filmov

tv

Types of Term Insurance Plans Explained: Which One is Right for You?

Показать описание

Term insurance plans are one of the simplest and most effective ways to provide financial security to your loved ones in case of an untimely demise. In this video, we break down the various types of term insurance plans available in India, including Level Term Plans, Increasing and Decreasing Term Plans, and Return of Premium Plans. Discover which option suits your family’s needs best and why term insurance is a crucial part of your financial planning. Watch the video to learn the benefits, features, and key points to consider when choosing a term insurance plan.

FAQs:

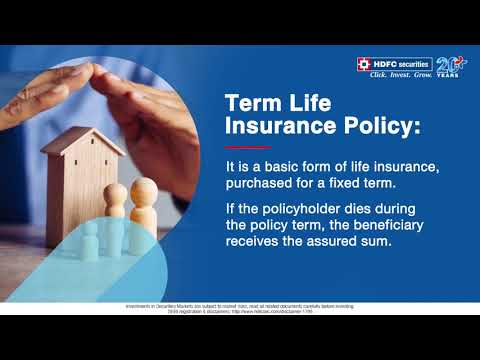

What is a Term Insurance Plan?

A term insurance plan is a type of life insurance that offers coverage for a fixed period. If the insured person passes away during the term, the nominee receives a death benefit.

What are the different types of Term Insurance? The common types of term insurance include:

1. Level Term Insurance (fixed coverage throughout the policy term)

2. Increasing Term Insurance (coverage increases over time)

3. Decreasing Term Insurance (coverage decreases over time, suitable for loan protection)

4. Return of Premium (refund of premiums if no claim is made)

5. Convertible Term Plans (can be converted to whole life insurance)

Which Term Insurance is the best?

The best term insurance depends on your financial goals and life stage. A Level Term Plan is suitable for most while Increasing Term Plans can be ideal for those seeking growing coverage.

Is a Return of a Premium Term Plan a good option?

While these plans return premiums if no claim is made, they tend to be more expensive than regular term insurance. It can be a good option if you want a safety net for your investment.

Can I convert my Term Insurance into a Whole Life Policy?

Some term insurance plans come with a convertible option, allowing you to switch to a whole-life policy as your needs change.

How much coverage do I need in a Term Insurance Plan?

Typically, coverage should be 10-20 times your annual income to ensure your family's financial needs are met in case of any unforeseen event.

#TermInsurance #LifeInsurance #TermInsuranceTypes #LevelTermInsurance #IncreasingTermInsurance #ReturnOfPremium #InsurancePlanning #PolicyBazaar

#LifeInsuranceBenefits #SecureYourFuture

FAQs:

What is a Term Insurance Plan?

A term insurance plan is a type of life insurance that offers coverage for a fixed period. If the insured person passes away during the term, the nominee receives a death benefit.

What are the different types of Term Insurance? The common types of term insurance include:

1. Level Term Insurance (fixed coverage throughout the policy term)

2. Increasing Term Insurance (coverage increases over time)

3. Decreasing Term Insurance (coverage decreases over time, suitable for loan protection)

4. Return of Premium (refund of premiums if no claim is made)

5. Convertible Term Plans (can be converted to whole life insurance)

Which Term Insurance is the best?

The best term insurance depends on your financial goals and life stage. A Level Term Plan is suitable for most while Increasing Term Plans can be ideal for those seeking growing coverage.

Is a Return of a Premium Term Plan a good option?

While these plans return premiums if no claim is made, they tend to be more expensive than regular term insurance. It can be a good option if you want a safety net for your investment.

Can I convert my Term Insurance into a Whole Life Policy?

Some term insurance plans come with a convertible option, allowing you to switch to a whole-life policy as your needs change.

How much coverage do I need in a Term Insurance Plan?

Typically, coverage should be 10-20 times your annual income to ensure your family's financial needs are met in case of any unforeseen event.

#TermInsurance #LifeInsurance #TermInsuranceTypes #LevelTermInsurance #IncreasingTermInsurance #ReturnOfPremium #InsurancePlanning #PolicyBazaar

#LifeInsuranceBenefits #SecureYourFuture

0:21:15

0:21:15

0:05:18

0:05:18

0:21:17

0:21:17

0:15:24

0:15:24

0:20:14

0:20:14

0:10:30

0:10:30

0:12:19

0:12:19

0:36:14

0:36:14

0:00:33

0:00:33

0:29:59

0:29:59

0:10:59

0:10:59

0:08:00

0:08:00

0:06:15

0:06:15

0:11:15

0:11:15

0:16:15

0:16:15

0:08:02

0:08:02

0:05:30

0:05:30

0:09:58

0:09:58

0:06:22

0:06:22

0:13:25

0:13:25

0:07:48

0:07:48

0:03:22

0:03:22

0:00:55

0:00:55

0:08:25

0:08:25