filmov

tv

How Visa Became The Most Popular Card In The U.S.

Показать описание

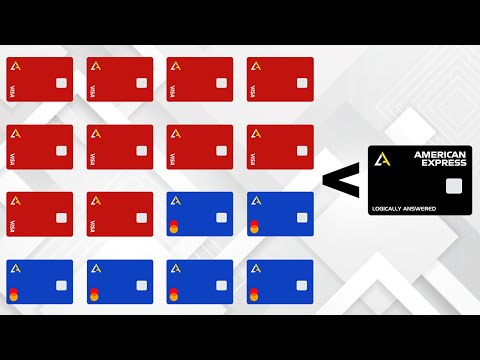

$6.7 trillion. That is how much Americans spent using their debit or credit cards in 2019. More than 60% of those purchases were made using cards from Visa, a company that has long dominated the payment card industry. As payment cards become more essential in our daily lives, Visa has quickly grown to become one of the most valuable companies in America. So how exactly does Visa make money and why does it dominate the payment card industry? Watch the video to find out.

Clarification: The 10% mentioned in the video at 11:45 refers to 10% of the average 2.2% of the swipe fee charged to merchants.

Americans are increasingly using plastic to spend their money, enabling Visa to grow its dominance in the credit and debit card space.

People in the U.S. spent $6.7 trillion through credit and debit cards in 2019, up 88% from 2009, according to a 2020 report by HSN Consultants. Of those transactions, more than 60% were made with Visa cards.

This has helped Visa grow into one of the world’s most valuable companies. As of Oct. 19, Visa has a market valuation of more than $491 billion. Its shares are also up more than 170% over the past five years.

However, some retailers argue that Visa’s success has come at the expense of merchants who rely on them to process payments. Some have even said the fees imposed by Visa are too high for businesses to survive.

“I know a lot of business owners and it saddens me because so many people have come to accept it as it is what it is,” Hub Convenience Stores CEO Jared Scheeler said. “These prices are so ridiculous. The amount we pay in swipe fees is so high that we have to do something about it, somebody has to do something about it.”

Swipe fees collected by Visa and Mastercard ballooned to $67.6 billion in 2019 from $25.6 billion in 2009, according to data from the National Retail Federation. The overall processing fees paid by U.S. merchants to accept all card payments jumped to $116.4 billion in 2019, up 88% since 2009.

“This is a central part of the problem with their dominance,” Merchants Payments Coalition executive committee member Doug Kantor said. “The exact way they were set up was to be this dominant price-setting entity and the fact that it’s gone on this long is a problem for everybody else in the economy.”

Visa declined to comment on this story.

To be sure, those in support of Visa argue the company is on the merchants’ side.

“Visa on some level is a victim of their own success in the sense that they’re so ubiquitous and so secure and so easy to use that people begin to take it for granted,” MoffettNathanson analyst Lisa Ellis said. “Visa’s business structure is very balanced and if anything is actually skewed, believe it or not, towards the merchants. They actually get the majority of their revenue from the banks and the ecosystem that’s supporting the merchants.”

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

How Visa Became The Most Popular Card In The U.S.

Clarification: The 10% mentioned in the video at 11:45 refers to 10% of the average 2.2% of the swipe fee charged to merchants.

Americans are increasingly using plastic to spend their money, enabling Visa to grow its dominance in the credit and debit card space.

People in the U.S. spent $6.7 trillion through credit and debit cards in 2019, up 88% from 2009, according to a 2020 report by HSN Consultants. Of those transactions, more than 60% were made with Visa cards.

This has helped Visa grow into one of the world’s most valuable companies. As of Oct. 19, Visa has a market valuation of more than $491 billion. Its shares are also up more than 170% over the past five years.

However, some retailers argue that Visa’s success has come at the expense of merchants who rely on them to process payments. Some have even said the fees imposed by Visa are too high for businesses to survive.

“I know a lot of business owners and it saddens me because so many people have come to accept it as it is what it is,” Hub Convenience Stores CEO Jared Scheeler said. “These prices are so ridiculous. The amount we pay in swipe fees is so high that we have to do something about it, somebody has to do something about it.”

Swipe fees collected by Visa and Mastercard ballooned to $67.6 billion in 2019 from $25.6 billion in 2009, according to data from the National Retail Federation. The overall processing fees paid by U.S. merchants to accept all card payments jumped to $116.4 billion in 2019, up 88% since 2009.

“This is a central part of the problem with their dominance,” Merchants Payments Coalition executive committee member Doug Kantor said. “The exact way they were set up was to be this dominant price-setting entity and the fact that it’s gone on this long is a problem for everybody else in the economy.”

Visa declined to comment on this story.

To be sure, those in support of Visa argue the company is on the merchants’ side.

“Visa on some level is a victim of their own success in the sense that they’re so ubiquitous and so secure and so easy to use that people begin to take it for granted,” MoffettNathanson analyst Lisa Ellis said. “Visa’s business structure is very balanced and if anything is actually skewed, believe it or not, towards the merchants. They actually get the majority of their revenue from the banks and the ecosystem that’s supporting the merchants.”

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

How Visa Became The Most Popular Card In The U.S.

Комментарии

0:14:10

0:14:10

0:09:00

0:09:00

0:09:53

0:09:53

0:12:30

0:12:30

0:03:53

0:03:53

0:15:36

0:15:36

0:13:12

0:13:12

0:07:47

0:07:47

0:20:21

0:20:21

0:12:16

0:12:16

0:21:37

0:21:37

0:00:59

0:00:59

0:08:05

0:08:05

0:06:56

0:06:56

0:02:03

0:02:03

0:01:04

0:01:04

0:05:23

0:05:23

0:14:42

0:14:42

0:02:15

0:02:15

0:03:18

0:03:18

0:00:34

0:00:34

0:24:03

0:24:03

0:05:52

0:05:52

0:04:56

0:04:56