filmov

tv

Loan Repayment & Bond Valuation Unit Review | Exam FM | Financial Mathematics - JK Math

Показать описание

Loan Repayment & Bond Valuation Unit 3 Review (Financial Mathematics)

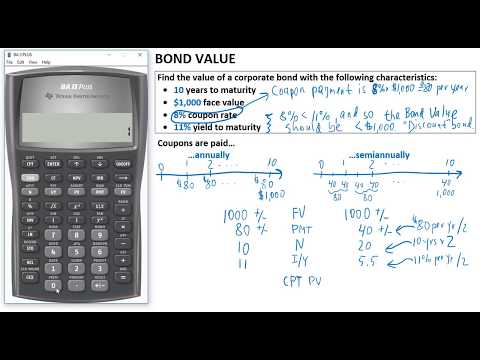

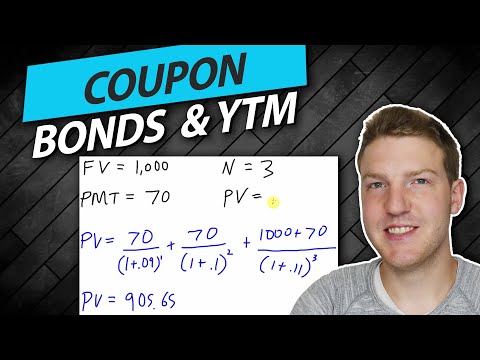

In this video we review the concepts of Financial Mathematics regarding loan repayment (amortization) and bond valuation that I cover in lessons 20 through 24 of my FM video series. This includes level (and non-level) payment loan amortization, bond valuation, market price of bonds, amortization for bonds, and callable bonds. If you have not watched my lesson and examples videos on these topics, be sure to do that first!

This video series is designed to help students understand the concepts of mathematics of investment and credit, as well as provide a starting point in preparation for the Actuarial Exam FM (Financial Mathematics).

Financial Mathematics requires a proficient understanding of Calculus concepts such as derivative and integration techniques. This implies that a solid understanding in various algebra skills, including manipulating equations, basic factoring methods, solving logarithmic equations, and more, are also required to fully comprehend and learn the concepts of the Financial Mathematics course.

Video Chapters:

00:00:00 Unit 3 Topics (Intro)

00:01:51 Reviewing Formulas

00:27:39 Problem 1

00:35:41 Problem 2

00:49:14 Problem 3

00:59:11 Problem 4

01:07:37 Problem 5

01:21:11 Problem 6

⚡️Math Products I Recommend⚡️

⚡️Textbooks I Use⚡️

⚡️My Recording Equipment⚡️

(Commissions earned on qualifying purchases)

Follow me on Social Media!

Thanks for watching! Any questions? Feedback? Leave a comment!

- Josh from JK Mathematics

Disclaimer: Please note that some of the links associated with the videos on my channel may generate affiliate commissions on my behalf. As an amazon associate, I earn from qualifying purchases that you may make through such affiliate links.

In this video we review the concepts of Financial Mathematics regarding loan repayment (amortization) and bond valuation that I cover in lessons 20 through 24 of my FM video series. This includes level (and non-level) payment loan amortization, bond valuation, market price of bonds, amortization for bonds, and callable bonds. If you have not watched my lesson and examples videos on these topics, be sure to do that first!

This video series is designed to help students understand the concepts of mathematics of investment and credit, as well as provide a starting point in preparation for the Actuarial Exam FM (Financial Mathematics).

Financial Mathematics requires a proficient understanding of Calculus concepts such as derivative and integration techniques. This implies that a solid understanding in various algebra skills, including manipulating equations, basic factoring methods, solving logarithmic equations, and more, are also required to fully comprehend and learn the concepts of the Financial Mathematics course.

Video Chapters:

00:00:00 Unit 3 Topics (Intro)

00:01:51 Reviewing Formulas

00:27:39 Problem 1

00:35:41 Problem 2

00:49:14 Problem 3

00:59:11 Problem 4

01:07:37 Problem 5

01:21:11 Problem 6

⚡️Math Products I Recommend⚡️

⚡️Textbooks I Use⚡️

⚡️My Recording Equipment⚡️

(Commissions earned on qualifying purchases)

Follow me on Social Media!

Thanks for watching! Any questions? Feedback? Leave a comment!

- Josh from JK Mathematics

Disclaimer: Please note that some of the links associated with the videos on my channel may generate affiliate commissions on my behalf. As an amazon associate, I earn from qualifying purchases that you may make through such affiliate links.

Комментарии

1:39:50

1:39:50

0:02:20

0:02:20

0:11:08

0:11:08

0:04:20

0:04:20

0:16:06

0:16:06

0:12:57

0:12:57

0:10:37

0:10:37

0:16:12

0:16:12

1:21:46

1:21:46

0:09:29

0:09:29

0:01:27

0:01:27

0:02:48

0:02:48

0:00:29

0:00:29

0:03:59

0:03:59

0:03:49

0:03:49

0:09:37

0:09:37

0:02:05

0:02:05

1:08:37

1:08:37

0:02:27

0:02:27

0:14:47

0:14:47

0:04:47

0:04:47

0:13:16

0:13:16

0:03:07

0:03:07

0:35:03

0:35:03