filmov

tv

How to Value a Dividend Stock! (Dividend Discount Model for Intrinsic Value Tutorial)

Показать описание

In this video, I take you step by step on how to value a dividend stock and how to perform 2 variations of the dividend discount model. Let me know your thoughts in the comments below!

Get up to 12 free stocks now using my link for Webull!:

Social Media (and other fun stuff):

I am not a Financial advisor or licensed professional. Nothing I say or produce on YouTube, or anywhere else, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk. Some of the links in the description may be affiliate links.

Dividend Discount Model Explained in 5 Minutes

How to Value a Stock Using the Dividend Discount Model

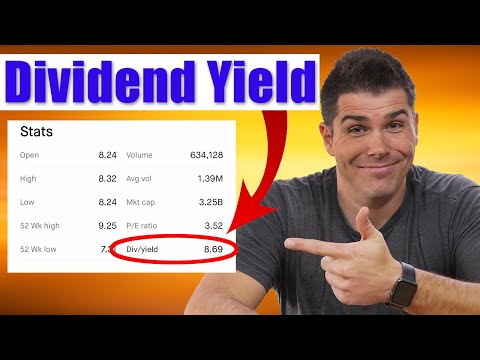

Dividend Yield Explained (For Beginners)

Dividend Stocks Explained for Beginners - What are Dividend Stocks?

How To Value a Dividend Company | Joseph Carlson Ep. 50

How to Value a Dividend Stock! (Dividend Discount Model Example)

How To Use Dividend Valuation Methods To Value A Stock

How to Value a Dividend Stock! (Dividend Discount Model for Intrinsic Value Tutorial)

Types of Shares growth stocks dividend stocks value stocks #financetelugu #money

How to Make $100 Per Month in Dividends #shorts

How to Value a Dividend Stock! (Step By Step)

Stock Multiples: How to Tell When a Stock is Cheap/Expensive

The Dividend Yield - Basic Overview

Are Dividend Investments A Good Idea?

How to valuate a Stock using the Dividend Discount Model (Step-by-step Tutorial)

Dividend Basics

The Dangers of Dividend Investing: 5 MUST KNOWS Before Buying Dividend Stocks!

How to Value a Dividend Stock!

Value Dividend Investing: The Ultimate Strategy for Long-Term Wealth

Growth Vs Value Investing

How dividends affect stock price, what are dividends, what is ex-dividend date?

The EASIEST Way To Find CHEAP Dividend Stocks (3 Examples)

How to calculate Dividend Per Share #divident #dividendinvesting #dividendstocks

3 Deeply DISCOUNTED Dividend Stocks To Buy In February 2025 💰

Комментарии

0:05:09

0:05:09

0:04:34

0:04:34

0:04:42

0:04:42

0:11:57

0:11:57

0:51:08

0:51:08

0:10:57

0:10:57

0:13:43

0:13:43

0:19:53

0:19:53

0:01:42

0:01:42

0:00:58

0:00:58

0:07:59

0:07:59

0:09:47

0:09:47

0:11:47

0:11:47

0:03:38

0:03:38

0:07:53

0:07:53

0:04:01

0:04:01

0:11:39

0:11:39

0:00:32

0:00:32

0:00:55

0:00:55

0:13:16

0:13:16

0:07:19

0:07:19

0:07:38

0:07:38

0:00:55

0:00:55

0:13:19

0:13:19