filmov

tv

Future Value - Time Value of Money (with Examples)

Показать описание

---

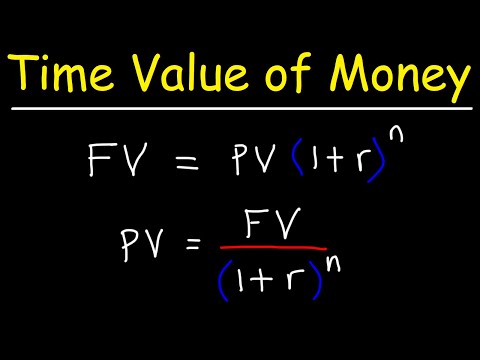

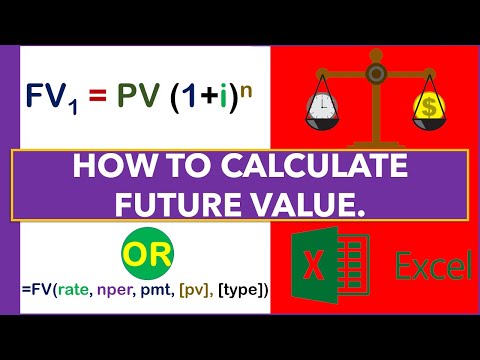

Future value is determining what the value of an investment will be at some point in the future, based on a certain rate of growth and a defined period of time. It's important to know how to calculate future value because in order to do accurate projections and analysis in order to forecast the value of our investments in the future, we need to know how to do this calculation.

We need at least three things to calculate a future value. We need a defined period of time. We need a rate of growth or an interest rate, and we need either a present value, an initial deposit, or we need a series of deposits or cash flows along the way.

Calculating future value takes those initial deposits or series of cashflows and projects them out into the future over that timeframe at that rate of growth. So we have our inputs and then we solve for future value.

Let's take a look at an example. Suppose we have an initial deposit of $1,000. If we were projecting out at a rate of 4%, it would effectively be like multiplying x 1.04.

For the first year, since we're doing this, example is annual compounding. So interest is just paid once per year. At the end of each year, at the end of the first year, we would have $1040... $1000 times 1.04, or growth growing at 4% gives us $1040. If our $1040 in the second year grew x 1.04, or 4%, then we would have $1081.60. And if that $1081.60 grew at another 4%, then our future value would be $1124.86 after three years.

Now, let's see how you would calculate that in a calculator. So in this case, because we have annual compounding, our number of periods is three. Our growth rate is 4% and we would not change that because we don't have more than one compounding period per year.

So our periodic rate is 4%. Our initial deposit is a thousand dollars. And remember that the thousand needs to be entered as a negative because that is cash out of pocket into the investment. When we solve for future value, we will yield a positive number because that would be cash back to us. We would have zero for payments because there are no periodic cash flows, simply the initial deposit of $1,000 growing at 4% and compounding. And then we would solve for future value and we would get $1124.86.

Now let's take a look at another example. In this example, let's imagine that we start out with an initial deposit, into an account of $5,000, and we're going to hold that account for four years. And at the end of each of those four years, we're going to deposit another $3,000 into the account all the while we'll be earning 6% annually on our investment, compounded annually. So just one payment, one interest payment per year.

So what would the effect of this be? Well, if we plug it into our calculator, it would look like this. So we have N is four periods. 6% is our interest rate. We have an initial deposit of $5,000. We have periodic payments of $3,000. And remember the signs on those are negative because they're cash, outlays cash out of pocket.

We would end up with a future value of $19,436. One thing to keep in mind is that future value does not take into account inflation changes in interest rates or changes in currency rates.

#investing #realestate #TrevorCalton #realestatefinanceandinvestments #realestatefinancetextbook #realestatefinance #stepbystep #stepbysteptutorial #diagram #example

Future value is determining what the value of an investment will be at some point in the future, based on a certain rate of growth and a defined period of time. It's important to know how to calculate future value because in order to do accurate projections and analysis in order to forecast the value of our investments in the future, we need to know how to do this calculation.

We need at least three things to calculate a future value. We need a defined period of time. We need a rate of growth or an interest rate, and we need either a present value, an initial deposit, or we need a series of deposits or cash flows along the way.

Calculating future value takes those initial deposits or series of cashflows and projects them out into the future over that timeframe at that rate of growth. So we have our inputs and then we solve for future value.

Let's take a look at an example. Suppose we have an initial deposit of $1,000. If we were projecting out at a rate of 4%, it would effectively be like multiplying x 1.04.

For the first year, since we're doing this, example is annual compounding. So interest is just paid once per year. At the end of each year, at the end of the first year, we would have $1040... $1000 times 1.04, or growth growing at 4% gives us $1040. If our $1040 in the second year grew x 1.04, or 4%, then we would have $1081.60. And if that $1081.60 grew at another 4%, then our future value would be $1124.86 after three years.

Now, let's see how you would calculate that in a calculator. So in this case, because we have annual compounding, our number of periods is three. Our growth rate is 4% and we would not change that because we don't have more than one compounding period per year.

So our periodic rate is 4%. Our initial deposit is a thousand dollars. And remember that the thousand needs to be entered as a negative because that is cash out of pocket into the investment. When we solve for future value, we will yield a positive number because that would be cash back to us. We would have zero for payments because there are no periodic cash flows, simply the initial deposit of $1,000 growing at 4% and compounding. And then we would solve for future value and we would get $1124.86.

Now let's take a look at another example. In this example, let's imagine that we start out with an initial deposit, into an account of $5,000, and we're going to hold that account for four years. And at the end of each of those four years, we're going to deposit another $3,000 into the account all the while we'll be earning 6% annually on our investment, compounded annually. So just one payment, one interest payment per year.

So what would the effect of this be? Well, if we plug it into our calculator, it would look like this. So we have N is four periods. 6% is our interest rate. We have an initial deposit of $5,000. We have periodic payments of $3,000. And remember the signs on those are negative because they're cash, outlays cash out of pocket.

We would end up with a future value of $19,436. One thing to keep in mind is that future value does not take into account inflation changes in interest rates or changes in currency rates.

#investing #realestate #TrevorCalton #realestatefinanceandinvestments #realestatefinancetextbook #realestatefinance #stepbystep #stepbysteptutorial #diagram #example

0:05:14

0:05:14

0:21:53

0:21:53

0:00:23

0:00:23

0:02:50

0:02:50

0:07:18

0:07:18

0:03:37

0:03:37

0:07:57

0:07:57

0:04:57

0:04:57

0:08:15

0:08:15

0:10:03

0:10:03

0:30:52

0:30:52

0:00:15

0:00:15

0:08:17

0:08:17

0:04:41

0:04:41

0:54:18

0:54:18

0:06:37

0:06:37

0:00:28

0:00:28

0:04:47

0:04:47

0:05:26

0:05:26

0:00:38

0:00:38

0:08:52

0:08:52

0:00:42

0:00:42

0:03:07

0:03:07

0:00:57

0:00:57