filmov

tv

Genesis of GARCH - Why you have been measuring volatility wrong all your life

Показать описание

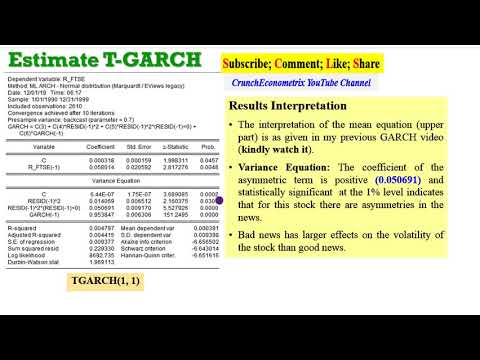

An introduction to GARCH, and why it can be a superior tool to sample standard deviation in measuring volatility.

Download the notebook in my GitHub page:

Download the notebook in my GitHub page:

Комментарии