filmov

tv

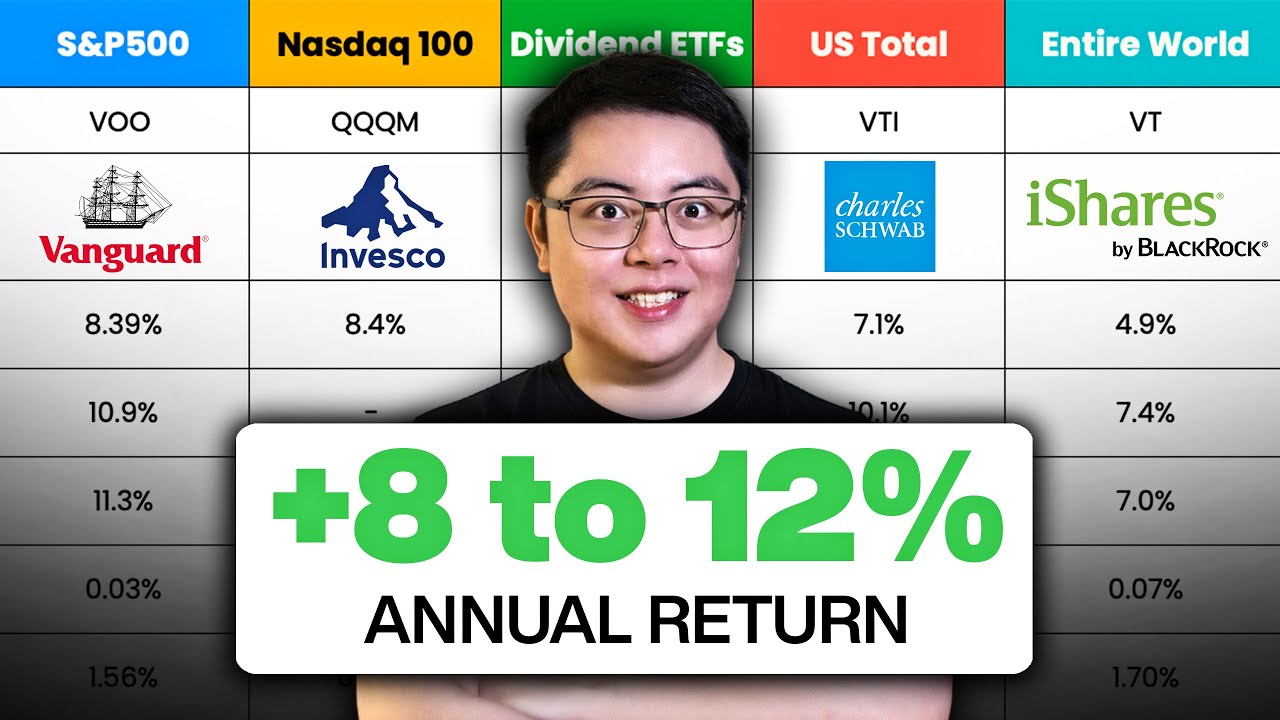

Best ETFs for First Time Investors

Показать описание

⬇️ Timestamps:

0:00 → Introduction

0:48 → S&P 500

4:12 → Ad Break

4:35 → Nasdaq-100

6:37 → Dividend ETFs

10:03 → US Total Stock Market

11:47 → Entire World’s Stock Market

13:53 → Conclusion

ETFs are perfect tools to build a diversified portfolio, what's more it only requires minimal effort and low costs, leaving traditional fund investments looking inferior! In this video, I’ll be your guide to the 5 ETF categories that you cannot go wrong buying.

First up, the classic S&P 500 index ETFs. Investing here is like placing your bets on the champions of the US economy. With top picks like VOO, SPLG, IVV, and SPY, you'll own a piece of top companies in the US such as Apple, Microsoft, and Amazon. And the numbers don't lie – their returns hovering around 10% over the years, think about it, a $10,000 investment could have blossomed to $29,000 in a decade with minimal effort!

Craving more growth potential? The Nasdaq-100 index ETFs like QQQ and its cost-effective sibling QQQM are your go-to, especially if you prefer tech stocks over other industries. But as always, with high growth comes higher volatility. For those seeking stability with a side of steady income, dividend ETFs such as VIG and SCHD could be your go-to, since they are more likely to be established, profitable companies, you can invest with a peace of mind.

For those who don't want to miss out on the dynamic smaller companies, the US Total Stock Market ETF, VTI, is your ticket to the broader market. And if investing in US alone doesn't sound right, you can tap into global market by investing in Global ETFs. These ETFs like ACWI and VT offer unparalleled diversification, enable you to minimize the geopolitic risks!

Which ETFs would you pick? Let me know in the comment!

—

❗️USEFUL LINKS❗️

✅Start Investing in the U.S. market now!👇🏻

✅Full Interactive Brokers Playlist👇🏻

✅Beginner's Step-By-Step Playlist to Start Investing 👇🏻

✅Exchange-Traded Funds (ETFs) Playlist 👇🏻

—

SOCIAL MEDIA LINKS

ETF

ETFs

US ETFs

S&P 500

How to buy S&P 500

Which ETF is the best

How do I choose the best ETFs

Best S&P 500

Best ETFs

VOO

SPY

IVV

SPLG

QQQ

QQQM

SCHD

VIG

VTI

VT

ACWI

Best US ETFs

Best World ETF

Dividend ETFs

Low fees ETFs

#ETFs #ExchangeTradedFunds #PassiveInvesting #S&P500 #VOO #SPLG #IVV #SPY #InvestingForBeginners #Nasdaq100 #QQQ #QQQM #DividendInvesting #VIG #SCHD #TotalStockMarket #VTI #GlobalStockMarket #ACWI #VT #PortfolioDiversification #USStockMarket #TechStocks #DividendYield #LongTermInvesting #InvestmentStrategy #FinancialFreedom #WealthBuilding #StockMarket #indexfunds

—

Disclaimer: This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Комментарии

0:16:20

0:16:20

0:10:09

0:10:09

0:08:56

0:08:56

0:16:13

0:16:13

0:09:13

0:09:13

0:13:34

0:13:34

0:26:27

0:26:27

0:05:12

0:05:12

0:00:50

0:00:50

0:13:06

0:13:06

0:13:29

0:13:29

0:11:32

0:11:32

0:10:10

0:10:10

0:13:33

0:13:33

0:07:12

0:07:12

0:11:31

0:11:31

0:15:04

0:15:04

0:19:05

0:19:05

0:09:28

0:09:28

0:18:25

0:18:25

0:14:50

0:14:50

0:12:31

0:12:31

0:20:24

0:20:24

0:13:18

0:13:18