filmov

tv

How to Transfer Stocks Between Brokerages

Показать описание

I am going to explain to you how to transfer stocks between brokerages, specifically IRA's and non retirement accounts. I used to do this for a living, so it is something I know very well. This only covers one type of transfer, but it is the most common form and hopefully this will help you with your transfer process!

➔ What I Use To Make These Videos

➔ Check Out These Popular Videos

► Why I Don't Invest in Bitcoin

► Waste Management Stock Analysis | Watch List Wednesday

► How to Build Credit Fast in 2020

► 5 Tips for Real Estate Agents (Part 2)

► A WARNING TO ALL INVESTORS!

➔ Stay Connect With Matt Mulvihill

➔ Don't Forget To SUBSCRIBE!

➔ What I Use To Make These Videos

➔ Check Out These Popular Videos

► Why I Don't Invest in Bitcoin

► Waste Management Stock Analysis | Watch List Wednesday

► How to Build Credit Fast in 2020

► 5 Tips for Real Estate Agents (Part 2)

► A WARNING TO ALL INVESTORS!

➔ Stay Connect With Matt Mulvihill

➔ Don't Forget To SUBSCRIBE!

[⚠️ Updated] Transfer Shares to any Account in Just 10 Minutes! | Demat to Demat CDSL Stock Transfer...

How to Transfer Stocks Between Brokerages

How To Transfer Stocks To Another Broker (Revolut To Interactive Brokers)

How To Transfer Stocks From One Broker to Another (EASY!)

Easily Transfer Your Stocks To Interactive Brokers

Transfer Shares to any Account in Just 10 Minutes! | Demat to Demat Stock Transfer with CDSL

Transfer Shares ONLINE From One Demat Account To Another

How to Transfer Stocks into Robinhood for Free (From Other Brokerages)

How History's Greatest Wealth Transfer Is Repeating in 2025 – Position Yourself Now

Tutorial: How To Transfer Assets/Stocks to Fidelity

How To Transfer Stocks Between Brokerages: From Robinhood to M1 Finance

How to TRANSFER BETWEEN Accounts QUESTRADE // Move Stocks & Money Tutorial // TFSA, RRSP & M...

How to transfer shares to a Different Broker? | Demat to Demat Share Transfer Tamil | CDSL

How To Transfer Your Robinhood Account To Fidelity - Brokerage Account ACATS Transfer Tutorial

How to transfer Demat account from another broker to Groww | How to transfer shares | CDSL easiest

Trading 212 For Beginners: Transfer from Invest to ISA

How to Transfer Stocks into Robinhood for Free [Easy]

How To Transfer a Stocks & Shares ISA

How to transfer Demat account from another broker to another broker | How to transfer shares

Stock Transfer Agent vs Stock Broker What are the Difference

How to transfer shares | Transfer shares from one broker to another | Neha Nagar #shorts

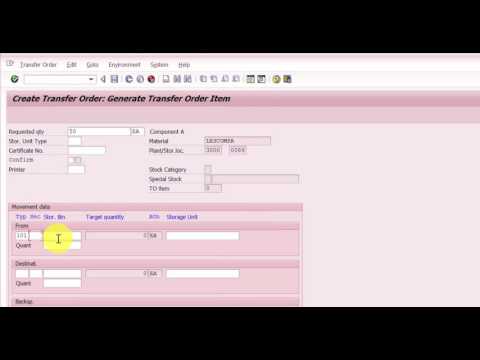

How to transfer Stock between Two Storage bins using LT01 - SAP WM Stock Transfer

How To Transfer Stocks from Robinhood to Robinhood [EASY Tutorial!]

ISA transfer rules explained

Комментарии

![[⚠️ Updated] Transfer](https://i.ytimg.com/vi/7nTWit9EA-8/hqdefault.jpg) 0:11:25

0:11:25

0:15:14

0:15:14

0:06:35

0:06:35

0:01:47

0:01:47

0:07:47

0:07:47

0:10:59

0:10:59

0:00:57

0:00:57

0:06:51

0:06:51

0:33:42

0:33:42

0:04:15

0:04:15

0:11:48

0:11:48

0:18:13

0:18:13

0:04:21

0:04:21

0:05:12

0:05:12

0:06:55

0:06:55

0:06:05

0:06:05

0:03:42

0:03:42

0:07:53

0:07:53

0:07:45

0:07:45

0:03:21

0:03:21

0:00:31

0:00:31

0:06:25

0:06:25

0:01:47

0:01:47

0:14:03

0:14:03