filmov

tv

How ONGC's Dominant Position In Domestic Market Will Affect Your Portfolio | Know Your Company

Показать описание

In the latest episode of Know You Company we deep dive into the largest crude oil and natural gas company in India ONGC. It enjoys a dominant position in the domestic market, supported by vast hydrocarbon reserves, with its KG Basin asset seeing a ramp-up in production. However, the company faces challenges such as declining production from matured fields and consistent execution delays, which have led to cuts in guidance for new assets. Additionally, its revenues are dependent on volatile spot market prices or fixed pricing, which can impact profitability.

#ongcshareprice #stockmarketnews #ongcshareanalysis

---------------------------------------------------------------------------------------------------------------------------------------------

Follow NDTV Profit here

#ongcshareprice #stockmarketnews #ongcshareanalysis

---------------------------------------------------------------------------------------------------------------------------------------------

Follow NDTV Profit here

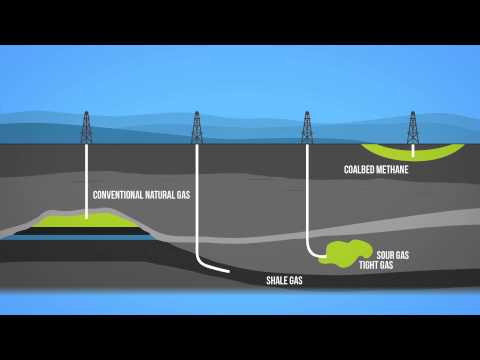

Natural Gas 101

stop any dog attack fast #smalldog

How to eat Roti #SSB #SSB Preparation #Defence #Army #Best Defence Academy #OLQ

Dr. Subramanian Swamy Reveals PM Modi's Next Moves After Winning The Elections #shorts

Top 10 soft skills for success in Life

Internship expectations vs reality

Indian Chess World Record 😱 #praggnanandhaa #gukesh #worldrecord

ONGC invites applications for apprentice posts

ONGC to invest USD 2 billion in Mumbai offshore to raise oil, gas output

ONGC Recruitment 2025 | ONGC Vacancy, Eligibility, Selection Process, Salary | Know Complete Details

Detailed Interview Document for ONGC | ONGC Interview Preparation | All ONGC related Questions

#fireman #shorts powerfull training 💪 by Sandeep Sir #viral #short

ONGC Recruitment 2025| Assistant Executive Engineer| SPACE Engg. Academy| Mukesh Bijja| 9848485698

Kho Kho pole dive

LEADING SEMI GOVERNMENT COMPANY – ABUDHABI ADNOC PROJECT – OFFSHORE PROJECT #aboardvacancy #jobnews...

Which branch of Engineering has more utility in ISRO?

ONGC/All JE & AE 2022 | Mechanical Engg.| Complete Fluid Mechanics Revision |Top 50 Qns #4

Geophysical techniques for Petroleum Exploration| P-1| Sumit Chakrabarti GM (Geology) ONGC (Retired)

Ek jhatke mein ho jayega The End 💔

Top 10 Biggest University in the World 🌍#shorts #school #shortsfeed

ICSE vs CBSE Students Intro..😂😜😝| Ajv | Shorts | #shorts

“First oil extracted…” Hardeep Puri announces new crude discovery in India

Fire Safety Interview | Fire Safety Interview Questions & Answers | Fire Technician Interview Q/...

How to apply for ONGC MRPL Recruitment of Engineers, Executive Sep 2014 ENCODING

Комментарии

0:03:39

0:03:39

0:00:34

0:00:34

0:00:16

0:00:16

0:00:35

0:00:35

0:00:19

0:00:19

0:00:33

0:00:33

0:00:26

0:00:26

0:01:16

0:01:16

0:00:58

0:00:58

0:09:52

0:09:52

0:20:07

0:20:07

0:01:01

0:01:01

0:07:32

0:07:32

0:00:05

0:00:05

0:00:14

0:00:14

0:01:16

0:01:16

0:55:56

0:55:56

0:32:27

0:32:27

0:00:21

0:00:21

0:00:36

0:00:36

0:00:31

0:00:31

0:04:51

0:04:51

0:06:21

0:06:21

0:02:35

0:02:35