filmov

tv

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 1

Показать описание

This is Reading 52 for the 2021 exam.

Elevate your CFA prep with IFT’s expert resources. Use code "IFT-YT10" to save 10% on your purchase today!

This CFA exam prep video covers:

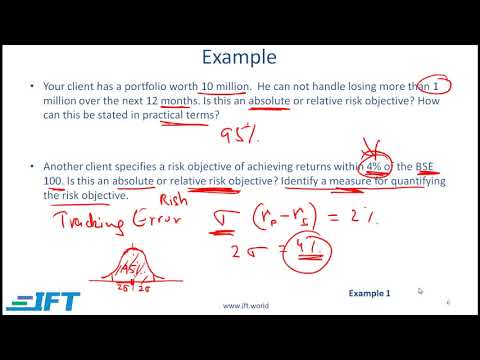

Investment characteristics of assets

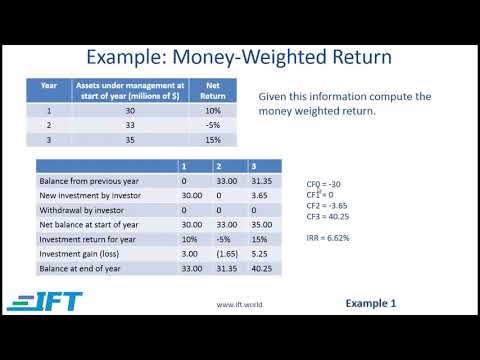

Annualized return and portfolio return

Elevate your CFA prep with IFT’s expert resources. Use code "IFT-YT10" to save 10% on your purchase today!

This CFA exam prep video covers:

Investment characteristics of assets

Annualized return and portfolio return

Portfolio Risk and Return - Part I (2024/2025 Level I CFA® Exam – PM – Module 1)

Portfolio Risk and Return – Part II (2024/2025 Level I CFA® Exam – PM – Module 2)

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 1

Level I CFA PM: Portfolio Planning and Construction-Lecture 1

Portfolio Management: An Overview (2024/2025 Level I CFA® Exam – PM – Module 1)

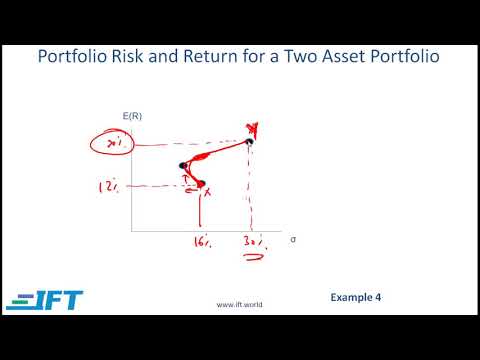

CFA® Level I Portfolio Management - Minimum Variance Portfolios and Efficient Frontier

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 4

Level I CFA PM: Portfolio Risk and Return: Part II-Lecture 1

Level I CFA PM: Portfolio Risk and Return: Part II-Lecture 2

Level I CFA PM: Portfolio Planning and Construction-Lecture 2

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 2

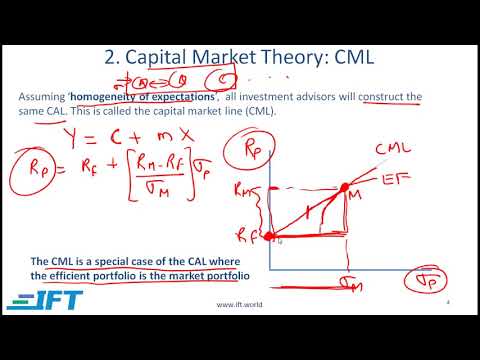

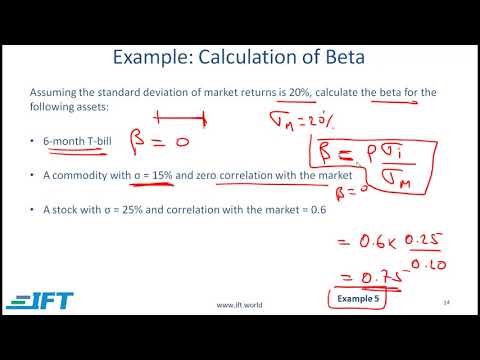

CFA Level I: Portfolio Management - CAL, CML, SML Explained

Level I CFA PM: Portfolio Risk and Return: Part II-Lecture 3

Level I CFA PM: Portfolio Risk and Return: Part I-Lecture 3

Evolution of Portfolio Theory – From Efficient Frontier to CAL to SML (For CFA® and FRM® Exams)

CFA® Level I Portfolio Management - Sharpe ratio, Treynor ratio, M2 , and Jensen’s alpha

Level I CFA Portfolio Management: An Overview-Lecture 1

CFA Level I: Portfolio Management - Basics of Portfolio Planning and Construction LOS (a-d) Part I

CFA Level 1: Portfolio Management Practice Question

CFA® Level I Portfolio Management - Risk Management Framework

CFA Level I - Complete CRASH COURSE - Quant + PM

CFA® Level I Portfolio Management - Portfolio Management Process

16. Portfolio Management

CFA Level I: Portfolio Management

Комментарии

0:55:39

0:55:39

0:54:59

0:54:59

0:30:40

0:30:40

0:25:04

0:25:04

0:50:55

0:50:55

0:07:51

0:07:51

0:12:37

0:12:37

0:20:59

0:20:59

0:23:16

0:23:16

0:17:14

0:17:14

0:25:13

0:25:13

0:08:21

0:08:21

0:26:09

0:26:09

0:15:21

0:15:21

0:21:35

0:21:35

0:05:10

0:05:10

0:16:24

0:16:24

0:15:20

0:15:20

0:11:52

0:11:52

0:03:22

0:03:22

9:53:04

9:53:04

0:04:19

0:04:19

1:28:38

1:28:38

0:03:12

0:03:12