filmov

tv

Does Refinancing Your Mortgage Impact Your Credit Scores? | Intelligent Finance Guide

Показать описание

We’re surrounded by information, content and news. Everywhere, all the time. The human mind can only meaningfully absorb a handful of new facts about the world. mymoneykarma’s insights team selects just the bits of news from the finance world that you should know about, things that you can actually do something about right now. Subscribe to our channel so you don’t miss out on our daily updates.

If you’re interested in learning more about practicing Intelligent Finance in your daily life, why not get started with this video here

What is mymoneykarma?

This channel is dedicated to simplifying the concepts and best practices of Personal Finance through explainers, FAQs, tips, and educational material. We empower viewers to each become a paragon of Intelligent Finance.

Founded by a group of Stanford alumni with a strong background in banking and technology, MyMoneyKarma has been revolutionizing the Indian Fintech sector and ushering in the future of personal finance. Committed to a social mission of creating a measurable impact on people’s lives, MyMoneyKarma has empowered millions of people to reclaim control over their finances by addressing the 3 biggest issues and barriers in the sector:

Low financial literacy means most people applying for loans, mortgages or credit cards have never checked, nor heard of, their credit scores. By this time, the damage has often been done

Low information transparency means it can be difficult to know the best interest rates for each customer’s unique profile, the financial providers that offer the best terms, and how to maximize one’s chances of being approved (where a rejection further worsens the credit score)

High effort and hassle means one is too hard-pressed to shop around, try multiple options and find the best fit, instead ending up with sub-optimal decisions and a whole lot of wasted time and sweat

MyMoneyKarma’s fully online loan optimization technology helps customers with an extensive range of financial products, delivering the lowest interest rates and comprehensive service at the touch of a button.

______________________________________________________

Get to know and Follow us:

Refinancing your loan can impact your credit score in 3 different ways.

The first is through credit age, the overall duration of your credit history. If your original mortgage is your longest-held account, closing it in favor of a fresh loan may negatively impact your credit scores, although only initially.

The second is through hard inquiries. When you refinance, you’ll generally want to shop around with different lenders to find the best loan terms possible. However, when you apply for a loan and the potential lender reviews your credit history, it results in a “hard inquiry” on your credit report. Hard inquiries remain on your credit report for up to 24 months, and take a slight hit on your credit score.

Finally, your score can also drop if you inadvertently miss payments. Some borrowers have gotten into trouble by skipping a mortgage payment when they (incorrectly) assumed their refinance would go through. Refinancing your mortgage may take longer than you expect, so don’t count on the process closing by a certain month.

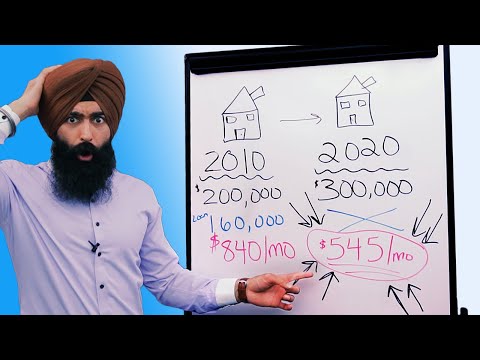

Does this mean you should not refinance your loan? Certainly not! In the long run, refinancing can save you an amount of money worth lots more than a few points’ drop in your credit score. However, it is always a good idea to stay aware of how each of your credit activities impacts your credit score.

Need to keep an eye on your credit score on a regular basis?

Well, all you need to do is sign up at the mymoneykarma website. We provide you free access to your credit score, detailed credit report, and personalized advice on how your credit can be improved. Moreover, checking your score with mymoneykarma is a soft inquiry, meaning it does not have any impact on your credit score. You can get started right away by following the link below.

0:02:28

0:02:28

0:01:40

0:01:40

0:04:26

0:04:26

0:12:55

0:12:55

0:03:05

0:03:05

0:05:59

0:05:59

0:03:13

0:03:13

0:13:40

0:13:40

0:00:53

0:00:53

0:04:35

0:04:35

0:01:00

0:01:00

0:00:12

0:00:12

0:14:35

0:14:35

0:03:56

0:03:56

0:04:24

0:04:24

0:11:01

0:11:01

0:00:39

0:00:39

0:04:36

0:04:36

0:01:13

0:01:13

0:06:38

0:06:38

0:09:04

0:09:04

0:06:57

0:06:57

0:14:17

0:14:17

0:14:05

0:14:05