filmov

tv

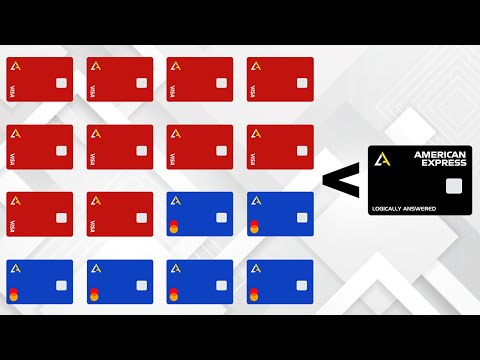

Visa Stock vs Mastercard Stock | Which is Better?

Показать описание

In this video, I’m going to analyze both Visa and Mastercard stock, ultimately deciding which I think is the better investment. Visa and Mastercard are the duopolies that dominate digital payments. These networks have a dominant market share, creating a huge competitive advantage. This network effect gives the companies a monopoly like economics and anti-trust concerns from some governments. Now, I’m going to analyze each stock individually, then look at the key differences, and at the end of the video explain which stock I like better.

******

Dividend Growth Investing provides the ability to create cash flow, without selling your position in a stock. This type of investing has a strong compounding effect when dividends are being reinvested back into your holdings. Over time, Dividend Investing can be your pathway to financial freedom!

Follow my Investment Journey!

Why Subscribe?

*Monthly analysis of my full dividend stock portfolio

*Weekly videos on a range of topics (Stock Reviews, What I bought that week, Investing theory, etc)

******

Disclaimer: This is my opinion and not to be considered financial advice

Visa Stock, V Stock, MasterCard Stock, MA Stock

#Dividends #DividendStocks #DividendInvesting

******

Dividend Growth Investing provides the ability to create cash flow, without selling your position in a stock. This type of investing has a strong compounding effect when dividends are being reinvested back into your holdings. Over time, Dividend Investing can be your pathway to financial freedom!

Follow my Investment Journey!

Why Subscribe?

*Monthly analysis of my full dividend stock portfolio

*Weekly videos on a range of topics (Stock Reviews, What I bought that week, Investing theory, etc)

******

Disclaimer: This is my opinion and not to be considered financial advice

Visa Stock, V Stock, MasterCard Stock, MA Stock

#Dividends #DividendStocks #DividendInvesting

Комментарии

0:12:10

0:12:10

0:12:30

0:12:30

0:16:37

0:16:37

0:08:03

0:08:03

0:20:09

0:20:09

0:00:19

0:00:19

0:08:25

0:08:25

0:13:12

0:13:12

0:00:28

0:00:28

0:06:06

0:06:06

0:26:18

0:26:18

0:11:06

0:11:06

0:06:18

0:06:18

0:09:09

0:09:09

0:12:48

0:12:48

0:14:10

0:14:10

0:18:00

0:18:00

0:08:52

0:08:52

0:35:34

0:35:34

0:08:32

0:08:32

0:11:31

0:11:31

0:06:13

0:06:13

0:31:13

0:31:13

0:14:47

0:14:47