filmov

tv

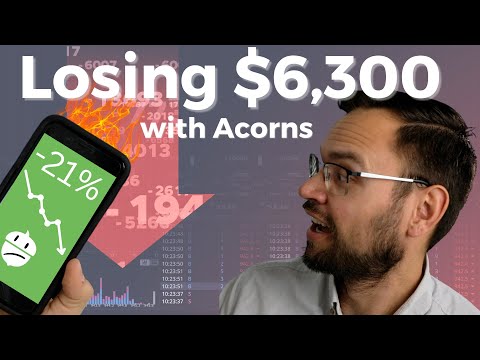

Exposing the Downsides about Acorns, Stash, Wealthfront, and Others

Показать описание

📫Follow me on Instagram: @MeetKevin📫

⚠️Best way to reach Meet Kevin®: DM on Instagram ⚠️

📅Post your Questions & I'll Answer in our Private Livestreams for:

➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖➖

❎I am not a CPA, attorney, insurance, or financial advisor and the information in these videos shall not be construed as tax, legal, insurance, construction, engineering, health and safety, electrical or financial advice. If you need such advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc. or financial advisor. Linked items may create a financial benefit for Meet Kevin®. The Paffrath Organization is a licensed real estate brokerage doing business as Meet Kevin® in California under DRE #02032575.

This is not an advertisement of property for sale and shall not be construed as anything other than an opinion for entertainment purposes only.

Trademarked Slogans (no use without written permission):

⛔️Meet Kevin ®

⛔️No-Pressure Agent ®

⛔️Providing More ®

Questions? Please Instagram DM @MeetKevin.

#Investing #Apps #DontSueMeBro

Комментарии

0:21:51

0:21:51

0:15:31

0:15:31

0:12:30

0:12:30

0:00:54

0:00:54

0:00:47

0:00:47

0:08:19

0:08:19

0:03:58

0:03:58

0:00:38

0:00:38

0:00:52

0:00:52

0:05:25

0:05:25

0:12:09

0:12:09

0:01:00

0:01:00

0:01:00

0:01:00

0:04:01

0:04:01

0:08:28

0:08:28

0:10:29

0:10:29

0:10:28

0:10:28

0:11:00

0:11:00

0:04:59

0:04:59

0:12:18

0:12:18

0:03:28

0:03:28

0:43:26

0:43:26

1:41:30

1:41:30

0:02:37

0:02:37