filmov

tv

Insurance Objection Handling [Part 2] | Objection Handling Training Live | Dr Sanjay Tolani

Показать описание

Special thanks to APLIC Hong Kong for this amazing video =)

[Table Of Content Bellow]

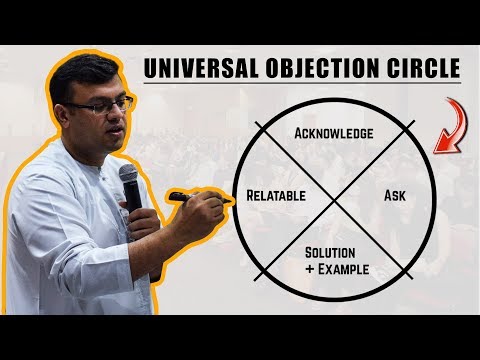

In today’s video I want to show you an Objection Handling Technique 💯 that I have been using for decades and I call it the Universal Objection Circle (UOC). Regardless of which prospect you speak to, sales objection is unavoidable in EVERY sales process. We can either choose to give up from the deal or PUSH FURTHER by tackling the crux of the issue. More often than not, financial advisors often neglect the IMPORTANCE of this Objection Handling process and end up losing the deal. 😱

The Universal Objection Circle is primarily broken into 4 parts. First of all you got to Acknowledge 🙌🏻 It is making sure that you first acknowledge there is an objection.

1. Acknowledge

You see a lot of clients get upset when we don’t understand where they are coming from so it is about saying the words like “I actually understand where you are coming from” and acknowledge that there is an objection. ✅

2. Ask

Second is ASK, asking the RIGHT QUESTIONS. Now when you ask these questions, they should either address a particular FEAR or to address a particular CONCERN. This helps to plant the seed of DOUBT to get the customer worry about the situation.

3. Solution & Example

The next would be Solution and Example. Once you have asked the right questions, the most important step after that is providing a SOLUTION with an EXAMPLE. 💊 If you don’t provide an example, people may not be able to understand what you are trying to say. So Break It Down to something very RELATABLE to them and that is very very important.

4. Relatable

The next step is to make it Relatable. Now the fourth and most important step is making sure that this example is relatable. Can they relate to the example on an Everyday Basis? Example if I am talking to a client and they don’t understand or related to the example I have provided, that OBJECTION continues to REMAIN. 😱 So if you do not have an example that they can relate to, you will never be able to get over that objection

Table Of Content:

01:11 - Objection: "I Have No Money!"

02:08 - Objection: "I Need To Ask My Wife!"

03:15 - Objection: "I Am Too Old!"

04:04 - Objection: "Sanjay, I Believe In The Future Education Will Be Free!"

⭐ Follow Dr. Sanjay Tolani ⭐

🎖 Who is Dr Sanjay Tolani? 🎖

Dr. Sanjay Tolani, became the “youngest member” at the age of 19 and the “youngest life member” at the Age of 28 to the Million Dollar Round Table (MDRT). He also has 13 Top of the Table Qualifications (TOT), which is considered the pinnacle of the financial services profession. To top things off, he is also the youngest Managing Director of an insurance brokerage in the Middle East.

📕 Get A Copy Of Dr. Sanjay’s Tolani Book 📕

Комментарии

0:06:51

0:06:51

0:14:17

0:14:17

0:02:07

0:02:07

0:08:43

0:08:43

0:08:31

0:08:31

0:16:44

0:16:44

0:18:20

0:18:20

0:11:36

0:11:36

0:00:54

0:00:54

0:03:00

0:03:00

0:04:22

0:04:22

0:08:22

0:08:22

0:02:44

0:02:44

0:07:24

0:07:24

0:03:55

0:03:55

0:27:15

0:27:15

0:03:13

0:03:13

0:05:25

0:05:25

0:07:53

0:07:53

0:03:55

0:03:55

0:26:40

0:26:40

0:06:21

0:06:21

0:01:22

0:01:22

0:00:37

0:00:37