filmov

tv

Introduction to Debt and Equity Financing

Показать описание

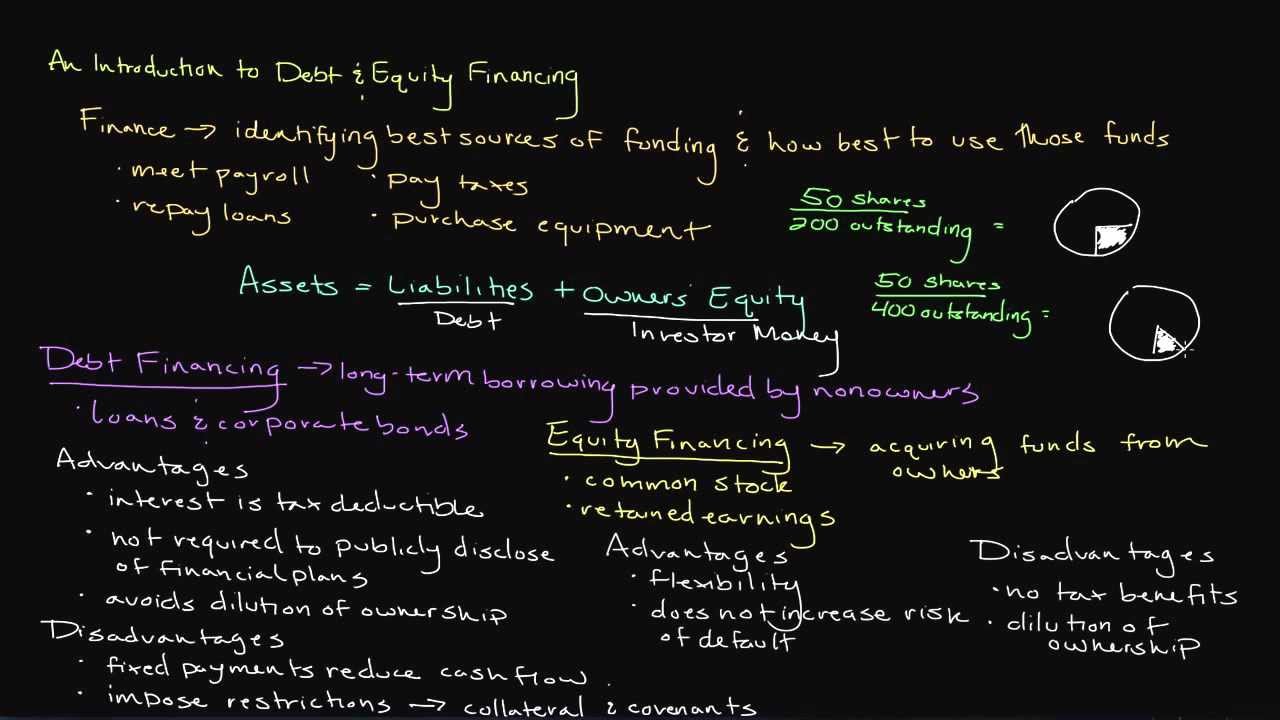

Finance is the function responsible for identifying the firm's best sources of funding as well as how best to use those funds. These funds allow firms to meet payroll obligations, repay long-term loans, pay taxes, and purchase equipment among other things. Although many different methods of financing exist, we classify them under two categories: debt financing and equity financing.

To address why firms have two main sources of funding we have take a look at the accounting equation. The basic accounting equation states that assets equal liabilities plus owners' equity. This equation remains constant because firms look to debt, also known as liabilities, or investor money, also known as owners' equity, to run operations.

Debt financing is long-term borrowing provided by non-owners, meaning individuals or other firms that do not have an ownership stake in the company. Debt financing commonly takes the form of taking out loans and selling corporate bonds.

Using debt financing provides several benefits to firms. First, interest payments are tax deductible. Just like the interest on a mortgage loan is tax deductible for homeowners, firms can reduce their taxable income if they pay interest on loans. Although deduction does not entirely offset the interest payments it at least lessens the financial impact of raising money through debt financing.

Another benefit to debt financing is that firm's utilizing this form of financing are not required to publicly disclose of their plans as a condition of funding. The allows firms to maintain some degree of secrecy so that competitors are not made away of their future plans. The last benefit of debt financing that we'll discuss is that it avoids what is referred to as the dilution of ownership. We'll talk more about the dilution of ownership when we discuss equity financing.

Although debt financing certainly has its advantages, like all things, there are some negative sides to raising money through debt financing. The first disadvantage is that a firm that uses debt financing is committing to making fixed payments, which include interest. This decreases a firm's cash flow. Firms that rely heavily in debt financing can run into cash flow problems that can jeopardize their financial stability.

The next disadvantage to debt financing is that loans may come with certain restrictions. These restrictions can include things like collateral, which require the firm to pledge an asset against the loan. If the firm defaults on payments then the issuer can seize the asset and sell it to recover their investment. Another restriction is a covenant. Covenants are stipulations or terms placed on the loan that the firm must adhere to as a condition of the loan. Covenants can include restrictions on additional funding as well as restrictions on paying dividends.

Equity financing involves acquiring funds from owners, who are also known as shareholders. Equity financing commonly involves the issuance of common stock in public and secondary offerings or the use of retained earnings.

A benefit of using equity financing is the flexibility that it provides over debt financing. Equity financing does not come with the same collateral and covenants that can be imposed with debt financing. Another benefit to equity financing also does not increase a firms risk of default like debt financing does. A firm that utilizes equity financing does not pay interest, and although many firm's pay dividends to their investors they are under no obligation to do so.

The downside to equity financing is that it produces no tax benefits and dilutes the ownership of existing shareholders. Dilution of ownership means that existing shareholders percentage of ownership decreases as the firm decides to issue additional shares. For example, lets say that you own 50 shares in ABC Company and there are 200 shares outstanding. This means that you hold a 25 percent stake in ABC Company. With such a large percentage of ownership you certainly have the power to affect decision-making. In order to raise additional funding ABC Company decides to issue 200 additional shares. You still hold 50 shares in the company, but now there are 400 shares outstanding. Which means you now hold a 12.5 percent stake in the company. Thus your ownership has been diluted due to the issuance of additional shares. A prime example of the dilution of ownership occurred in in the mid-2000's when Facebook co-founder Eduardo Saverin had his ownership stake reduced by the issuance of additional shares.

Комментарии

0:04:52

0:04:52

0:06:01

0:06:01

0:04:06

0:04:06

0:02:43

0:02:43

0:05:55

0:05:55

0:02:21

0:02:21

0:05:35

0:05:35

0:06:43

0:06:43

0:52:20

0:52:20

0:02:04

0:02:04

0:30:57

0:30:57

0:05:20

0:05:20

0:30:42

0:30:42

0:01:14

0:01:14

0:06:43

0:06:43

0:12:12

0:12:12

0:06:04

0:06:04

0:01:16

0:01:16

0:07:38

0:07:38

0:03:50

0:03:50

0:03:24

0:03:24

0:08:25

0:08:25

0:01:48

0:01:48

0:01:37

0:01:37