navigating the diverse landscape of blockchain investments and understanding the varied roles tokens play in decentralized platforms.

#utilitytokens

#securitytokens

#tokenization

#cryptocurrency

#blockchaintechnology

#digitalassets

#investment

#finance

#trading

#regulation

#securitytokenoffering

#securitytokenization

#assettokenization

#compliance

#KYC

#AML

#KnowYourCustomer

#AntiMoneyLaundering

#fundraising

#financialinclusion

#tokeneconomics

#whitepaper

#cryptocurrencytrading

#investmentstrategies

#legalframework

#digitalsecurities

#investmentopportunities

#financialliteracy

#investoreducation

#web3 #explainervideo #explainer #web3otechnology #web30technology #web30 #blockchain #blockchaintechnology #blockchaingame #blockchaingames #blockchainnewstoday #blockchainpartnerspro #web3game #web3coin #web3gaming #web3otechnology #web3games #web3coins #web3marketing #fix #fixed #rezolver #migration #transfer #nfts #nftsgames #claim #presale #airdrop #airdrops #presalecrypto #presalecoin #delay #delayed #chain #missing #token #slippage #stake #staking #stakingcryptocurrency #stakingrewards #liquidity #rewards #crypto #cryptocurrency #cryptonews #cryptocurrencies #cryptotrading #cryptocurrencynews #cryptomining #cryptonewstoday #cryptomarket #cryptoworld #cryptocrash

altcoins,

Alternative Investment,

AML,

Anti-Money Laundering,

Art and Collectibles,

Artificial Intelligence (AI),

Asset Fractionalization,

Asset Management,

asset management,

Asset Tokenization,

asset tokenization,

Asset-backed Tokens,

asset-backed tokens,

Atomic Swaps,

Big Data,

Bitcoin,

Blockchain as a Service (BaaS),

Blockchain Interoperability,

blockchain technology,

Blockchain,

Blockchain-based Investment Opportunities,

Capital Raising,

Cross-chain Transactions,

Crypto Regulations,

cryptocurrency trading,

Cryptocurrency,

cryptocurrency,

Cryptographic Hash Functions,

Cryptographic Tokens,

Cryptography,

Custody Services,

Decentralized Autonomous Organizations (DAOs),

Decentralized Finance (DeFi),

decentralized finance,

Digital Assets,

digital assets,

Digital Securities,

digital securities,

Digital Signatures,

Distributed Computing,

diversification,

Dividend Tokens,

Double Spending,

E-commerce,

Education,

Energy and Sustainability,

Equity Tokens,

Ethereum ERC-20,

Ethereum ERC-721,

Ethereum,

finance,

financial inclusion,

financial literacy,

FinTech,

Fractional Ownership,

fundraising,

Gaming Industry,

Institutional Adoption,

InsurTech,

Intellectual Property,

Internet of Things (IoT),

investment opportunities,

investment strategies,

Investment Tokens,

investment,

investor education,

Investor Protection,

investor protection,

Know Your Customer,

legal framework,

Machine Learning,

Multi-Chain Applications,

Network Tokens,

Non-Fungible Tokens (NFTs),

Payment Tokens,

portfolio management,

Price Volatility,

Privacy and Security,

Privacy Coins,

Private Placement,

Proof of Stake,

Proof of Work,

Public Offering,

Real Estate,

RegTech,

regulation,

Regulatory Compliance,

Revenue Sharing Tokens,

risk management,

Royalties,

SEC,

Secondary Market,

Securities and Exchange Commission (SEC),

Securities Law,

Security Token Exchange,

Security Token Offering (STO),

security token offering,

Security Token Services,

security tokenization,

Security Tokens,

security tokens,

Smart Contracts,

smart contracts,

Social Media,

Stablecoins,

STOs,

Supply Chain,

Token Airdrops,

Token Arbitrage,

Token Bounties,

Token Burn,

Token Buyback,

Token Crowdfunding,

Token Distribution,

Token Economics Models,

Token Economics,

token economics,

Token Incentives,

Token Investment Funds,

Token Investment Strategies,

Token Issuance Platforms,

Token Legal Issues,

Token Liquidity,

Token Lockup,

Token Market Analysis,

Token Market Cap,

Token Market Forecast,

Token Market Outlook,

Token Market Trends,

Token Masternodes,

Token Metrics,

Token Mining,

Token Offering Platform,

Token Portfolio Management,

Token Price Analysis,

Token Price Prediction,

Token Price Volatility,

Token Price,

Token Rewards,

Token Sale Best Practices,

Token Sale Mechanics,

Token Sale,

Token Sales Restrictions,

Token Scams and Fraud,

Token Staking,

Token Standardization,

Token Standards,

Token Swap,

Token Taxation,

Token Trading Strategies,

Token Use Cases,

Token Utility,

Token Value,

token value,

Token Vesting,

Tokenization Providers,

Tokenization Solutions,

Tokenization,

tokenization,

Trading Platform,

trading,

transparency,

Utility Tokens,

utility tokens,

utility vs security,

Venture Capital,

Voting Rights Tokens,

Web 3.0,

Комментарии

0:05:36

0:05:36

0:04:26

0:04:26

0:09:38

0:09:38

0:01:24

0:01:24

0:01:27

0:01:27

0:07:54

0:07:54

0:03:02

0:03:02

0:02:46

0:02:46

0:01:57

0:01:57

0:23:35

0:23:35

0:10:28

0:10:28

0:07:22

0:07:22

0:13:18

0:13:18

0:03:13

0:03:13

0:00:57

0:00:57

0:12:24

0:12:24

0:08:45

0:08:45

0:28:59

0:28:59

0:15:36

0:15:36

0:02:01

0:02:01

0:03:17

0:03:17

0:07:04

0:07:04

0:01:00

0:01:00

0:01:07

0:01:07