filmov

tv

CFA Level I: Portfolio Management - CAL, CML, SML Explained

Показать описание

CFA | FRM | CFP | Financial Modeling

Live Classes | Videos Available Globally

Follow us on:

We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with!

This Video lecture was recorded by our Lead Trainer for CFA, Mr. Utkarsh Jain, during one of his live Session in Pune (India).

To know more about CFA/FRM training at FinTree, visit:

Portfolio Risk and Return - Part I (2025 Level I CFA® Exam – PM – Module 1)

Portfolio Management: An Overview (2025 Level I CFA® Exam – PM – Module 1)

CFA® Level I Portfolio Management - Risk Management Framework

CFA® Level I Portfolio Management - Portfolio Management Process

CFA Level I: Portfolio Management - CAL, CML, SML Explained

Level I CFA Portfolio Management: An Overview-Lecture 1

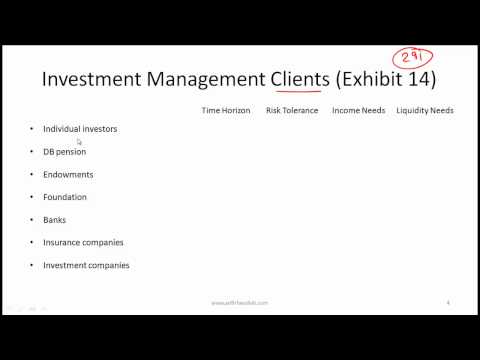

CFA Level I Portfolio Management An Overview Video Lecture by Mr. Arif Irfanullah Part 1

CFA level 1 Portfolio Management Revision

Standard V – Investment Analysis (2025 Level III CFA® Exam – Ethics – Reading 32)

CFA® Level I Portfolio Management - Minimum Variance Portfolios and Efficient Frontier

CFA® Level I Portfolio Management - Portfolio Construction: Strategic vs Tactical Asset Allocation

CFA LEVEL 1 | Portfolio Management in One Shot @thewallstreetschool

CFA Level 1 Portfolio Management Revision Lecture | CA Vikas Vohra | edZeb

Portfolio Risk and Return – Part II (2025 Level I CFA® Exam – PM – Module 2)

CFA® Level II Portfolio Management - Active Management & Analysis of Active Returns

CFA Level I Portfolio Management - Technical analysis vs Fundamental analysis

CFA Level I - Portfolio Management - Efficient Frontier!

Portfolio Management | Chapter 1 Risk & Return Complete Lecture | CFA L1 @thewallstreetschool

CFA® Level I Portfolio Management - Sharpe ratio, Treynor ratio, M2 , and Jensen’s alpha

2017 : CFA Level I: Portfolio Management: An Overview

CFA Level I: Portfolio Management - Basics of Portfolio Planning and Construction LOS (a-d) Part I

CFA® Level I Portfolio Management - Behavioural Finance: Representativeness Bias (Base rate neglect)...

My approach to Portfolio Management for the Retail Investor

CFA® Level I Portfolio Management - Behavioural Finance: Loss Aversion Bias (Emotional Bias)

Комментарии

0:55:39

0:55:39

0:50:55

0:50:55

0:03:22

0:03:22

0:04:19

0:04:19

0:08:21

0:08:21

0:16:24

0:16:24

0:22:26

0:22:26

1:40:57

1:40:57

0:37:12

0:37:12

0:07:51

0:07:51

0:05:49

0:05:49

4:03:54

4:03:54

5:55:54

5:55:54

0:54:59

0:54:59

0:07:46

0:07:46

0:04:40

0:04:40

2:51:53

2:51:53

7:09:03

7:09:03

0:05:10

0:05:10

0:13:30

0:13:30

0:15:20

0:15:20

0:02:57

0:02:57

0:55:24

0:55:24

0:03:14

0:03:14