filmov

tv

Sales Tax imposed on advance payment received | Budget 2024-25

Показать описание

Pakistan Budget 2024-25 has proposed significant changes in tax rates. Section 2 of the Sales Tax Act provides definitions.

Section 2(44) of the Sales Tax Act has been amended and Sales Tax imposed on advance payment received from suppliers/ vendors.

Watch this video for details.

Sales tax definitions

Sales Tax on Advance payment

Time of Supply

Sales Tax definitions

Rates of sales tax

Sales Tax Act 1990

Updates by Qazi

...............................................................

#sakestax #advance #budget #pakistan #advancepayment #2024 #2025 #fbr #tax

Section 2(44) of the Sales Tax Act has been amended and Sales Tax imposed on advance payment received from suppliers/ vendors.

Watch this video for details.

Sales tax definitions

Sales Tax on Advance payment

Time of Supply

Sales Tax definitions

Rates of sales tax

Sales Tax Act 1990

Updates by Qazi

...............................................................

#sakestax #advance #budget #pakistan #advancepayment #2024 #2025 #fbr #tax

Sales Tax imposed on advance payment received | Budget 2024-25

Bad News | Sales Tax on Milk | Standard Rate 18% | Further and Advance Tax also Applicable | FBR |

Quick Understanding of Sales Tax for beginner | Some Basic Understanding FBR |

Sales Tax Increased By 18% | Retailers Worried About Sales Tax | Breaking News

Advance Tax Imposed on Sale, Purchase & Instalment's || Smak Group Of Marketing & Sales

FBR decided to impose effective section 40B of the Sales Tax Act 1990 to curb tax evasion

FBR new Tax Plan | Retailers | Shopkeepers | Traders | Fixe Rates | Maximum Tax How much | FBR |

Further Tax in electricity bills is sales tax (third type) #fbr

KASNEB DECEMBER 2024 EXAMS PREP

What is Sales Tax Rate (16% or 5%) on Restaurant Business and how to file sale tax return under PRA?

Budget 2024-2025, How much tax will filers and non-filers have to pay now?

How much Taxes need to Pay at the time of Import | Custom Duties | RD | Sales Tax | Income Tax | FBR

Tax Return 2024: Tax on Electricity Bill | How to Declare in Income Tax Return

How much does a TAX ANALYST make?

Advance Tax Imposed on Sale/Purchase & Instalment's | Avenue Marketing

Budget 2024-25 Sales Tax | Sales Tax imposed in Budget | Huge Taxes applied and Exemptions withdrawn

What is the meaning of Further Sale tax | When we will charge Further Sale tax | Rate of Sale tax

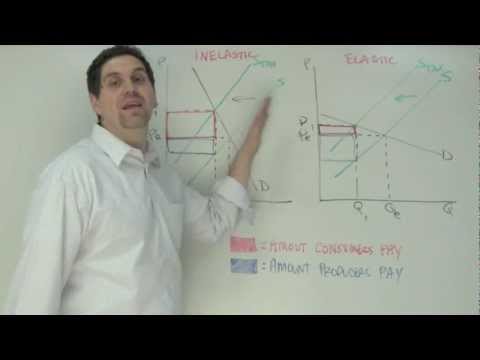

Micro Unit 6, Question 12- Tax Incidence (Excise Tax)

Microeconomics: Excise Tax Effect on Equilibrium

TAX LEVIED ON PETROL IN INDIA......#maps ..

Income Tax on Business Explained

FBR's New Withholding Tax Regime for Motor Vehicles | Advance Tax on New Purchase Car

What is Value Added Tax(VAT)? How VAT Works? Indirect Tax-VAT vs Sales Tax Comparison-Urdu/Hindi

The only TAX SYSTEM VIDEO you will ever need. | INDIAN TAX SYSTEM EXPLAINED | Aaditya Iyengar

Комментарии

0:03:00

0:03:00

0:09:55

0:09:55

0:07:09

0:07:09

0:01:31

0:01:31

0:08:58

0:08:58

0:08:06

0:08:06

0:02:54

0:02:54

0:00:16

0:00:16

11:54:59

11:54:59

0:02:42

0:02:42

0:09:16

0:09:16

0:17:33

0:17:33

0:05:15

0:05:15

0:00:40

0:00:40

0:14:03

0:14:03

0:12:34

0:12:34

0:09:29

0:09:29

0:02:12

0:02:12

0:03:39

0:03:39

0:00:05

0:00:05

0:01:28

0:01:28

0:03:37

0:03:37

0:12:43

0:12:43

0:07:15

0:07:15