filmov

tv

APR Calculator

Показать описание

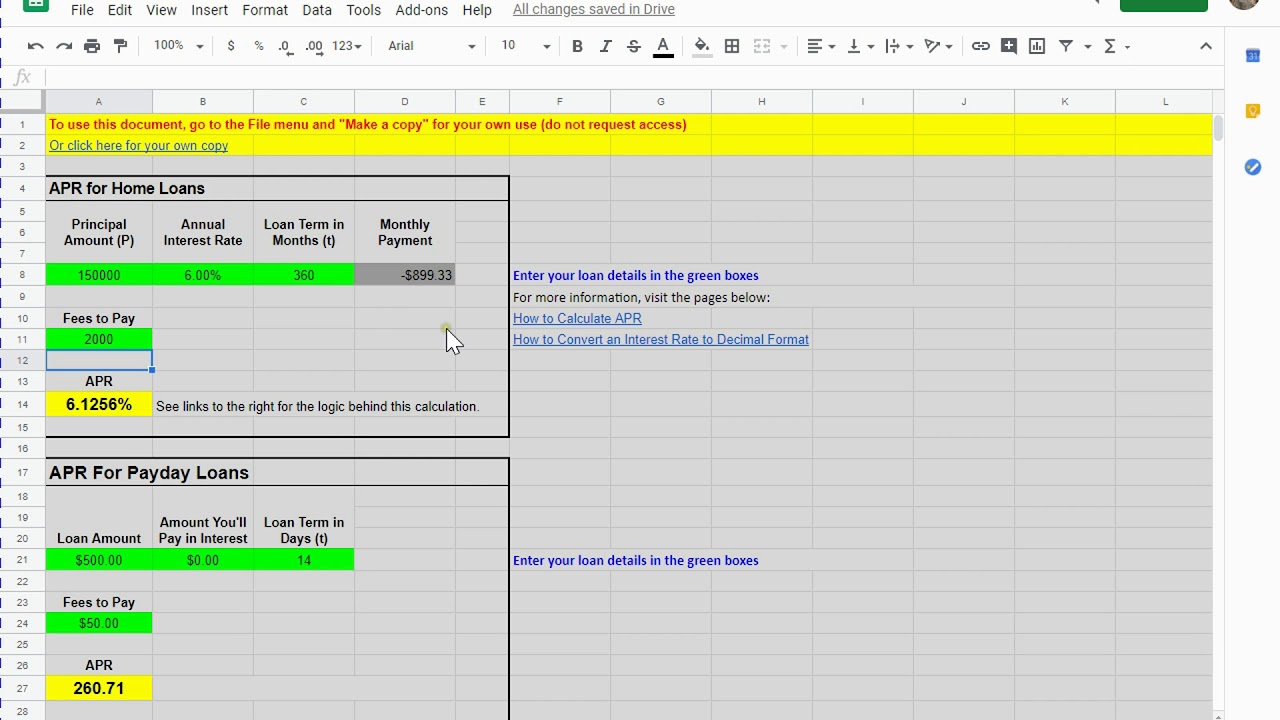

Instructions for using the APR calculator in Google Sheets.

Calculate APR for a home loan or payday loan (and similar) products. See how up-front fees affect your total financing costs.

Note that APR isn't perfect, but it's helpful for getting closer to an apples-to-apples comparison of total borrowing costs. If you're paying closing costs, finance charges, or other fees, learn more about those charges.

In addition to your interest rate and interest costs, other financing costs affect your expenses. An annual percentage rate attempts to provide an estimated cost of borrowing, expressed as a percentage of your loan amount per year. For example, with an APR of 10 percent and a loan balance of $200, you would pay roughly $20 in interest to maintain that debt. However, you're counting some finance charges in that amount, and you might have a lower interest rate (say, 18 percent, for example). APR is only accurate if you keep a loan exactly as long as the calculation expects you to.

To use the sheet, make your own copy so that nobody else can wipe out your work (it's a shared worksheet). Then, you can change the green cells to customize for your loan and run what-if scenarios.

🔑 9 Keys to Retirement Planning

🐢 6 Safest Investments

Calculate APR for a home loan or payday loan (and similar) products. See how up-front fees affect your total financing costs.

Note that APR isn't perfect, but it's helpful for getting closer to an apples-to-apples comparison of total borrowing costs. If you're paying closing costs, finance charges, or other fees, learn more about those charges.

In addition to your interest rate and interest costs, other financing costs affect your expenses. An annual percentage rate attempts to provide an estimated cost of borrowing, expressed as a percentage of your loan amount per year. For example, with an APR of 10 percent and a loan balance of $200, you would pay roughly $20 in interest to maintain that debt. However, you're counting some finance charges in that amount, and you might have a lower interest rate (say, 18 percent, for example). APR is only accurate if you keep a loan exactly as long as the calculation expects you to.

To use the sheet, make your own copy so that nobody else can wipe out your work (it's a shared worksheet). Then, you can change the green cells to customize for your loan and run what-if scenarios.

🔑 9 Keys to Retirement Planning

🐢 6 Safest Investments

Комментарии

0:04:54

0:04:54

0:02:13

0:02:13

0:07:12

0:07:12

0:09:15

0:09:15

0:02:36

0:02:36

0:00:59

0:00:59

0:01:56

0:01:56

0:08:56

0:08:56

0:21:18

0:21:18

0:08:13

0:08:13

0:02:04

0:02:04

0:01:32

0:01:32

0:11:58

0:11:58

0:02:28

0:02:28

0:04:30

0:04:30

0:01:50

0:01:50

0:04:17

0:04:17

0:01:33

0:01:33

0:04:43

0:04:43

0:04:43

0:04:43

0:04:24

0:04:24

0:07:05

0:07:05

0:13:47

0:13:47

0:01:59

0:01:59