filmov

tv

Warren Buffett Explains How To Invest During High Inflation

Показать описание

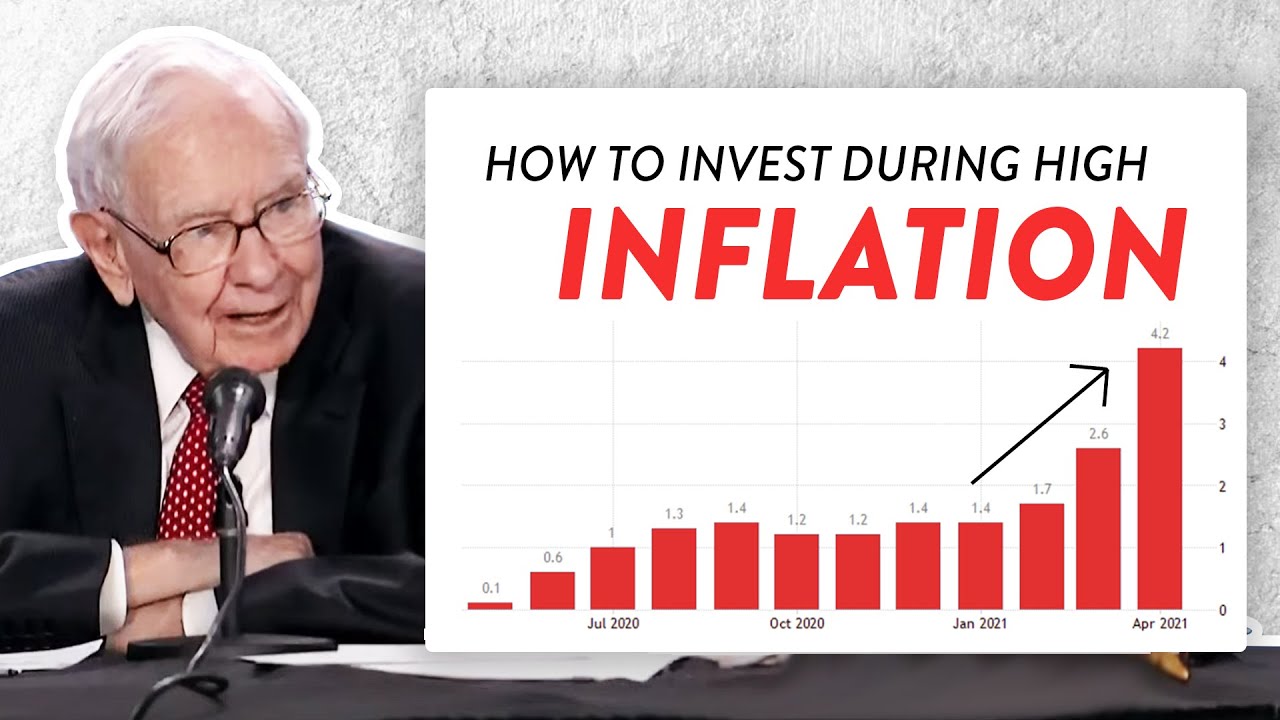

Inflation has been rising recently, and Warren Buffett has been seeing it happen within Berkshire Hathaway. Today, we analyse some of Buffett's old shareholder letters, to examine how Buffett thinks about investing during inflationary times.

★ ★ PROFITFUL ★ ★

#warrenbuffett #inflation

DISCLAIMER:

Neither New Money or Brandon van der Kolk are financial advisers. The information provided in this video is for general information only and should not be taken as professional advice. There are risks involved with stock market investing and consumers should not act upon the content or information found here without first seeking advice from an accountant, financial planner, lawyer or other professional. Consumers should always research companies individually and define a strategy before making decisions. Brandon van der Kolk and New Money are not liable for any loss incurred, arising from the use of, or reliance on, the information provided by this video.

★ ★ PROFITFUL ★ ★

#warrenbuffett #inflation

DISCLAIMER:

Neither New Money or Brandon van der Kolk are financial advisers. The information provided in this video is for general information only and should not be taken as professional advice. There are risks involved with stock market investing and consumers should not act upon the content or information found here without first seeking advice from an accountant, financial planner, lawyer or other professional. Consumers should always research companies individually and define a strategy before making decisions. Brandon van der Kolk and New Money are not liable for any loss incurred, arising from the use of, or reliance on, the information provided by this video.

Warren Buffett Explains the 7 Rules Investors Must Follow in 2023

Warren Buffett Explains How To Value Stocks (Example Included)

Warren Buffett explains why Berkshire reduced its big Apple stake

Warren Buffett explains how you could've turned $114 into $400,000

Warren Buffett Explains the 2008 Financial Crisis

Warren Buffett Explains How To Calculate Intrinsic Value Of A Stock

Warren Buffett explains the 3 main tasks for a board of directors

Warren Buffett Explains How To Make A 50% Return Per Year

Warren Buffett: BEST Dividend Investing Strategy for 2024 👉START with $100 👈 Set up Passive Income 👍...

Warren Buffett | How To Invest For Beginners: 3 Simple Rules

Warren Buffett Explains How To Invest During High Inflation

Warren Buffett: How to Invest During High Inflation

Warren Buffett breaks down how he would invest if he had to start again with $1 million

Warren Buffett: You Only Need To Know These 7 Rules

Warren Buffett Explains How To Compound One Million Dollars

Warren Buffett explains when to consider selling a stock

BUFFETT EXPLAINS HOW TO MAKE 50% PER YEAR

Warren Buffett Explains Investing vs Speculating

Warren Buffett Explains His Formula For Success

Warren Buffett Explains How To Be A Successful Value Investor (First TV Interview 1985)

Warren Buffett: How to invest your first $10,000

Warren Buffett Explains How to Do Well in the Stock Market

'I Got RICH When I Understood THIS' — Warren Buffett

Warren Buffett Explains His Checklist For Picking Stocks

Комментарии

0:18:51

0:18:51

0:18:43

0:18:43

0:09:36

0:09:36

0:03:14

0:03:14

0:05:31

0:05:31

0:08:56

0:08:56

0:10:11

0:10:11

0:11:22

0:11:22

0:07:27

0:07:27

0:13:21

0:13:21

0:13:21

0:13:21

0:13:56

0:13:56

0:05:20

0:05:20

0:10:38

0:10:38

0:09:42

0:09:42

0:02:53

0:02:53

0:03:55

0:03:55

0:01:32

0:01:32

0:15:15

0:15:15

0:13:29

0:13:29

0:10:37

0:10:37

0:00:23

0:00:23

0:10:28

0:10:28

0:03:42

0:03:42