filmov

tv

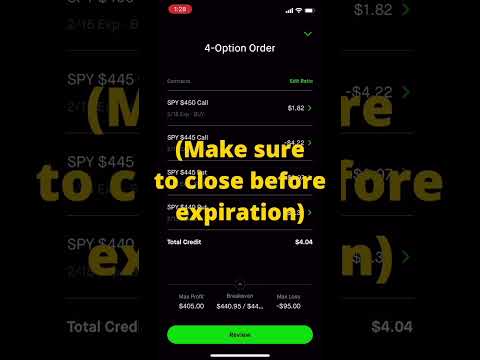

Insane Weekly Income Selling Options

Показать описание

It’s time to set goals. I am looking at setting a weekly goal of 2k a week and 8k a month for option premium. Is this crazy or should I tone it down and pick lower goals. I have been close to averaging $7,500 the last two months with sticking to an average of six trades a week. One more trade weekly might help me reach this goal.

I have been on a journey to learn the right way to trade stock options. Along the way I have decided to share with others both my successes and failures. My hope is that others can learn and shorten their journey to learn how to incorporate one of the best ways to make passive income.

Thanks for joining me on my journey!

Uncle Jim

My Blog with my options strategies, monthly reviews, and lessons on getting started.

If you would like early access, special content and some handholding then check out my Patreon page.

Seeking Alpha Premium will be available for $189 for the first year (vs. $239). In addition, you can try Seeking Alpha Premium for free for seven days.

Try Barchart, first 30-days are free, then billed annually at $199.95 (equates to $16.67 per month)

Enjoy the content? ☕️ Buy us a coffee Your support fuels creativity! Thank you!

I have been on a journey to learn the right way to trade stock options. Along the way I have decided to share with others both my successes and failures. My hope is that others can learn and shorten their journey to learn how to incorporate one of the best ways to make passive income.

Thanks for joining me on my journey!

Uncle Jim

My Blog with my options strategies, monthly reviews, and lessons on getting started.

If you would like early access, special content and some handholding then check out my Patreon page.

Seeking Alpha Premium will be available for $189 for the first year (vs. $239). In addition, you can try Seeking Alpha Premium for free for seven days.

Try Barchart, first 30-days are free, then billed annually at $199.95 (equates to $16.67 per month)

Enjoy the content? ☕️ Buy us a coffee Your support fuels creativity! Thank you!

Комментарии

0:26:31

0:26:31

0:27:36

0:27:36

0:25:49

0:25:49

0:00:59

0:00:59

0:01:00

0:01:00

0:00:29

0:00:29

0:00:41

0:00:41

0:00:56

0:00:56

0:16:30

0:16:30

0:01:01

0:01:01

0:00:59

0:00:59

0:00:54

0:00:54

0:11:54

0:11:54

0:00:07

0:00:07

0:00:10

0:00:10

0:00:20

0:00:20

0:25:50

0:25:50

0:00:59

0:00:59

0:05:28

0:05:28

0:18:25

0:18:25

0:00:30

0:00:30

0:19:12

0:19:12

0:00:22

0:00:22

0:00:31

0:00:31