filmov

tv

How to fill out the W-8BEN

Показать описание

A Canadian consultant working for a US company is asked to provide a completed W-8Ben. What is a W-8BEN, and how do you complete one?

============

============

Some American payers are obliged by law to withhold tax on income they pay to their subcontractors, which makes sense if those subcontractors are American and subject to US tax laws. But a consultant who is based outside the US and is not a US citizen is not subject to those withholding laws.

US payers can be penalized by the IRS if they don’t withhold tax properly. To be safe, they need to have a document on file to show that you (their payee) are exempt from these taxes. That’s the role of the W-8BEN.

1:30 Looking at the form part by part

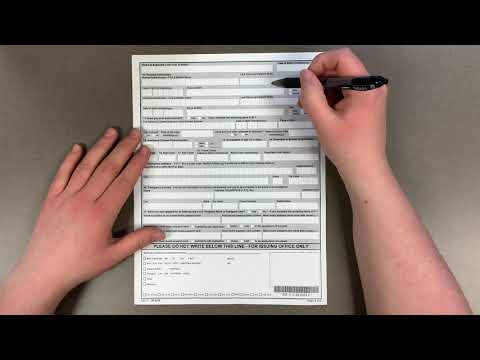

The W-8BEN can look intimidating at first glance, in reality but it breaks down into three basic sections.

Part I – Identification

This part asks for your name, address, and foreign identifying tax number. Being Canadian, you can use your social insurance number (SIN) as your foreign tax number.

Part II – Why you are exempt

In this part you explain why you are exempt. As a consultant based in Canada, you only have to complete Question 9 by entering Canada in the blank space. Question 10 can be ignored in this case because it doesn’t apply.

Part III – Signature

And finally, part three is where you sign and date.

Send the completed and signed form off to your US client and that's it.

=============================

Did you know Personal Tax Advisors files your GST/HST for free?

============

============

Some American payers are obliged by law to withhold tax on income they pay to their subcontractors, which makes sense if those subcontractors are American and subject to US tax laws. But a consultant who is based outside the US and is not a US citizen is not subject to those withholding laws.

US payers can be penalized by the IRS if they don’t withhold tax properly. To be safe, they need to have a document on file to show that you (their payee) are exempt from these taxes. That’s the role of the W-8BEN.

1:30 Looking at the form part by part

The W-8BEN can look intimidating at first glance, in reality but it breaks down into three basic sections.

Part I – Identification

This part asks for your name, address, and foreign identifying tax number. Being Canadian, you can use your social insurance number (SIN) as your foreign tax number.

Part II – Why you are exempt

In this part you explain why you are exempt. As a consultant based in Canada, you only have to complete Question 9 by entering Canada in the blank space. Question 10 can be ignored in this case because it doesn’t apply.

Part III – Signature

And finally, part three is where you sign and date.

Send the completed and signed form off to your US client and that's it.

=============================

Did you know Personal Tax Advisors files your GST/HST for free?

Комментарии

0:03:15

0:03:15

0:04:09

0:04:09

0:00:30

0:00:30

0:08:38

0:08:38

0:14:02

0:14:02

0:02:15

0:02:15

0:18:28

0:18:28

0:04:26

0:04:26

0:00:42

0:00:42

0:01:28

0:01:28

0:03:43

0:03:43

0:17:57

0:17:57

0:07:43

0:07:43

0:04:38

0:04:38

0:15:39

0:15:39

0:11:42

0:11:42

0:10:56

0:10:56

0:06:26

0:06:26

0:01:35

0:01:35

0:08:15

0:08:15

0:13:20

0:13:20

0:04:13

0:04:13

0:08:29

0:08:29

0:06:53

0:06:53