filmov

tv

What To Do When The Insurance Company Totals Your Car - Lehto's Law Ep. 4.41

Показать описание

People often ask me what they should do when the insurance company is going to total their car. What steps should they take? And what can you do to avoid being ripped off.

What to do? When you don't know what to do | Pastor Anthony Martinez

WHAT TO DO WHEN NOTHING GOES OUR WAY | Buddhism In English

Learn What To Do When You're Asked to Do the Impossible with Rick Warren

what to do when you feel like doing nothing (unmotivated, burnt out, unproductive)

Learn What To Do When The Heat Is On with Rick Warren

What to do when your partner is depressed - Esther Perel

Pema Chödrön: What to Do When You Lose It Completely

What to do when a narcissist turns people against you

What To Do When Your Heart Condemns You | ReviveNow Church | Jaco and Leslie Theron

What to Do When You Don't Know What to Pray - How to Get Unstuck in Prayer

What To Do When You Don’t Know What To Do

What To Do When She Pulls Away

'What to Do When You Get Another Chance' with Pastor Rick Warren

Learn What To Do When God Tests You With Success with Rick Warren

What To Do When You're At Your Lowest Moment

What To Do When A Girl Looks At You

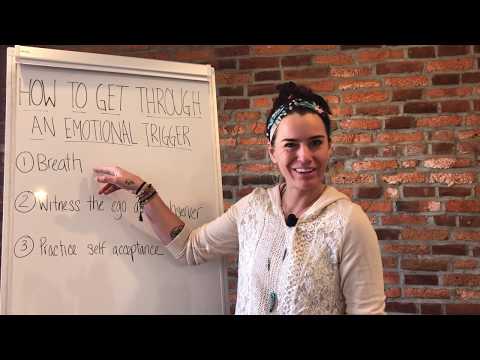

Here's what to do when you're triggered

What to do when your Sea-Monkeys die? #shorts

'What to Do When It Feels Hopeless' with Rick Warren

What To Do When Your Parents Don’t Support You #Shorts

Estrangement: What To Do When Your Kids Won’t Talk to You

What To Do When You're Broke

What To Do When A Key Employee Quits | Straight Talk with Lou Mosca

What To Do When You're Feeling Stuck | Joyce Meyer's Talk It Out Podcast | Episode 88

Комментарии

1:43:31

1:43:31

0:09:26

0:09:26

1:17:40

1:17:40

0:11:00

0:11:00

1:14:19

1:14:19

0:02:20

0:02:20

0:02:49

0:02:49

0:15:58

0:15:58

1:40:31

1:40:31

1:00:51

1:00:51

0:03:36

0:03:36

0:09:42

0:09:42

1:04:42

1:04:42

1:05:42

1:05:42

0:08:23

0:08:23

0:03:05

0:03:05

0:07:43

0:07:43

0:00:12

0:00:12

1:07:06

1:07:06

0:00:24

0:00:24

0:32:30

0:32:30

0:19:15

0:19:15

0:02:02

0:02:02

0:47:17

0:47:17