filmov

tv

Financial Freedom: Can You Get Financially Free Early?

Показать описание

FINANCIAL FREEDOM: How to Get the Freedom In JUST 5 YEARS!

Also follow us on:

Also Subscribe our Other YouTube channels for powerful content:

In this video, I'll break down the concept of FIRE (Financial Independence, Retire Early) and COAST FIRE like never before. Plus, I’ll explain how anyone can apply these principles to achieve their financial freedom.

To help you visualize how different approaches to money lead to different outcomes, I’ll take you through a story of three friends

Raju is the high earner, but he spends most of his salary on a lavish lifestyle, leaving little room for savings or investments.

Farhan has a moderate income, but he focuses on saving and investing consistently.

Rancho earns the least but starts investing early, even in small amounts, and benefits from the power of compounding over time.

FIRE (Financial Independence, Retire Early)

In this video, I break down the 4% rule or the 4 percent withdrawal rate, explain how to calculate your FIRE number, and show you the importance of understanding your annual expenses. For example, if your annual expenses are ₹6 lakhs, you'll need to accumulate ₹1.5 crore (25 times your yearly expense) to retire comfortably. I’ll also give you a step-by-step plan for achieving this goal.

COAST FIRE: Financial Independence Without Sacrificing Your Lifestyle

COAST FIRE is a lesser-known but equally powerful financial strategy, which involves building up enough investments early in your career so that you don’t have to worry about saving for the rest of your life. Instead, you let your investments grow on autopilot, allowing you to coast through life, focusing on work you love or even reducing your work hours.

Investing Early: The Power of Compounding

In the video, I explain the immense power of compounding and why it's crucial to start investing as early as possible. Even if you can only invest small amounts, those investments will grow exponentially over time if you allow them to compound.

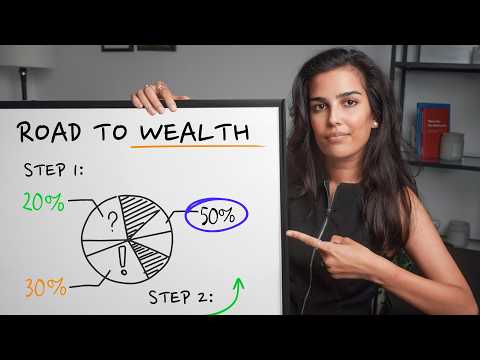

How to Achieve Financial Freedom

So how do you achieve financial freedom? Here are the two main strategies I cover in this video:

Aggressive Saving and Investing: The key is to invest in assets that generate passive income.

COAST FIRE: If you don't want to save aggressively forever, you can focus on building up your investments early on, so they can grow on their own. By doing this, you can "coast" through the rest of your career, working as much or as little as you want without worrying about money.

Common Financial Mistakes to Avoid

I also cover common mistakes people make when trying to achieve financial independence:

Not investing early enough: The earlier you start, the less you have to save.

Lifestyle inflation: As your income grows, it’s tempting to upgrade your lifestyle, but this can make it harder to save and invest.

Not diversifying: Relying too heavily on a single investment, like fixed deposits or gold, can limit your wealth-building potential.

Ignoring inflation: As the cost of living rises, it’s essential to invest in assets that outpace inflation, like equities.

In this video, I recommend tools and strategies that can help you achieve financial freedom, including:

SIP (Systematic Investment Plan) for consistent investing in mutual funds.

Diversified portfolios that include small-cap stocks, large-cap stocks, and mutual funds to balance risk and reward.

Index funds for long-term growth with minimal effort.

Emergency funds to cover unexpected expenses without derailing your investment plan.

By the end of this video, you'll have a clear understanding of what it takes to achieve financial independence and retire early. Whether you choose to pursue FIRE or COAST FIRE, the key is to start investing early, make smart financial decisions, and stay consistent. You don’t have to work a job you hate until you're 60. You can achieve financial freedom much sooner by following the strategies outlined in this video.

Some of our related old Videos:

Magic of Dividends for Financial Freedom:

Regular Income from Stocks - Dividend Investing for Beginners:

POWER OF COMPOUNDING in Investing:

Analysis of Top Wealth Creator Stock in India:

This is a beginners guide to invest in shares (stock market) in India.

Best Way To Invest in 20s:

How to Calculate Intrinsic Value of a Stock:

Chapters:

00:00 Intro

01:31 Let's start with a story

07:22 What is FIRE and COAST FIRE

15:05 Financial Freedom Guide

17:10 Inflation Tax Solution

Also follow us on:

Also Subscribe our Other YouTube channels for powerful content:

In this video, I'll break down the concept of FIRE (Financial Independence, Retire Early) and COAST FIRE like never before. Plus, I’ll explain how anyone can apply these principles to achieve their financial freedom.

To help you visualize how different approaches to money lead to different outcomes, I’ll take you through a story of three friends

Raju is the high earner, but he spends most of his salary on a lavish lifestyle, leaving little room for savings or investments.

Farhan has a moderate income, but he focuses on saving and investing consistently.

Rancho earns the least but starts investing early, even in small amounts, and benefits from the power of compounding over time.

FIRE (Financial Independence, Retire Early)

In this video, I break down the 4% rule or the 4 percent withdrawal rate, explain how to calculate your FIRE number, and show you the importance of understanding your annual expenses. For example, if your annual expenses are ₹6 lakhs, you'll need to accumulate ₹1.5 crore (25 times your yearly expense) to retire comfortably. I’ll also give you a step-by-step plan for achieving this goal.

COAST FIRE: Financial Independence Without Sacrificing Your Lifestyle

COAST FIRE is a lesser-known but equally powerful financial strategy, which involves building up enough investments early in your career so that you don’t have to worry about saving for the rest of your life. Instead, you let your investments grow on autopilot, allowing you to coast through life, focusing on work you love or even reducing your work hours.

Investing Early: The Power of Compounding

In the video, I explain the immense power of compounding and why it's crucial to start investing as early as possible. Even if you can only invest small amounts, those investments will grow exponentially over time if you allow them to compound.

How to Achieve Financial Freedom

So how do you achieve financial freedom? Here are the two main strategies I cover in this video:

Aggressive Saving and Investing: The key is to invest in assets that generate passive income.

COAST FIRE: If you don't want to save aggressively forever, you can focus on building up your investments early on, so they can grow on their own. By doing this, you can "coast" through the rest of your career, working as much or as little as you want without worrying about money.

Common Financial Mistakes to Avoid

I also cover common mistakes people make when trying to achieve financial independence:

Not investing early enough: The earlier you start, the less you have to save.

Lifestyle inflation: As your income grows, it’s tempting to upgrade your lifestyle, but this can make it harder to save and invest.

Not diversifying: Relying too heavily on a single investment, like fixed deposits or gold, can limit your wealth-building potential.

Ignoring inflation: As the cost of living rises, it’s essential to invest in assets that outpace inflation, like equities.

In this video, I recommend tools and strategies that can help you achieve financial freedom, including:

SIP (Systematic Investment Plan) for consistent investing in mutual funds.

Diversified portfolios that include small-cap stocks, large-cap stocks, and mutual funds to balance risk and reward.

Index funds for long-term growth with minimal effort.

Emergency funds to cover unexpected expenses without derailing your investment plan.

By the end of this video, you'll have a clear understanding of what it takes to achieve financial independence and retire early. Whether you choose to pursue FIRE or COAST FIRE, the key is to start investing early, make smart financial decisions, and stay consistent. You don’t have to work a job you hate until you're 60. You can achieve financial freedom much sooner by following the strategies outlined in this video.

Some of our related old Videos:

Magic of Dividends for Financial Freedom:

Regular Income from Stocks - Dividend Investing for Beginners:

POWER OF COMPOUNDING in Investing:

Analysis of Top Wealth Creator Stock in India:

This is a beginners guide to invest in shares (stock market) in India.

Best Way To Invest in 20s:

How to Calculate Intrinsic Value of a Stock:

Chapters:

00:00 Intro

01:31 Let's start with a story

07:22 What is FIRE and COAST FIRE

15:05 Financial Freedom Guide

17:10 Inflation Tax Solution

Комментарии

0:09:49

0:09:49

0:18:39

0:18:39

1:36:28

1:36:28

0:13:17

0:13:17

0:00:24

0:00:24

0:23:17

0:23:17

0:00:32

0:00:32

0:07:49

0:07:49

0:00:49

0:00:49

0:00:25

0:00:25

1:09:32

1:09:32

0:00:36

0:00:36

0:01:01

0:01:01

0:29:37

0:29:37

0:10:01

0:10:01

0:00:49

0:00:49

0:00:30

0:00:30

0:00:33

0:00:33

0:06:21

0:06:21

0:00:37

0:00:37

0:00:26

0:00:26

0:00:27

0:00:27

0:00:52

0:00:52

0:00:25

0:00:25