filmov

tv

How To Analyze a Balance Sheet

Показать описание

How To Analyze a Balance Sheet

My FULL Investment Course Is Available Now On My Website:

Further Support The Channel Via Patreon!

Hey, I'm Daniel Pronk and in this video, I explain how to properly read a balance sheet to see if a company's financially strong. Balance sheets are crucial to understanding a business and seeing if it is a good investment. In this video we learn how to read Balance Sheets and red flags to look for.

My FULL Investment Course Is Available Now On My Website:

My Favorite Investing Books:

Rule 1 Investing

This is not investment advice. Please do all your own research before buying and selling any stocks or securities. I am not responsible for any loss or gain you may have.

My FULL Investment Course Is Available Now On My Website:

Further Support The Channel Via Patreon!

Hey, I'm Daniel Pronk and in this video, I explain how to properly read a balance sheet to see if a company's financially strong. Balance sheets are crucial to understanding a business and seeing if it is a good investment. In this video we learn how to read Balance Sheets and red flags to look for.

My FULL Investment Course Is Available Now On My Website:

My Favorite Investing Books:

Rule 1 Investing

This is not investment advice. Please do all your own research before buying and selling any stocks or securities. I am not responsible for any loss or gain you may have.

How To Analyze a Balance Sheet

How To Read & Analyze The Balance Sheet Like a CFO | The Complete Guide To Balance Sheet Analysi...

How to Analyze a Balance Sheet Like a Hedge Fund Analyst

How to Read and Understand a Balance Sheet (Apple in Review)

Common-size Analysis (Vertical Analysis): Balance Sheet

Balance Sheet Analysis In Just 40 Minutes | Balance Sheet Explained

5. Understanding balance sheet

Principles of the Balance Sheet. A mini crash course with everything you need to know

Financial Reporting and Analysis | Lecture-1

How to read Balance Sheet of a company | fundamental analysis of stock market

How to Analyze a Balance Sheet? | Learn with Upstox ft. CA Rachana Ranade

The BALANCE SHEET for BEGINNERS (Full Example)

How We Analyze A Bank's Balance Sheet

How to Read & Analyze a Balance Sheet like a CFO - For Beginners

Balance sheet analysis

Balance Sheet - How to Read and Analyze? Learn Fundamental Analysis in Stock Market Ep 16

How to Analyze the Balance Sheet to Pick Stocks

Relationship between 💵 Income Statement & ⚖️ Balance Sheet

Vertical Analysis of a Balance Sheet | Explained with Example

BALANCE SHEET explained

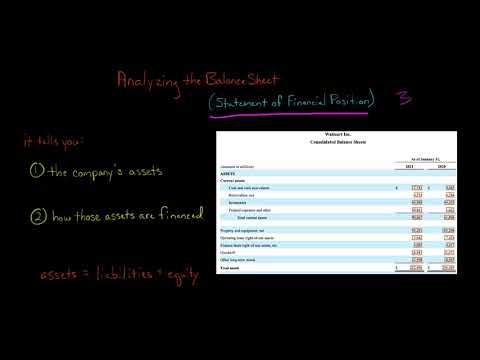

Analyzing the Balance Sheet | Financial Statement Analysis

All of the Balance Sheet Ratios for Financial Analysts

How to Read Balance Sheet on Moneycontrol? (Hindi) Part 1

Balance Sheet Explained in Tamil | Learn Share Market in Tamil

Комментарии

0:16:19

0:16:19

0:21:32

0:21:32

0:14:26

0:14:26

0:15:36

0:15:36

0:06:01

0:06:01

0:37:10

0:37:10

0:09:21

0:09:21

1:19:24

1:19:24

0:45:22

0:45:22

0:11:01

0:11:01

0:07:02

0:07:02

0:06:59

0:06:59

0:02:28

0:02:28

0:18:11

0:18:11

0:24:44

0:24:44

0:28:41

0:28:41

0:13:57

0:13:57

0:09:17

0:09:17

0:12:49

0:12:49

0:09:10

0:09:10

0:14:22

0:14:22

0:30:13

0:30:13

0:14:17

0:14:17

0:10:23

0:10:23