filmov

tv

APR and EAR Differences and Calculation (Intermediate Accounting I #7)

Показать описание

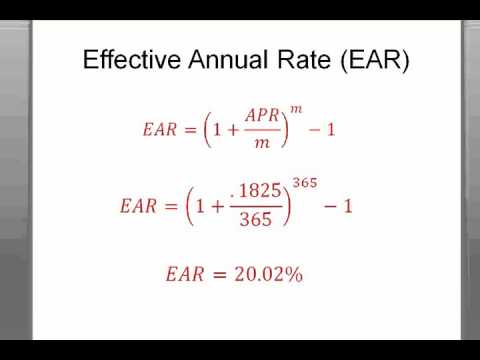

APR (Annual Percentage Rate) is a reflection of the percent owed in simple interest at the end of the year. When compounding is involved, the APR can understate the true effective APR (this term is synonymous with EAR) rate or the EAR (Effective Annual Rate). We'll go about calculating both rates in this tutorial. By the end I'll summarize it all and show the effect of compounding on APR rates (dramatically affects the rates).

We appreciate all of the support you guys have given us. Be apart of the mission to help us reach more students by subscribing, thumbs upping and adding the videos to your favorites!

We appreciate all of the support you guys have given us. Be apart of the mission to help us reach more students by subscribing, thumbs upping and adding the videos to your favorites!

APR and EAR Differences and Calculation (Intermediate Accounting I #7)

APR vs. EAR

Explaining APR vs. EAR | Annual Percentage Rate vs. Effective Annual Rate | Finance 101

Annual Percentage Rate (APR) and effective APR | Finance & Capital Markets | Khan Academy

Time Value of Money (Apr vs. EAR)

APR vs EAR vs APY | How Credit Card Companies Take Advantage | Finance Strategists

EAR vs APR

Effective annual interest rate (EAR)

APR, EAR, and Periodic Rate

Chapter 6: EAR and APR Explained

Effective Interest Rate vs Nominal Interest Rate | (EAR vs APR) | Explained with Examples

Calculating APR & EAR using Excel

APR vs EAR

Mastering APR to EAR Conversion: Excel Tutorial for Clearer Financial Insight

Ch 05 02 APR and EAR

Converting APR to EAR or EFF

20_Compounding and Effective Annual Rate (EAR and APR)

Convert an APR to an EAR

(20 of 26) Ch.6 - Going back from Effective Annual Rate (EAR) to Annual Percentage Rate (APR)

EAR vs APR

APR and EAR and Amortization

BA II Plus - EAR

EAR vs APR on HP 12c

TI BA II Plus Financial Calculator to Compute EAR and APR

Комментарии

0:08:56

0:08:56

0:02:00

0:02:00

0:04:35

0:04:35

0:07:12

0:07:12

0:14:53

0:14:53

0:01:55

0:01:55

0:03:54

0:03:54

0:05:56

0:05:56

0:01:00

0:01:00

0:13:27

0:13:27

0:11:45

0:11:45

0:16:46

0:16:46

0:10:22

0:10:22

0:02:21

0:02:21

0:11:18

0:11:18

0:02:05

0:02:05

0:08:53

0:08:53

0:03:11

0:03:11

0:04:05

0:04:05

0:09:59

0:09:59

0:04:59

0:04:59

0:00:47

0:00:47

0:10:12

0:10:12

0:08:13

0:08:13