filmov

tv

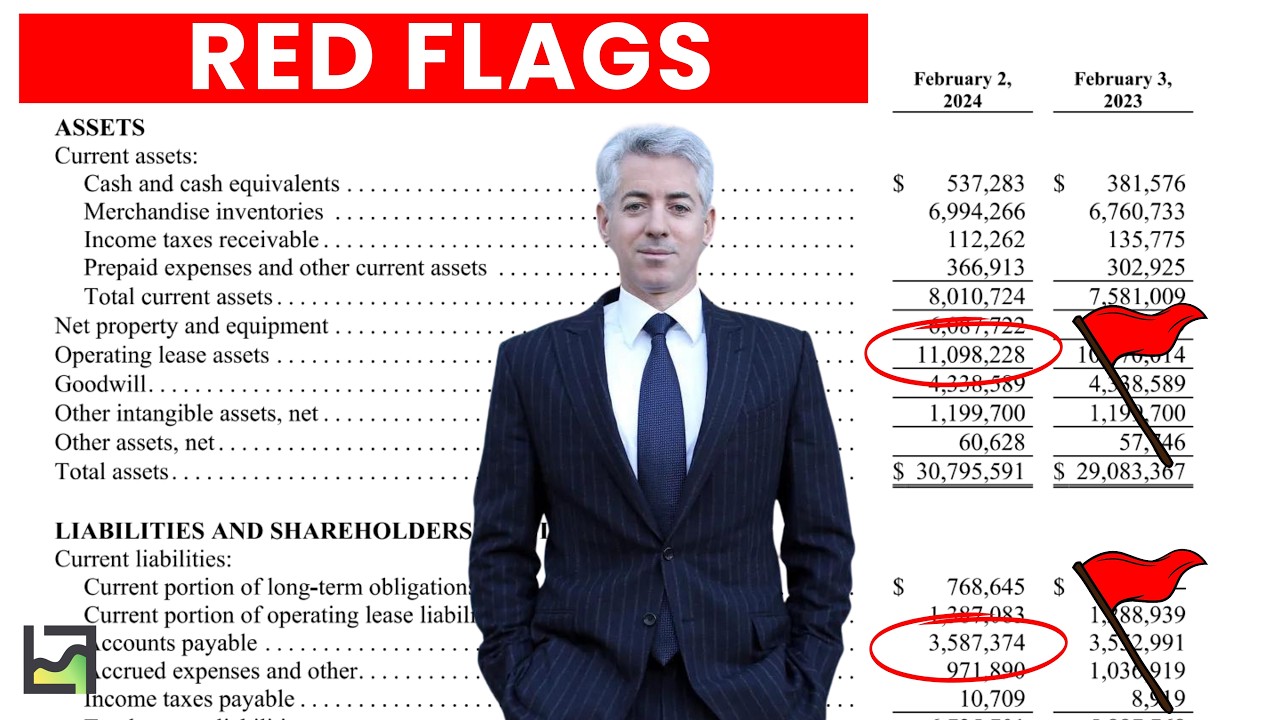

Balance Sheet Red Flags (4 Warnings Signs)

Показать описание

▼FREE ACCOUNTING INFOGRAPHIC EBOOK:▼

▼ABOUT US:▼

👨💼Brian Stoffel is a writer, investor, YouTuber, and financial educator. He's a teacher at heart. Brian has been investing for over a decade and has written over 4,000 articles for The Motley Fool. Brian plans his life and his investments around “antifragile” principles.

❗️❗️DISCLAIMER:❗️❗️

All content on this channel is for discussion, education, entertainment, and illustrative purposes only and SHOULD NOT be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on this channel. There are risks associated with investing in securities. Loss of principal is possible. Past performance is not a predictor of future investment performance. Brian Feroldi and the guests on this channel are not responsible for investment actions taken by viewers. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing. Any past performance discussed during this program is no guarantee of future results. Investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

All views expressed are personal opinions as of the date of recording and are subject to change without the responsibility to update views. No guarantee is given regarding the accuracy of the information on this channel. Releasees undertake no obligation to provide accurate or sound investment statements. You waive any and all duties that may exist flowing from you to any Releasee. You agree not to hold any Releasee liable for any possible claim for damages arising from any decision you make based on information or other content on the Channel.

*Some of the links and other products in this video are from companies for which Brian Feroldi will earn an affiliate commission or referral bonus. Brian Feroldi is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date.

0:00 Intro

0:20 Balance Sheet Red flag 1

1:40 Balance Sheet Red flag 2

2:52 Balance Sheet Red flag 3

4:05 Balance Sheet Red flag 4

▼ABOUT US:▼

👨💼Brian Stoffel is a writer, investor, YouTuber, and financial educator. He's a teacher at heart. Brian has been investing for over a decade and has written over 4,000 articles for The Motley Fool. Brian plans his life and his investments around “antifragile” principles.

❗️❗️DISCLAIMER:❗️❗️

All content on this channel is for discussion, education, entertainment, and illustrative purposes only and SHOULD NOT be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on this channel. There are risks associated with investing in securities. Loss of principal is possible. Past performance is not a predictor of future investment performance. Brian Feroldi and the guests on this channel are not responsible for investment actions taken by viewers. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing. Any past performance discussed during this program is no guarantee of future results. Investing involves risk and possible loss of principal capital; please seek advice from a licensed professional.

All views expressed are personal opinions as of the date of recording and are subject to change without the responsibility to update views. No guarantee is given regarding the accuracy of the information on this channel. Releasees undertake no obligation to provide accurate or sound investment statements. You waive any and all duties that may exist flowing from you to any Releasee. You agree not to hold any Releasee liable for any possible claim for damages arising from any decision you make based on information or other content on the Channel.

*Some of the links and other products in this video are from companies for which Brian Feroldi will earn an affiliate commission or referral bonus. Brian Feroldi is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date.

0:00 Intro

0:20 Balance Sheet Red flag 1

1:40 Balance Sheet Red flag 2

2:52 Balance Sheet Red flag 3

4:05 Balance Sheet Red flag 4

Комментарии

0:06:21

0:06:21

0:06:08

0:06:08

0:04:52

0:04:52

0:05:02

0:05:02

0:02:45

0:02:45

0:05:05

0:05:05

0:01:50

0:01:50

0:09:10

0:09:10

0:01:51

0:01:51

0:04:23

0:04:23

0:03:37

0:03:37

0:05:59

0:05:59

0:05:54

0:05:54

0:04:46

0:04:46

0:33:24

0:33:24

0:18:04

0:18:04

0:06:12

0:06:12

0:03:15

0:03:15

0:06:18

0:06:18

0:21:31

0:21:31

0:03:48

0:03:48

0:16:19

0:16:19

0:10:29

0:10:29

0:01:58

0:01:58