filmov

tv

Understanding Fixed Indexed Annuities with Nationwide!

Показать описание

Fixed Indexed Annuities and their allocation options have become overly cumbersome. Understanding and explaining to your client how a 300% participation works, or what these new indices are, can seem impossible.

Dayna Parks, Director of Fixed Annuity Product Development for Nationwide joined the BREW to clear the air! She broke down the pricing structure and options behind these allocations, and explained how they prepare for the future renewal rates!

Dayna Parks, Director of Fixed Annuity Product Development for Nationwide joined the BREW to clear the air! She broke down the pricing structure and options behind these allocations, and explained how they prepare for the future renewal rates!

Dave, Can You Clarify What A Fixed Index Annuity Is?

Fixed Indexed Annuities Explained

Basics of Fixed Indexed Annuities

5 PROS & CONS of a Fixed Indexed Annuity

Understanding Fixed Indexed Annuities with Nationwide!

Understanding Fixed Indexed Annuities - A Simple Explanation

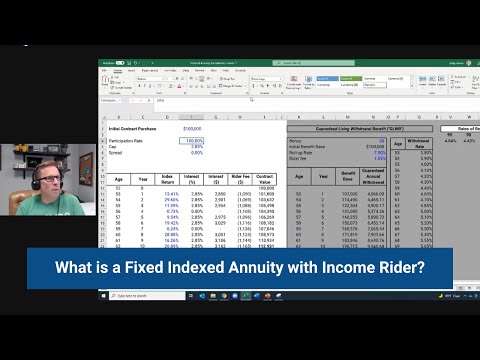

What is a Fixed Indexed Annuity with Income Rider?

Fixed Index Annuities Pros and Cons

Indexed Annuities - EXPLAINED!

Downside Of Indexed Annuities

What Is a Fixed Indexed Annuity (FIA)?

Fixed Indexed Annuities | Income Rider - Why, How, When

What Are the Benefits of Fixed Indexed Annuities?

How Fixed Index Annuities Work - How Do Fixed Indexed Annuities Work?

Is It Time to Reconsider Fixed Indexed Annuities?

What Are Fixed Indexed Annuities?

Understanding Fixed Indexed Annuities

Why Dave Ramsey Doesn't Understand Fixed Index Annuities

Understanding Fixed Index Annuities – How Does a Fixed Index Annuity Work?

Index Annuities- Real World Example Over 20 Years

The Ultimate Guide to Understanding Fixed Index Annuities

Dave Ramsey Is Wrong About Fixed Index Annuities

Fixed Indexed Annuity ***MUST SEE*** Fixed Index Annuity Explained

Fixed Index Annuities Explained

Комментарии

0:03:35

0:03:35

0:08:45

0:08:45

0:02:24

0:02:24

0:25:31

0:25:31

0:27:56

0:27:56

0:11:01

0:11:01

1:30:34

1:30:34

0:13:01

0:13:01

0:02:47

0:02:47

0:00:52

0:00:52

0:02:00

0:02:00

0:08:44

0:08:44

0:05:11

0:05:11

0:04:32

0:04:32

0:04:45

0:04:45

0:00:31

0:00:31

0:02:58

0:02:58

0:10:13

0:10:13

0:02:26

0:02:26

0:12:17

0:12:17

0:07:25

0:07:25

0:06:16

0:06:16

0:19:17

0:19:17

0:00:36

0:00:36