filmov

tv

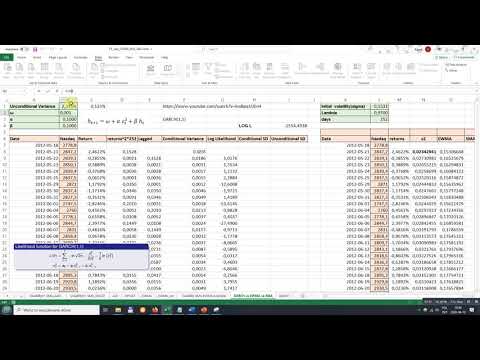

Stock Forecasting with GARCH : Stock Trading Basics

Показать описание

How do you use the GARCH model in time series to forecast the volatility of a stock?

Code used in this video:

Theory of GARCH video:

Coding in GARCH video:

Code used in this video:

Theory of GARCH video:

Coding in GARCH video:

Stock Forecasting with GARCH : Stock Trading Basics

(EViews10): Forecasting GARCH Volatility #forecast #garchforecasts #volatilityforecast

Predicting Futures Markets with Arima/Garch

What are ARCH & GARCH Models

Volatility Analysis and Forecasting for AAPL Stock Using GARCH Model

GARCH model - Eviews

GARCH(1,1) in MS Excel

Time Series Analysis using Python | The GARCH Model

GARCH Volatility Model

Advanced Stock Market Predictions: Leveraging ARIMA and GARCH Models'

Predicting Stock Prices and Making $$$ Using the ARMA Model

1. Modeling & Analysis of Apple Stock Prices in R | GARCH Models

(EViews10) - How to Forecast ARCH Volatility #arch #forecasting #volatility #econometrics #modeling

GARCH Modelling for Volatility in Eviews

Coding the GARCH Model : Time Series Talk

S50676 (SRD) - Modelling the Volatility & Forecasting the Gold Price using GARCH Model

R : Forecasting volatility using GARCH(1,1)

10.2: GARCH using RStudio

G#1 Introduction to ARCH/GARCH model

Machine learning for daily realised volatility prediction - Alexandra Gkolia

Time Varying Volatility and GARCH in Risk Management

Garch Modelling in R

Value-at-Risk, Volatility (GARCH) Estimation and Forecast in 3 minutes in Excel

Video 10 Estimating and interpreting a GARCH (1,1) model on Eviews

Комментарии

0:08:13

0:08:13

0:03:53

0:03:53

0:05:10

0:05:10

0:13:02

0:13:02

0:21:30

0:21:30

0:12:29

0:12:29

0:13:49

0:13:49

0:06:32

0:06:32

0:04:47

0:04:47

0:09:57

0:09:57

0:08:59

0:08:59

0:09:37

0:09:37

0:11:34

0:11:34

0:10:08

0:10:08

0:04:59

0:04:59

0:01:12

0:01:12

0:14:53

0:14:53

0:18:37

0:18:37

0:09:48

0:09:48

0:06:23

0:06:23

0:34:51

0:34:51

0:02:25

0:02:25

0:09:27

0:09:27